BOFIT Weekly Review 29/2024

Economic growth strong in the first quarter of this year; Russian attacks on Ukraine’s energy systems and lack of skilled workers weaken economic outlook

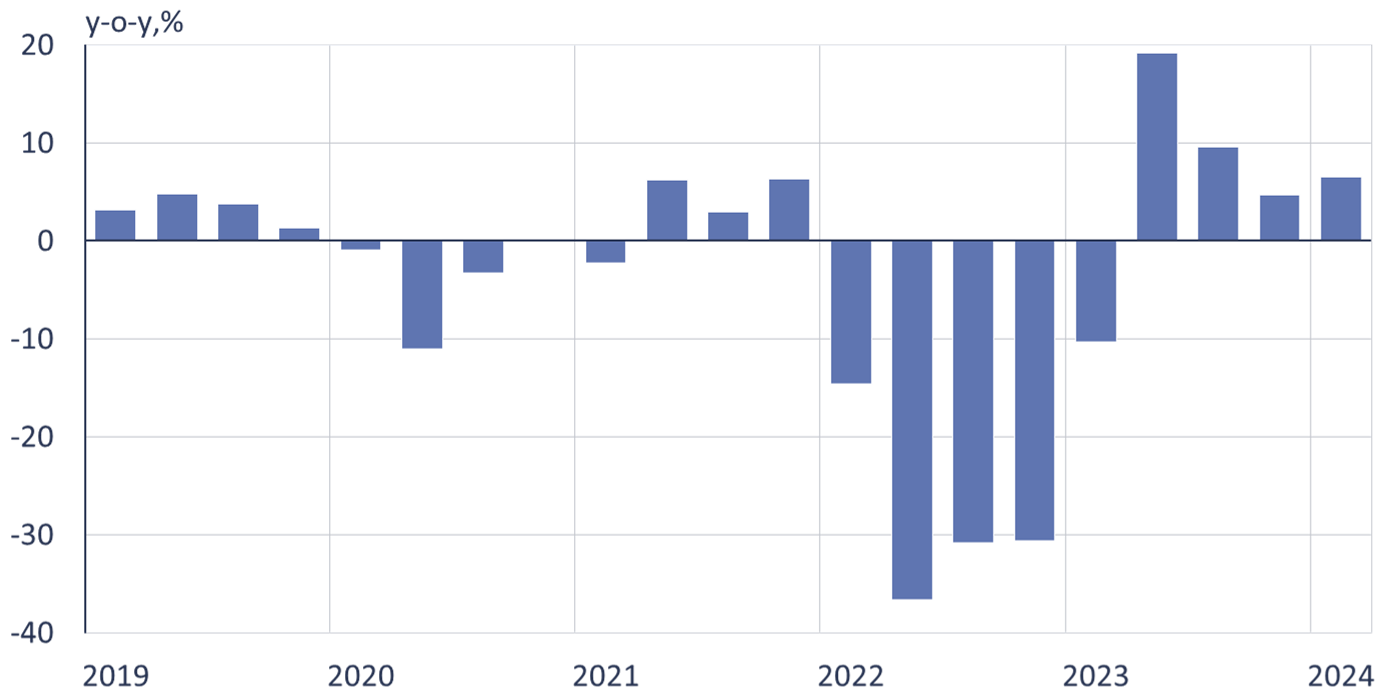

Ukraine’s GDP growth accelerated to 6.5 % p.a. in the first quarter of this year according to the preliminary estimate from Ukraine’s State Statistics Service. Compared to the previous quarter, real seasonally-adjusted GDP grew by 1.2 %. Growth was driven by growth in exports especially via Black Sea ports, stronger consumer demand and state-funded construction projects. The vast damage inflicted by Russian bombing of the electrical grid since March (80 % of thermal power plant capacity was disabled in May), as well as a lack of skilled workers, is expected to significantly limit second-quarter growth and later this autumn as the heating season starts.

Figure 1. On-year growth in 2024 remained strong, even as the effects of the low base reference faded

Sources: Ukrstat, BOFIT.

Ukraine’s abilities in repairing its damaged electricity production and distribution infrastructure, as well as securing heating and power supplies through next winter, remain a huge economic questions. Ukraine is currently negotiating with the European Union on the possibility of increasing electricity imports. According to Ukraine’s energy inspection agency, power outages and rolling brownouts should decline in August as planned repairs at several nuclear plants are completed. Due to Russia’s significant degradation of Ukraine’s energy infrastructure, the National Bank of Ukraine (NBU) has revised its 2024 economic growth outlook downward from 3.6 % to 3 %.

The recovery of exports has been a bright spot in Ukraine’s economic performance. The value of exports in January-April slightly exceeded last year’s level (up 0.3 %), amounting to roughly 13.5 billion dollars. The growth in foreign trade and exports was boosted by the improved security situation in the Black Sea. The EU’s reimposition of tariffs on Ukrainian agricultural products, however, threatens the current recovery in exports.

Goods transported by road moved more smoothly in the first quarter of the year as Hungarian, Slovak and Polish farmers agreed in January to end their three-month blockade of Ukraine’s western border. Following Russia’s full-scale invasion of Ukraine, the EU in June 2022 eliminated all tariffs and import quotas on Ukrainian products in order to support the Ukrainian economy. As a condition for ending EU farmer protests, the EU has now agreed to reinstate import duties on Ukrainian agricultural goods whenever import volumes exceed the average import volumes of 2022 and 2023. In accordance with the EU farmer agreement, the tariffs on Ukrainian oats were reimposed in mid-June. Tariffs on sugar and eggs also came back into force at the beginning of July. Additional tariffs will be reimposed on chicken, maize, honey and barley groats when the agreed import threshold values are exceeded.

Falling food prices kept inflation below 2024 target, but rising energy prices fuel inflation

The rise in consumer prices remained surprisingly slow in the first half of this year, allowing the National Bank (NBU) to incrementally lower its key policy rate from 25 % in June 2023 to 13 % this June. The drop in food prices has been the biggest factor restraining inflation, a reflection of last year’s good harvests and protests on Ukraine’s western border against Ukrainian grain exporters. In addition, energy prices started to surge in March, when Russia launched its current bombing campaign of Ukraine’s energy infrastructure. The hryvnia’s stable exchange rate has supported price stability, although depreciation pressures have intensified this year.

Figure 2. Consumer price inflation accelerated in recent months

Sources: National Bank of Ukraine, BOFIT.

As anticipated, 12-month inflation accelerated from 3.3 % in May to 4.8 % in June as the basis effect from last year’s bumper harvests began to wane. Energy prices and wages is also rising. Higher global oil prices, depreciation of the hryvnia and a rush to buy fuel before tax hikes took effect, boosted fuel prices by 25.5 % in June. Inflationary pressures were subdued, however, by a 6.5 % y-o-y drop in the prices of unprocessed foods (down 9.5 % in May), especially as the first grain harvests started earlier than usual this year. The NBU currently expects inflation to accelerate to over 8 % by the end of this year as the effect of transitory factors fade.

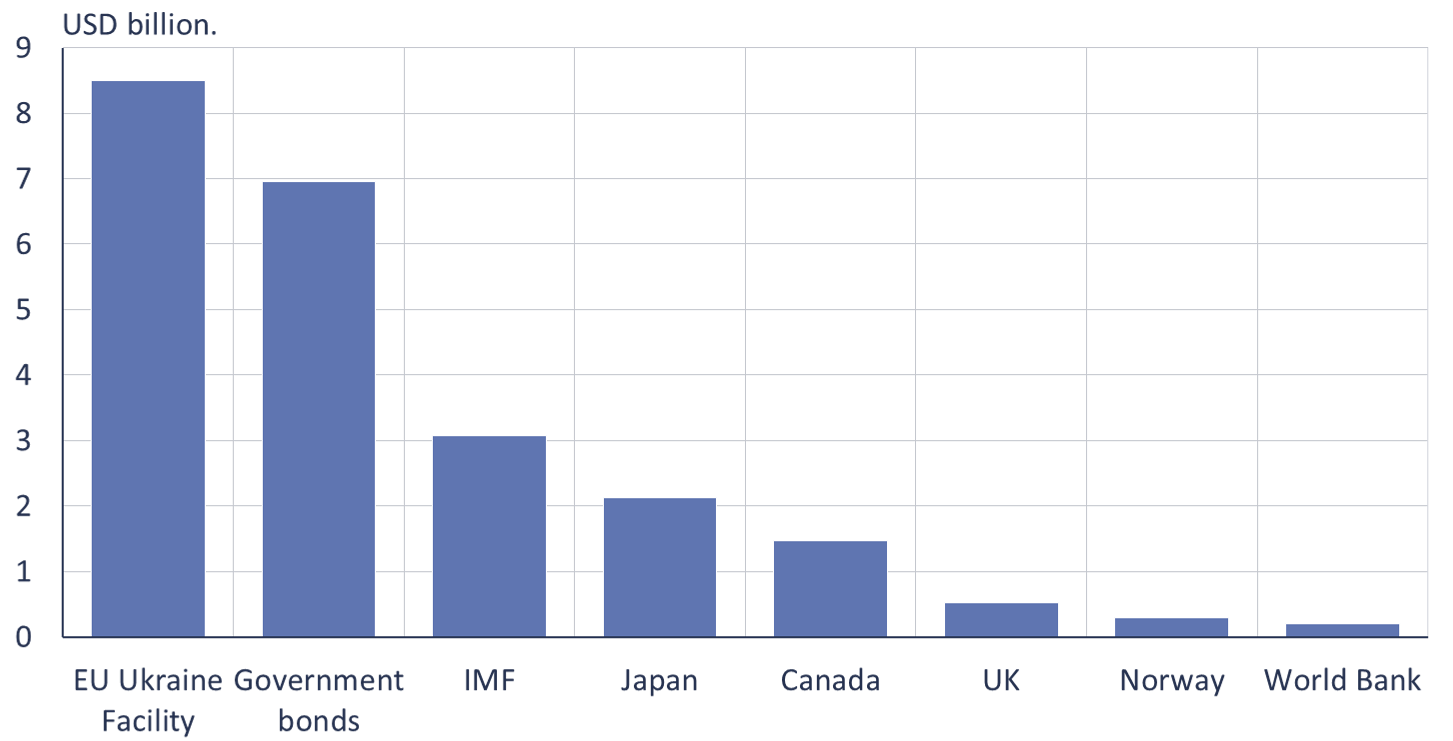

Government’s fiscal situation improved this year; tight schedules for talks on restructuring loans

Ukraine’s government budget deficit for the whole year was estimated to be about 38 billion dollars, of which a total of 23 billion dollars had been covered by July 9, 2024. To cover the government’s budget deficit, Ukraine has this year received about 16 billion dollars from partners abroad, of which 99 % has been granted in the form of loans. The biggest single source of funding is the EU’s support mechanism, the Ukraine Facility (8.5 billion dollars this year). The government has also raised 7 billion dollars from the domestic bond market. During this year, Ukraine’s government budget will almost certainly get additional financing from the Ukraine Facility (a total of 16 billion euros) and from the IMF lending programme (about 2.3 billion dollars in two tranches if lending benchmarks are met). The NBU’s own projections show the country’s need for foreign financing should decline to 25 billion dollars in 2025 and 13 billion dollars in 2026.

In June, the G7 countries reached a common agreement to loan 50 billion dollars of Russian assets frozen abroad to Ukraine. G7 experts estimate the total value of Russia’s frozen assets at around 260 billion euros. Interest costs on the loan would be covered with the income from frozen assets, which are estimated to be in the range of 2.5–3 billion euros a year. Ukraine is unlikely to see any of this money this year, however. According to an EU decision, 1.2–1.4 billion euros in income from frozen Russian assets in the EU area can be used this year for the acquisition of military equipment with funds channelled to Ukraine via the Ukraine Assistance Fund. Further proceeds from the frozen funds of about 1 billion euros could be released to Ukraine by the end of this year. Unanimous agreement by all EU members is not needed to channel assets to the Ukraine Assistance Fund, a move opposed by Hungary. On July 17, the EU Parliament voted to approve the plan to use Russian frozen assets for Ukraine's benefit.

Figure 3. Over half of Ukraine’s financing needs for 2024 were covered as of July 9, 2024

Sources: Ukraine’s finance ministry, BOFIT.

At the end of June, the IMF Executive Committee approved its fourth review of Ukraine’s Extended Fund Facility (EFF), making available a new tranche of 2.2 billion dollars in low-interest credit to Ukraine’s budget. The 48-month EFF programme in total provides 15.6 billion dollars in low-interest loans to Ukraine. Funding tranches are released quarterly as long as Ukraine meets its agreed performance criteria for macroeconomic development and reforms.

The EFF criteria include requirements for the implementation of anti-corruption reforms and restructuring of Ukraine’s commercial loans. Bonds worth roughly 20 billion dollars come due next month. Talks of the group representing Ukraine’s government and creditors, the Ad Hoc Bondholder Committee, were held in June, but adjourned as both parties were still far from agreement. According to Ukraine’s government, creditor proposals failed to comply with the criteria set for restructuring of IMF loans. Ad Hoc Bondholder Committee members hold about 20 % of the bonds coming due. Ukraine’s finance ministry has also announced that it will continue talks with Ukraine’s other creditors.