BOFIT Weekly Review 28/2024

China strives to develop its microchip production capabilities

Microchips, or chips, are semiconductor components used in electronic devices to perform a vast range of tasks, such as data processing and storage. They play a central role in fields such as artificial intelligence (AI) and are found in a myriad of products including weapons systems and cars. They have been at the centre of trade policy since the US began restricting exports to China of advanced microchips and chip manufacturing equipment on the basis of national security. Other countries, including the Netherlands and Japan, have now joined in preventing Chinese acquisition of chips and chip-making equipment. As a result, China finds itself at a technological disadvantage with respect to the most advanced countries in the field. To make up the gap, China has begun to invest heavily in the sector. It is unclear, however, whether China can benefit simply by throwing resources at the problem.

Microchip manufacturing

Microchips are multi-layered silicon structures that integrate vast numbers of electronic components. A microchip might be compared to a tiny skyscraper with different layouts on each floor. Each layer contains components such as transistors, capacitors and other devices that embody electronic switches and pathways. Microchips are typically printed on a substrate silicon wafer 30 centimetres in diameter. Many microchips are printed on a single wafer and then separated from the wafer later in the manufacturing process.

The layers of the microchips are created by coating the silicon wafer with thin layers of metals, electrical insulators and semiconductors. Photolithography, the process of printing the microcircuit structure, involves coating each layer with photoresistant materials that harden when exposed to light. Areas coated with photoresistant materials and not exposed to light can be readily dissolved and washed away with chemical solvents. This forms a protective mask that protects the layer of metals, insulators and semiconductors in the next step, when the wafer is subject to chemical etching. The mask protects the layer from the etching treatment as the rest of layer is removed. When the hardened mask is removed, the process is repeated, creating the layer-structure of the microchip.

Miniaturisation is key to improving microchip performance and reducing energy consumption, so all the components on the chip, such as resistors, transistors and capacitors, need to be made as small as possible. One barrier facing the manufacturer is photolithographic resolution, i.e. the precision available in creating the structural mask. This is directly related to the light wavelengths used in the lithographic process.

The shortest wavelength of light visible to us is about 380 nanometres (nm), so modern lithographic techniques rely on ultraviolet wavelengths invisible to the human eye. The most advanced extreme ultraviolet (EUV) lithographic machines use light with a wavelength of 13.5 nm for the manufacture of advanced 3−7 nm microchips. Older generation lithographic machines use deep ultraviolet (DUV) with a wavelength of 193 nm. DUV machines are mostly used in production of less advanced chips, but 7 nm chips have also been produced with the multiple patterning technique. The technique is slow and produces a lower yield of viable chips, constraining the production capacity of the microchip fabrication facility (fab). From the standpoint of commercial potential of a manufacturing process, it is essential to reach high yields without lengthy manufacturing processes.

China’s dependence on imports of advanced microchips and lithographic equipment

While China accounts for about 20 % of global microchip production, its market share of semiconductor manufacturing equipment is smaller. As a result, it has been reliant on imported sophisticated lithographic equipment. The Dutch ASML is the world’s sole producer of EUV lithographic machines. In 2019, however, the Netherlands joined the US in their restrictions on semiconductors exports to China, and banned the export of EUV machines to China. ASML continued the unrestricted sale of DUV machines to China until 2023, when the Netherlands set further restrictions to limit export of DUV machines as well. Japan, which also produces DUV machines, also imposed restrictions last year on exports of DUV machines to China.

The US last year also set restrictions on the export of the advanced microchips to China. The biggest makers of advanced chips, most notably Nvidia and Intel, are based in the US, so the ban on exports effectively limits Chinese access to advanced chips and makes China increasingly reliant on its own domestic chip producers. As China has no domestic producers of EUV machines, the focus has turned to improving the performance of its domestic DUV machines. Bloomberg and the publication TechInsights report that the Chinese SMIC manufactures Huawei’s 7-nm chips with domestic DUV machines with multiple patterning capabilities. The chip was incorporated last year into Huawei’s Mate 60 smartphone. Reports last year indicated that production of the chip was tedious and the yield was low. Recent patent filings by Chinese firms on alternative techniques for making 5 nm chips with DUV machines suggest, however, that yields may have improved. Industry observers note that the name of the fab game is making the best products at lowest cost, which is what EUV machines deliver in the production of advanced chips.

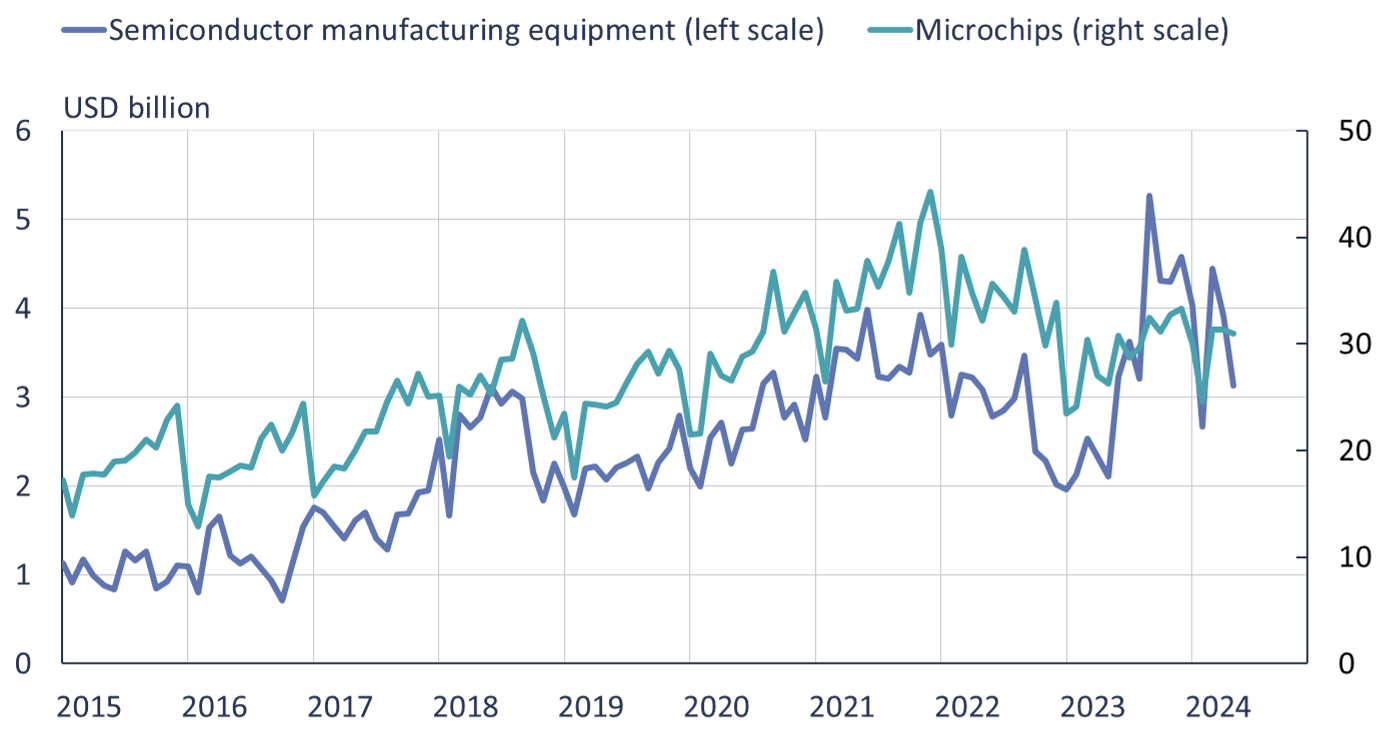

Without the possibility of importing advanced microchips and lithographic machines, China cannot move forward on development of AI chips or other advanced technologies. The figure below shows the value of Chinese imports of semiconductor manufacturing equipment and microchips in recent years. Microchip imports have declined since 2021, but the US ban on exports of advanced microchips has not seemed to have affected imports. This may be due to the fact that the ban targets advanced chips, while other US chips remain available. Manufacturing equipment imports spiked last summer and early autumn, possibly on the news that Dutch restrictions that the export of DUV lithographic machines to China would be subject to export licences. Media reports suggest that Chinese chipmakers may have gone on a DUV-machine buying spree before the restrictions entered into force, although it is possible that the import spike represents purchases of other types of semiconductor manufacturing equipment.

Value of China’s imports of microchips and equipment for semiconductor manufacture, 2015–2024

Sources: China Customs, Macrobond and BOFIT.

US, Dutch and Japanese export restrictions have forced China to invest in all aspects of its own semiconductor sector: chip design, manufacturing, as well as microchip packaging, and semiconductor manufacturing equipment. While EUV technology patents have been filed in China, it is unlikely that China can construct entire EUV lithographic machines in the near future. China has instead moved ahead on developing microchip packaging to create powerful devices by packaging multiple chips into single units. Such packaging equipment technology is available in China, and could provide a strategy for partly getting around the unavailability of EUV machines.

China announced in May the creation of the third national semiconductor investment funds. Total fund assets are 344 billion yuan (47.3 billion dollars). At the same time, the US, EU and South Korea have announced their own initiatives for developing their semiconductor sectors, making it more challenging for China to stake out its own claims on the technology frontier.