BOFIT Weekly Review 28/2024

Foreign investment flows to and from China have increased yuan’s international use

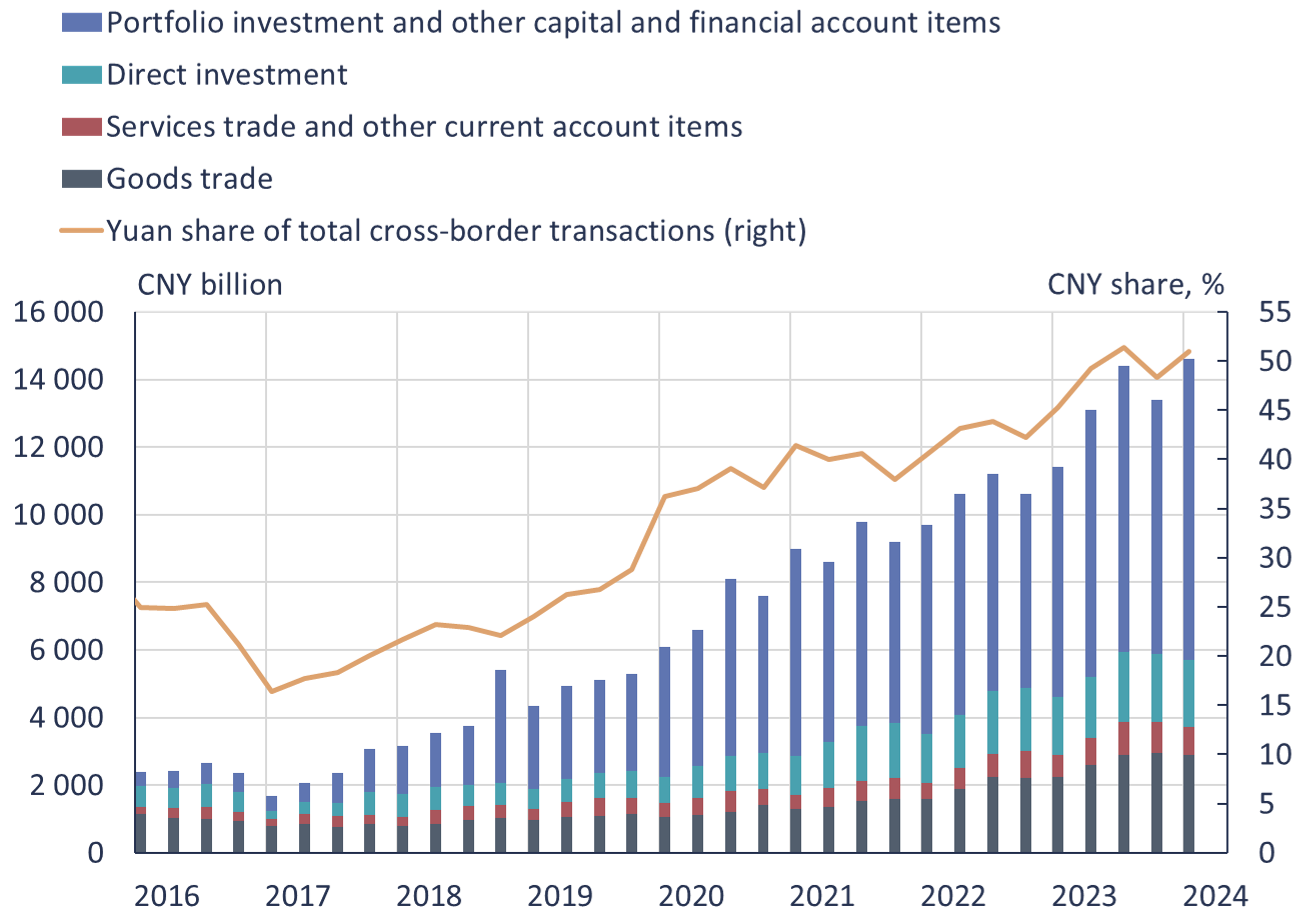

Over a year ago, the yuan surpassed the US dollar to become China’s most used cross-border payment currency. In May this year, the yuan’s share had climbed to 53 %, while the US dollar had fallen to 43 %, the euro to 2 % and the Hong Kong dollar to 1 %. In comparison, the yuan’s share in 2019 was only about 25 %. The biggest driver of yuan use in cross-border payments and receipts is foreign portfolio investment trading in mainland China’s stock and bond markets. These transactions are always conducted in yuan. The yuan’s share in Chinese foreign trade is smaller, but growing. Use of the yuan outside China remains very limited and central banks around the world have reduced their yuan reserves since 2022.

People’s Bank of China statistics show that balance of payments cross-border transactions amounting to 14.6 trillion were made in yuan in the first quarter of this year. Goods trade accounted for about 20 % of transactions, services and other current account items about 5 % and direct investment just under 15 %. The overwhelming share of cross-border yuan transactions (over 60 %) involved portfolio investments or other items on the balance-of-payments financial account.

Value of China’s yuan-denominated cross-border settlement and yuan’s share of China’s total cross-border transactions

Sources: People’s Bank of China, SAFE, CEIC and BOFIT.

Use of the yuan has also increased in China’s own foreign trade, with 28 % of the country’s goods trade this year conducted in yuan. That share approaches the 2015 peak, after which use of yuan declined due to forex market uncertainty. (In 2021, for example, the yuan’s share had fallen to 15 %.) With Russia’s war of aggression in Ukraine and the stepping-up of Western sanctions on Russia, use of the yuan in Russia-China trade has increased dramatically. Russian officials last March said that 92 % of China-Russia trade was conducted in either yuan or rubles (likely mostly in yuan). In addition, many developing economies (including Brazil, Argentina, Iraq and Pakistan) have publicly announced in recent years their willingness to accept yuan payments in trade with China, and media reports suggest Saudi Arabia is considering oil trade with China in yuan. Some other countries have also reportedly shifted to using yuan payments with Russian entities to skirt Western sanctions.

International payments via the SWIFT messaging network saw the yuan overtake the Japanese yen at the end of last year as the world’s fourth-most-used currency. In May, 4.5 % of SWIFT international payments were conducted in yuan. When payments within the euro area are not included, the yuan’s share surprisingly decreases (and is 3.1 %), with the dollar’s share at 59.4 % and the euro’s share 13.1 %. Not all international payments traffic is conducted via SWIFT, which itself estimates that about 80 % of all international payments go through it. In principle, yuan payments can be made entirely outside the SWIFT system using China’s own international payment system (Cross-border International Payment System or CIPS). In reality, very few non-Chinese banks are currently able to transmit payment messages directly in CIPS, and must instead rely on SWIFT messaging. Estimates from two years ago, suggest that in about 80 % of payments through CIPS, the messages were still transmitted via SWIFT.

Capital inflows to and from China have increased, especially with the connections of China’s domestic stock and bond markets with Hong Kong (the Stock and Bond Connect programmes that link onshore and offshore exchanges) and the inclusion of mainland Chinese yuan-denominated securities in international indices. At the end of May, foreign investors held 4.2 trillion yuan in mainland China debt securities, an on-year increase of 32 %. In the first five months of this year, the Stock Connect purchases of foreign investors of shares listed on the Shanghai and Shenzhen exchanges amounted to 83 billion yuan (12 billion dollars) more than the value of shares sold through Stock Connect. Last month saw a major sell-off, however. Foreign investors currently hold mainland China listed shares totalling around 2.8 trillion yuan. In any case, China’s financial markets remain hard for outsiders to access and the holdings of foreign investors still represent only about 3 % of both stock and bond market capitalisation.

The issuance of foreign entities’ yuan-denominated bonds in mainland China (Panda bonds) has increased since last year. At the end of 2022, capital controls were eased to allow money raised from Panda bond issues to be moved abroad if certain conditions are met. Part of the current allure of Panda bonds is their relative cheapness. China’s nominal interest rates are well below the US level. In January-May, Panda bonds worth 81 billion yuan (11 billion dollars) were issued in interbank market, increasing the total stock of Panda bonds to around 240 billion yuan (up from 195 billion yuan at the end of 2023). Most bond issuers, however, are corporations registered abroad, but with business operations or other links to mainland China. The issuance of fully foreign entities is much smaller.

Central banks, in contrast, have reduced their yuan allocations in their foreign exchange reserves. The 149 central banks that report to the IMF declared total yuan reserves of 247 billion dollars as of end-March, a decline of about 84 billion dollars from March 2022. The yuan’s share of allocated reserves has fallen from 2.8 % two years ago to 2.1 %. The reserves are mostly held in US dollars (58.9 % of allocated reserves), euros (19.7 %) and yen (5.7 %).