BOFIT Weekly Review 27/2024

Sanctions on Russia further tightened in June

The European Union, United States and United Kingdom expanded their economic sanctions on Russia in June. The new round of sanctions are intended to limit Russia’s ability to make war in Ukraine, and focus on constraining Russia’s financial sector, restricting Russian foreign trade and preventing circumvention of sanctions. The latest sanctioned entities on the US and UK black lists include e.g. the Moscow Exchange and third-country firms that assist Russia in evading sanctions. The EU and the UK have introduced new measures to prevent circumvention of the oil price cap mechanism. In addition, the latest round of EU and US sanctions target Russian production and export of liquefied natural gas (LNG).

Oil, the biggest source of Russia’s export earnings, is the key target of sanctions

Oil & gas are central to Russia’s export revenues and government finances. Russian Customs reports that oil & natural gas accounted for about 60 % of Russia’s total goods exports in 2023. Last year, oil & gas revenues accounted for about 30 % of federal budget revenues. Most of that came from extraction taxes on crude oil.

Key sanctions related to oil are the EU import ban on Russian oil and the G7 and EU price ceiling mechanism. The intent of the price-ceiling system is to limit Russia’s oil export revenues by forcing the sale of crude at a discount without reducing the volume of exports to such an extent that it drives up global oil prices. Provision of critical services is banned for vessels that transport Russian oil sold above the price ceiling. Similar restrictions have also been imposed on Russian refined oil products.

Russia has managed to partly circumvent the price mechanism through the use of a fleet of shadow tankers that do not rely on services from sanctioning countries. According to estimates by CREA and the Kyiv School of Economics (KSE), about 80 % of Russian crude oil has been transported on shadow tankers in recent months in avoidance of the price ceiling. The IEA and CREA estimate that the average price of a barrel of Urals blend crude has in recent months been in the range of $65–75, which is well above the price ceiling of $60. Even under the shadow system, Urals was still selling at a $12–13 discount relative to North Sea dated. About 40 % of Russian petroleum products are estimated to be shipped using shadow vessels. The IEA estimates the average price of Russian premium products has remained well below the established price ceiling and are cheaper than other comparable products.

The newest sanctions packages identify dozens of shadow vessels and bans them from EU ports. Based on assessment from Bloomberg and the global trade intelligence platform Kpler, most of these sanction-listed ships have ceased to operate. Kpler estimates that the tankers subject to sanctions earlier transported about 13 % of the volume of Russia crude oil exports. Russia appears to have found alternative tankers to replace the sanctioned vessels as the volume of crude oil exported by sea remains stable. If export volumes remain at current levels, Russia still earns from its oil exports hundreds of millions of dollars every day even if the price falls to the $60 level of the price ceiling.

EU imposes first restrictions on Russian natural gas exports

Natural gas exports have also been a fairly important revenue source for Russia. The EU had placed no restrictions on importing Russian gas prior to the latest sanctions package. Nevertheless, pipeline gas imports from Russia to the EU diminished sharply after Russia itself ceased to transmit gas to a number of EU countries in spring 2022. Russian pipeline gas is still imported to a few EU countries, including Austria and Hungary. In addition, many EU countries import Russian LNG.

The EU’s latest sanction package includes a ban on Russian exports of LNG via the EU to third countries. It is still permitted to import LNG into EU countries as long as the terminal is connected to the EU gas grid (e.g. Finland and Sweden are not integrated with the EU grid). In addition, the package bans new investment, as well as providing goods or services to current LNG projects in Russia.

Although Russia no longer publishes data on its LNG exports, the statistical reporting of importing countries make it possible to estimate the value of Russia’s LNG exports. Using this approach, last year’s LNG exports were worth about 18 billion dollars or 4 % of Russia’s total goods exports. Figures of the International Gas Union (IGU) indicate that about half of Russian LNG exports went to EU countries and the remainder mostly to Asia. The EU’s high representative for foreign affairs and security policy, Josep Borrell, says that about 20 % of the Russian LNG into the EU is re-exported to third countries outside the EU.

Sanctions limit Russia’s access to critical technologies

A core element in Western sanctions on Russia involve restrictions on exports of critical goods and services to Russia. All countries participating in sanctions regimes have banned the export of certain critical technologies, particularly technologies with potential military uses. These restrictions were further extended in the latest sanction packages.

Exports from sanctioning countries to Russia of goods subject to sanctions have dried up almost completely. While Russia has managed to substitute some of its lost imports with imports from other countries, estimates based on mirror trade statistics suggest that Russia has not been able to substitute all of its lost imports. If sanctioned goods are available from alternative suppliers, they often come at a higher price, lower quality or both. Russia has also failed to a large extent in offsetting lost imports with domestically produced alternatives (BOFIT Policy Brief 5/2024).

Mirror statistics also suggest that measures to prevent circumvention of sanctions have had an impact. For example, mirror statistics show that imports to Russia of many sanctioned common high priority goods began to decline in recent months, i.e. in a period when sanctions monitoring had been stepped up and the organisations in third countries assisting Russia in circumventing sanctions targeted.

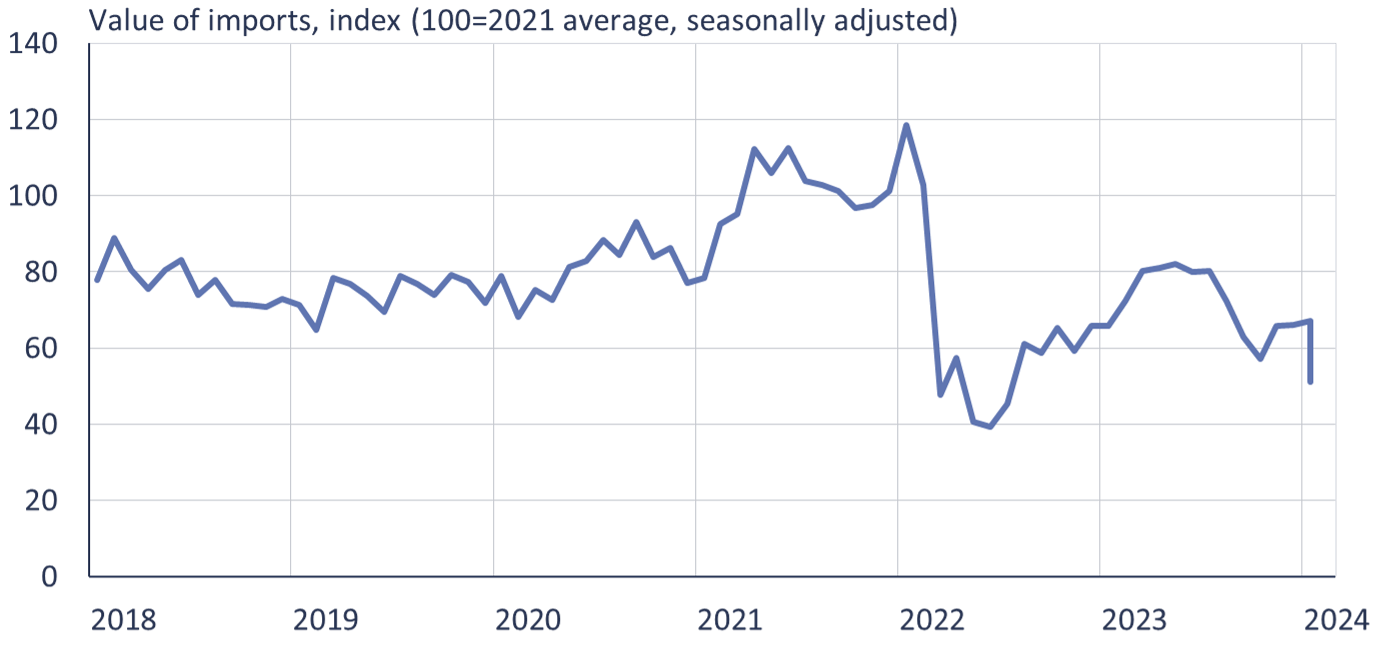

Russian imports of many high priority goods subject to sanctions have declined in recent months

Note: Estimates based on mirror trade statistics for 97 countries, with a focus on 35 Common High Priority Items in the HS84 and HS85 categories.

Source: Global Trade Tracker, BOFIT.

Foreign direct investment in Russia has collapsed over the past two years

As a consequence of war and sanctions, foreign direct investment (FDI) flows into Russia have dried up. Since 2022, the FDI figures released by the Central Bank of Russia (CBR) have been much less detailed than before. Nevertheless, the CBR figures show that the value of the total FDI stock in Russia has shrunk by nearly half since the invasion of Ukraine. At the end of 2021, the total stock of FDI in Russia was valued at around $500 billion. By the end of 2023, it had fallen to $280 billion.

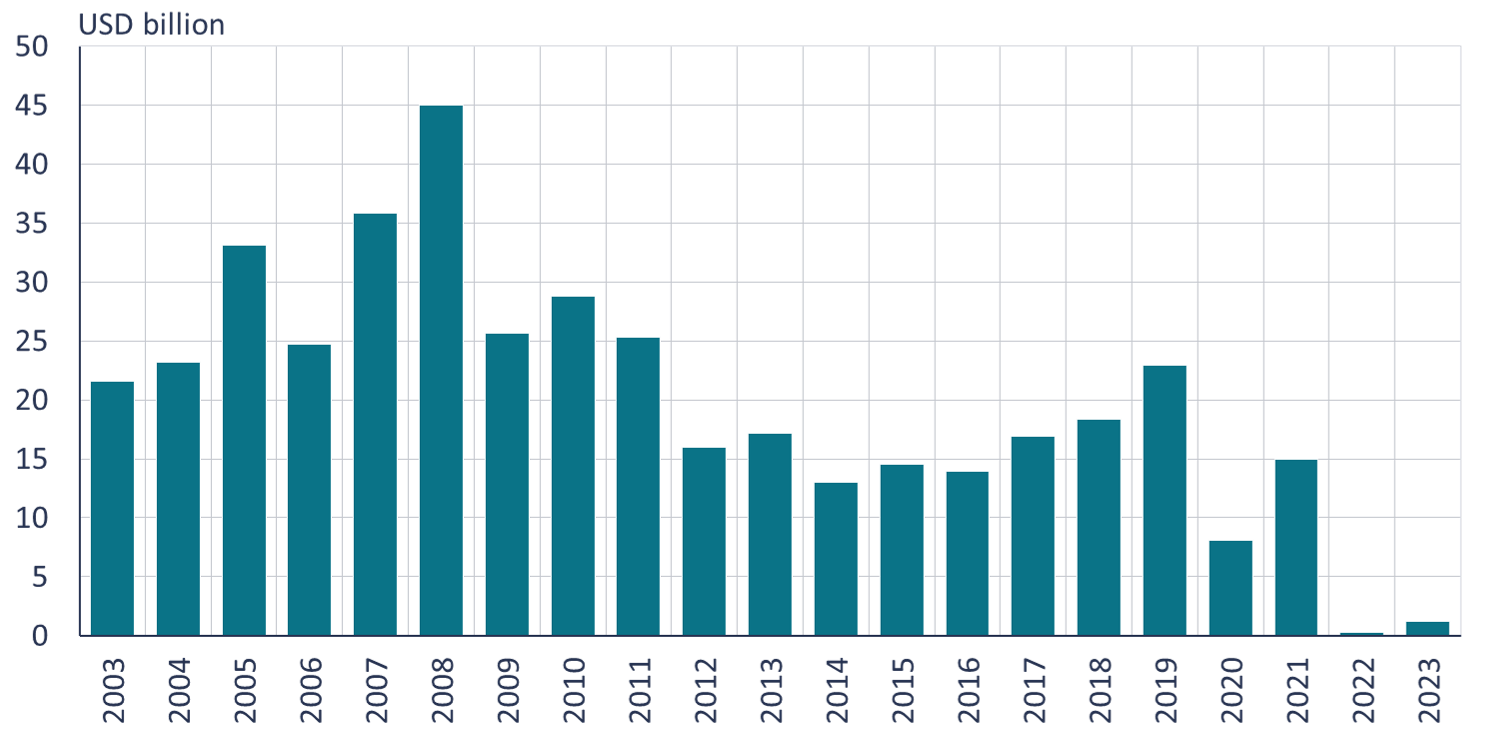

UNCTAD figures show that the net inflow of foreign direct investment to Russia was substantially negative in 2022, i.e. investments were drawn out. Although net inflow turned slightly positive in 2023, it still was on its lowest level since 2003. Russia’s investment development has also been poor by international standards. The total value of greenfield FDI projects launched in Russia in 2022–2023 combined was just a tiny fraction of any single year in the previous two decades. The value of projects in Russia was smaller than e.g. in Afghanistan. The value of projects started in Ukraine, in contrast, was over four times that of Russia. In addition, the value of net cross-border mergers & acquisitions in Russia was significantly negative in 2022–2023. Russia ranked last globally according to this measure.

The value of greenfield FDI projects in Russia has slowed to a trickle over the past two years

Sources: UNCTAD, BOFIT.

Lots of foreign firms still operate in Russia

Many foreign firms have departed at their own initiative from Russia since the start of the war, even if they were not actually compelled to do so by sanctions. The KSE database of nearly 4,000 firms shows that about half of their monitored firms continue to do business in Russia, some in a more limited manner than previously.

Companies based in countries that have not imposed sanctions on Russia have largely continued to operate as usual in Russia. For example, 90–95 % of Chinese, Indian and Turkish firms have chosen to stay in Russia. About half of firms from countries that have imposed sanctions continue to operate in Russia. Among EU countries, Greek, Italian and Austrian firms remain most active in the Russian market. For this group, 70–80 % of firms continued to conduct business in Russia after the invasion of Ukraine.

Finnish companies have been the most active in exiting the Russian market. Nearly all larger Finnish companies have ended their operations in Russia. A recent survey of export managers by the Finland Chamber of Commerce found that 76 % of the responding firms were doing business in Russia before the invasion of Ukraine in February 2022. Not a single respondent said they were still engaged in business in Russia in the survey results released in June (although two firms noted they were still in the process of winding down operations).

Sanctions important in supporting Ukraine’s defence, but insufficient to restrain Russia

Sanctions have led to drying up of foreign direct investment in Russia, limited Russia’s export earnings, complicated Russian access to many high-tech goods, and driven up prices when such goods are available. Russia has to some extent managed to circumvent sanctions, so the most recent sanction packages seeking to block loopholes are very welcome.

Sanctions are an important means of degrading Russia’s capacity to make war in Ukraine. They can still be tightened further and made more effective. But sanctions alone are not enough. It thus remains of highest importance for the West to continue providing financial and military support to Ukraine in defending against Russia’s unjustified aggression.