BOFIT Weekly Review 26/2024

Exports supporting Chinese economic growth; domestic demand remains weak

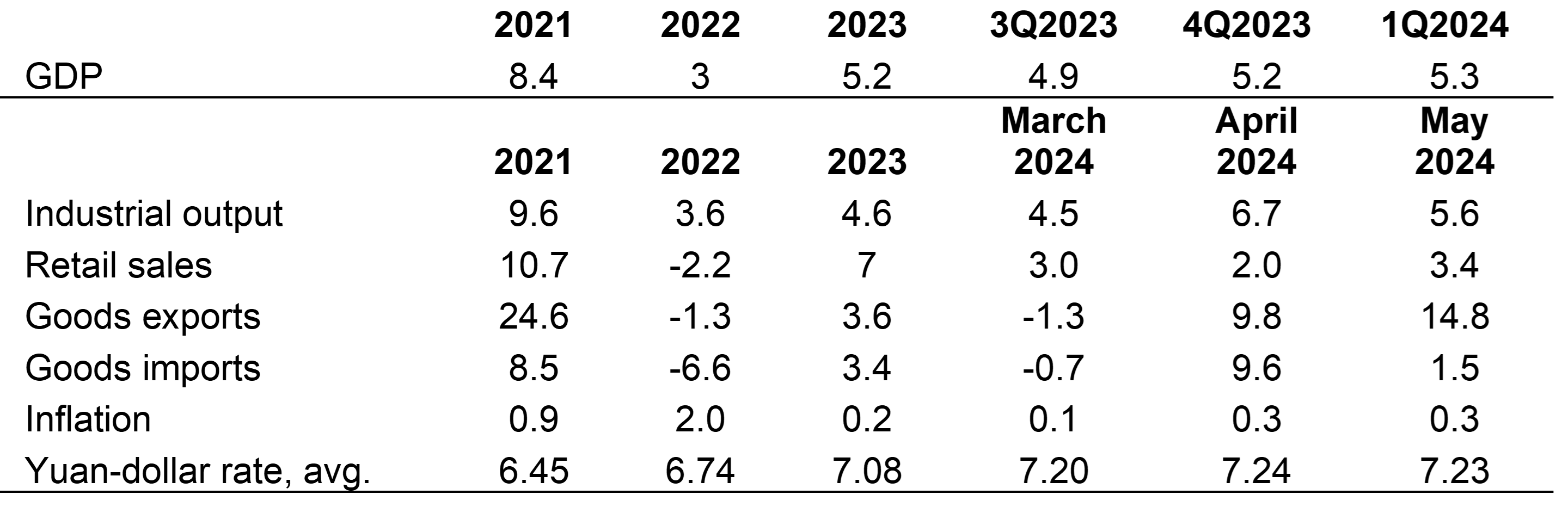

Industrial output growth slowed somewhat from April but was still 5.6 % y-o-y in May. Industrial output was supported by export activity, with the value of goods exports in May rising by 7 % y-o-y in dollar terms (10 % in yuan). The dollar-value of exports in January-May was on par with the same period last year. The value of goods imports in dollars was up by 1 % y-o-y (4 % in yuan) for May and 2 % for the first five months of this year.

Monthly retail sales, a rough proxy for domestic consumption, revived a bit in May, but real growth still only amounted to around 3.5 % y-o-y. The government earlier this year launched a programme that incentivised consumers to exchange their old home appliances, cars and other durable goods for new ones. While the value of home appliance sales in April-May grew by 11 % y-o-y, car sales slumped by 2 % (compared to 3 % growth in the value of retail sales overall). The number of cars sold, however, rose by 5 % y-o-y, led by booming sales of electric cars (up 33 %).

New government measures to halt the collapse of China’s real estate market have had little apparent effect. The volume of real estate sales, measured in terms of floorspace, fell by 21 % y-o-y in May, and was down by 20 % for the first five months of this year. The value of apartment sales in May plunged 24 % y-o-y. China National Bureau of Statistics (NBS) reports that the value of real estate sales in January-May was only about half the value of the same period in 2021, and that housing prices continue to fall. There are no comprehensive national figures on price trends, however.

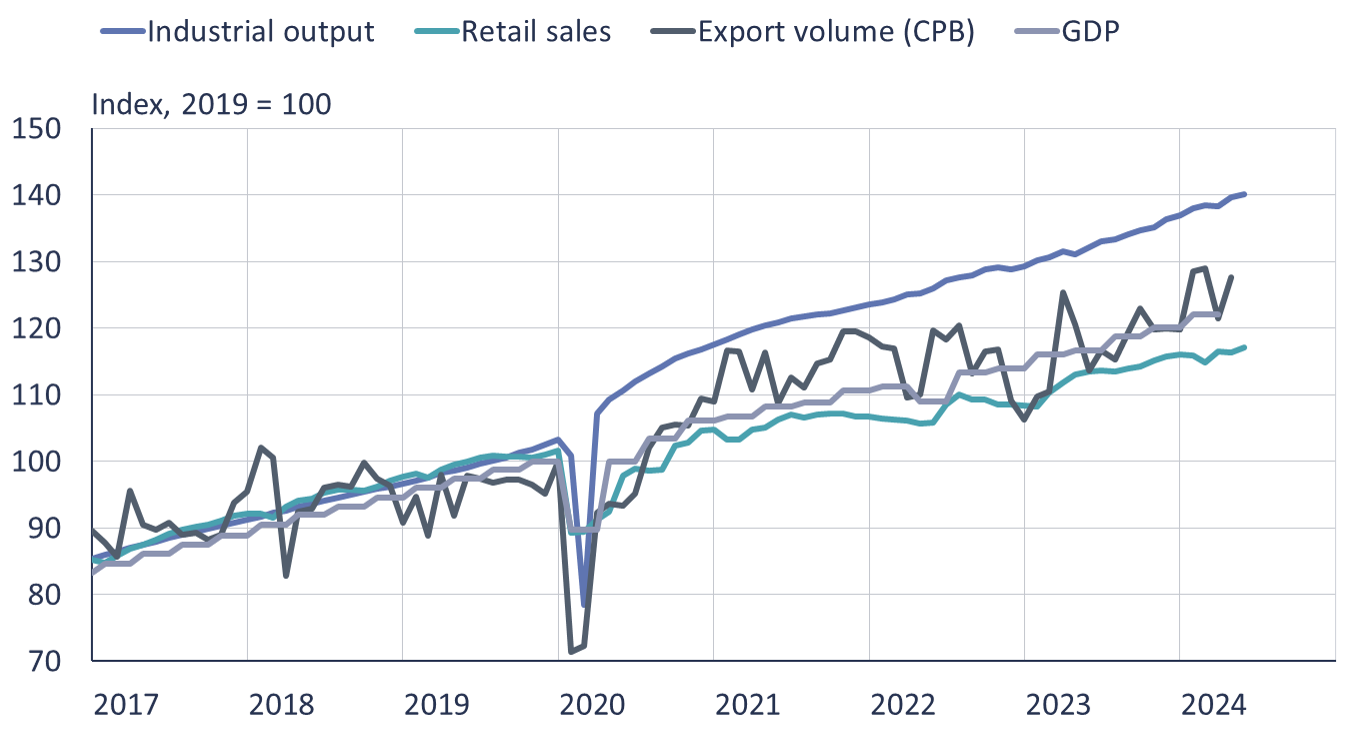

Retail sales have significantly lagged growth of industrial output and exports in recent years

* Nominal growth in retail sales based on consumer price index deflator.

Sources: China National Bureau of Statistics, CPB World Trade Monitor, CEIC, Macrobond and BOFIT.

Weak demand for bank loans; government issues more debt

The People’s Bank of China’s broad measure of credit, aggregate financing to the real economy (AFRE), rose by 8.4 % y-o-y in May. Most of the increase came from the unremitting growth in central and local government bond issues (stock up by 15 % y-o-y). May growth in bank loan stock was the lowest since records began to be kept at the start of 1998 (even if on-year growth rate in May was still 8.9 % y-o-y). Consumer price inflation remained a modest 0.3 % in May. Although party leaders have pointed to the need for more accommodative monetary policy to increase demand for financing and support the economy, the central bank has kept its policy rates and bank reserve requirements unchanged. Instead of seeking a rapid increase in financing, the PBoC says it focuses more on better utilisation of funds to higher productivity uses. The PBoC noted in its monetary policy report that the structural change in the economy, a move away from the credit-dependent construction and heavy industry sectors, makes it less reliant on debt financing going forward.

The government has increased its borrowing in recent months to support the economy. In March, the government began issuing ultra-long special treasury bonds. When issuance of the current batch of ultra-long bonds ends in November, the government expects to have issued 1 trillion yuan in such bonds with maturities of 20, 30 and even 50 years. The coupon on the 50-year government bond issued this month was 2.53 %. The finance ministry said that the central government expects to keep half of the money raised from its ultra-long bond sales and transfer the rest to local governments. The money would go to strengthening China’s technological and scientific self-sufficiency, food and energy security as well as regional development.

In January-May, local governments issued about 1.5 trillion yuan in new debt, which is about a third less than in the same period as last year. Two-thirds of this year’s 4.6-trillion-yuan quota granted to regional governments was still unused as of June 1 (of which, 3.9 trillion yuan consisted of off-budget special bonds). The party leadership has encouraged provinces to move ahead with issuing special bonds. Allocation of public assets, however, is challenging. It has been particularly difficult to find profitable projects in which to invest. In June, China’s National Audit Office published a budget implementation report that also covered the abuse of government funds. The report noted that assets acquired with money from special bond issues went to unapproved projects and that state companies had raised money with illegal financial products to e.g. pay down old debts or wages. The report also revealed that certain projects have received more government funding than needed to cover planned costs and that public projects only rarely manage to attract private financing.

Real 12-month changes and consumer prices, %

Sources: China National Bureau of Statistics, China Customs, WTO, CEIC and BOFIT.