BOFIT Weekly Review 25/2024

Rising government spending and rapid wage growth fuel demand and economic imbalances in Russia

Government spending continues to climb

Preliminary figures from Russia’s finance ministry show federal budget spending increased by 19 % y-o-y in the first five months of this year. Growth was especially brisk in recent months. The finance ministry also estimates that federal budget revenues rose substantially in the first months of the year. Therefore the ministry figures suggest that the federal budget deficit for January-May was about 1 trillion rubles (0.5 % of GDP).

The finance ministry’s preliminary estimates, however, are clouded by uncertainty. Previously the ministry reported for January-April a preliminary estimate of the budget deficit of 1.5 trillion rubles. A few weeks later the figures published by the Accounts Chamber of the Russian Federation suggested that the deficit actually amounted to nearly 4 trillion rubles. The difference apparently reflects the fact that the finance ministry’s revenue estimates were significantly higher than those of the accounts chamber. The finance ministry noted that revenue growth in January-April partly reflected one-time payments.

The 2024 budget framework calls for an overall annual deficit of 1.6 trillion rubles. At the beginning of June, however, the government submitted to the Duma its proposed changes to this year’s budget. The cabinet currently expects spending to exceed the current budget framework by about 500 billion rubles. The federal budget deficit is also expected to go up by about the same amount as no additional revenue increases are expected. Tax revenues from oil & gas are expected to be slightly lower than budgeted earlier, but should be offset by higher revenue streams from elsewhere.

Russia’s federal budget spending growth has again spiked in recent months

Sources: Russian Ministry of Finance, CEIC, BOFIT.

National Wealth Fund assets to finance infrastructure projects this year

According to first deputy economic development minister Ilya Torosov, the government will free up about 900 billion rubles (10 billion dollars) from Russia’s National Wealth Fund to distribute in the form of long-term low-interest loans (1-1.5 % p.a.) for financing infrastructure projects. The largest financing package – about 400 billion rubles – has been set aside for construction near the port of Ust Luga of a Gazprom facility for gas liquefaction and processing of ethane-containing gas. State-owned conglomerate Rostec should also get nearly 300 billion rubles for implementing an aviation development programme that includes producing 600 aeroplanes by 2030 for the needs of the domestic aviation companies. About 100 billion rubles have been promised for cheap leasing of aircraft, ships and busses, and another 80 billion rubles for construction of the Kazan-Yekaterinburg expressway. Some 30 billion rubles have been earmarked for construction of municipal infrastructure in Russia-occupied areas of Ukraine.

The economic development ministry has also proposed that the ceiling for assets invested from the fund in infrastructure project financing should be increased from its current 4.2 trillion rubles to 6 trillion rubles, but no decision has yet been reached. As of end-May, National Wealth Fund assets were valued at roughly 12.7 trillion rubles (7 % of GDP). Of that, about 5 trillion consists of more liquid assets (yuan-denominated securities and gold). The rest is mostly tied up in shares and bonds of large Russian corporations. National Wealth Fund assets are also planned to be used to cover budget deficits.

Tax hikes expected to increase budget revenues next year

At the beginning of June, the government submitted to the Duma a number of major amendments to the tax system. The proposed changes had been initiated earlier this spring by president Vladimir Putin. The revised taxation is expected to boost federal budget revenues by 2.6 trillion rubles (1.3 % of GDP) already in 2025. The additional tax income is intended to help finance new national projects (BOFIT Weekly 21/2024).

A proposed income tax hike has aroused a major public discussion. Russia introduced a flat 13 % income tax in the early 2000s. Since the start of 2021, annual income above 5 million rubles has been taxed at a 15 % rate. The proposed five-tier progressive income tax arrangement would range between 13 % and 22 %. The 13 % rate would continue for the first 2.4 million rubles in annual income (about 200,000 rubles or 2,200 dollars a month). All additional income above that would be taxed progressively. The finance ministry notes that the proposed changes would only affect about 3 % of the working-age population, or about 2.5 million people. The income tax increase is expected to bring in an additional 500 billion rubles to federal coffers each year. Although income tax revenues are typically collected to regional budgets, the new income tax revenues would go to the federal budget.

Perhaps the most lucrative change for the government, however, would be raising of the corporate profit tax from its current level of 20 % to 25 %. The profit tax hike is predicted to boost the government’s tax take by at least 1.6 trillion rubles a year, all of which would go directly to the federal budget. Certain changes are also planned for taxation of small firms that should increase budget revenues by about 350 billion rubles annually. Other major changes include extraction taxes on certain products such as iron ore, minerals used in fertiliser production, gold and precious stones, as well as a number of new excise taxes (e.g. nicotine). The stamp tax paid when registering a real estate transaction would be changed from a fixed fee to a percentage based on the sale price. The proposed tax changes are expected to add nearly 200 billion rubles a year to the federal budget.

Higher government spending boosts output, but also adds to inflation pressures

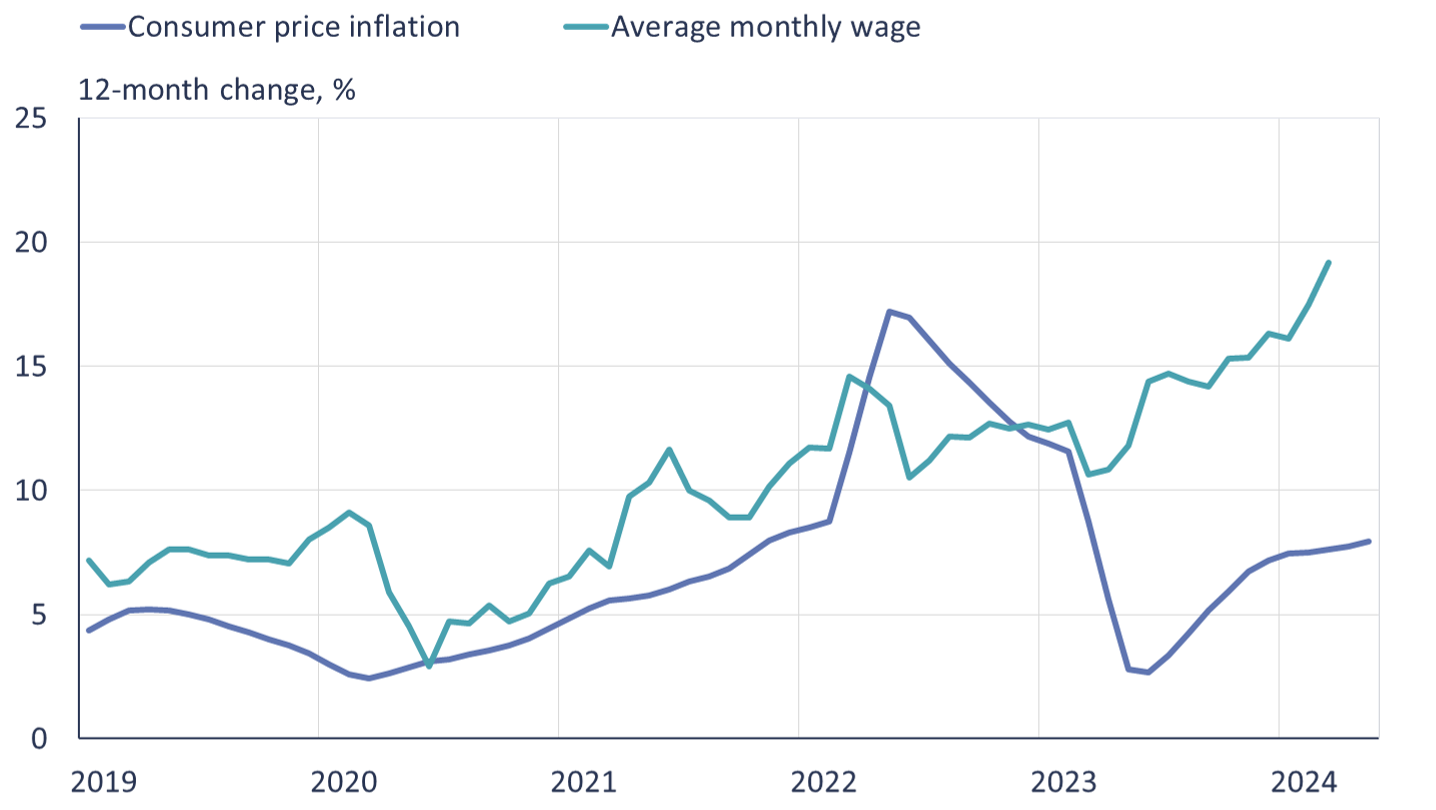

Following a mild March performance, Russia’s economic indicators were robust again in April. Manufacturing and construction benefitted from higher budget spending. Even as the retail sales trend calmed in April, consumer demand was fuelled by rapid wage growth. The average monthly wage rose in March in nominal terms by 22 % y-o-y. The last similar wage increase was seen in 2008 just before the global financial crisis hit Russia. Russia’s unemployment rate fell in April to 2.6 %.

Inflation has picked up in recent months. Rosstat reports that May consumer prices were up by 8.3 % y-o-y. Inflation expectations have also increased. At its June meeting, the executive board of Central Bank of Russia decided to keep the key rate unchanged at 16 %, noting that a possible rate hike might be forthcoming at its next meeting in end-July. The CBR board noted that demand continues to rise so fast the supply cannot keep pace. Inflation pressures can be further raised by risks related to foreign trade trends and vast government subsidy programmes potentially leading to an excessively rapid credit expansion.

Russia has devoted large amounts of money and industrial resources to sustaining its war effort, which leaves less resources available for dealing with other economic and social needs. Even if output grows to meet the needs of the war effort, economic imbalances are building up.

Wages in Russia have risen quickly in recent months

Sources: Rosstat, CEIC, BOFIT.