BOFIT Weekly Review 23/2024

Companies in Russia rely largely on domestic banks for financing

Sanctions limit access to foreign lenders

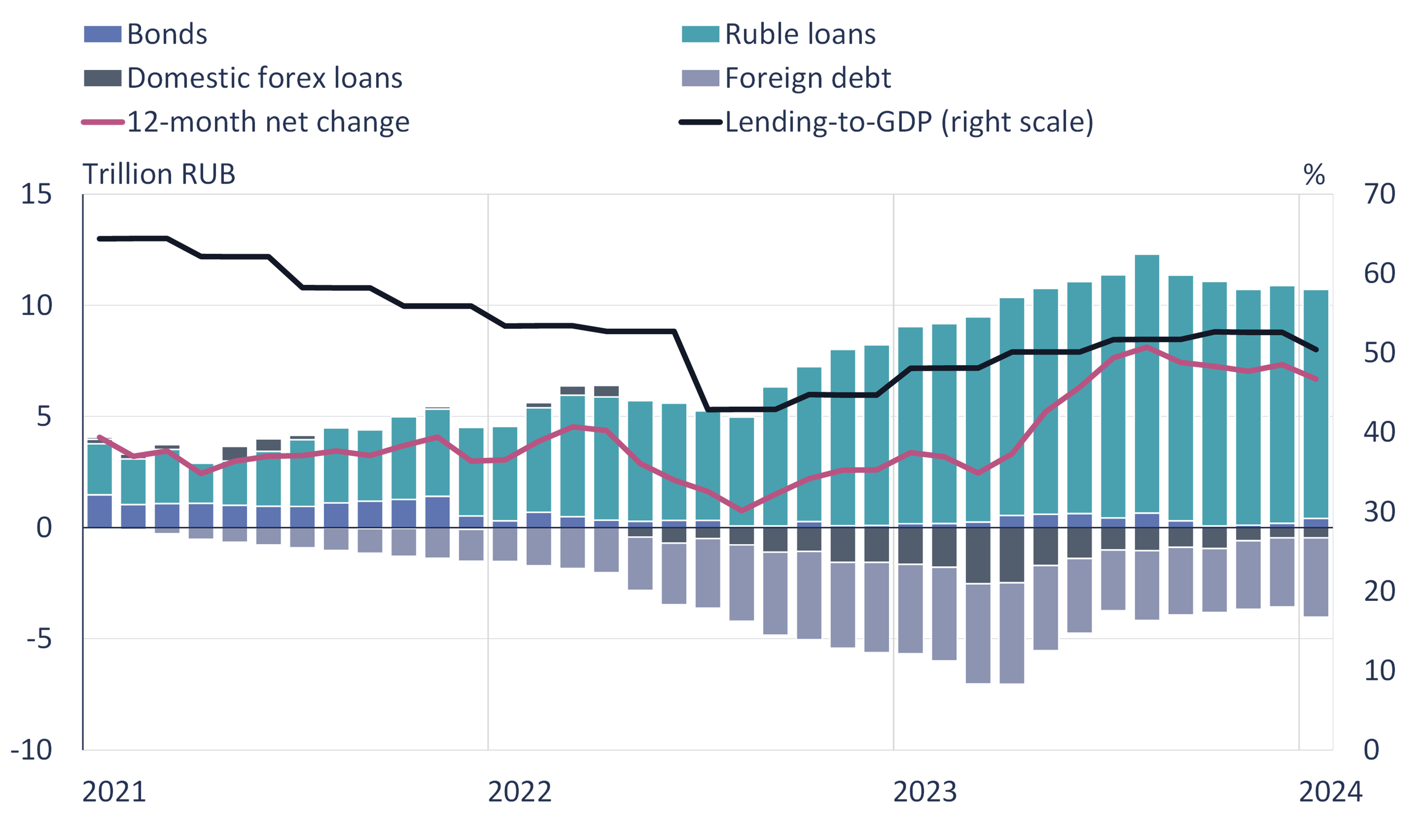

The access of large Russian corporations to international financial markets is extremely limited due to financial market sanctions. No Russian firm has announced a significant new bond issue or syndicated loan since 2021. Russian companies have instead sought to pay off foreign loans and bonds as they mature – a trend highlighted by the country’s rapidly shrinking foreign debt. At the end of last year, Russia’s total foreign debt amounted to a mere 317 billion dollars, or 172 billion dollars less than at the end of 2021. Just over 60 % of foreign debt (200 billion dollars) was denominated in foreign currencies. Corporate sector forex-denominated debt, in particular, has declined – and the pace of debt repayment shows no sign of slowing this year. As of end-March 2024, Russian foreign debt amounted to just 304 billion dollars. The Central Bank of Russia (CBR) reports that Russia’s shrinking foreign debt reflects reductions in collateral of banks and corporate sector direct investment, as well as accelerated repayment of long-term corporate loans and bonds.

Prior to February 2022, foreign borrowing was key to the fundraising efforts of Russian export firms. As a consequence of war and sanctions, even giant resource extraction firms have had to turn to domestic financing sources. Because Russia’s equity and bond markets are fairly small, and because foreign investors, led by large institutional investors, have pulled out of Russia, the domestic banking sector has become the default financing source for most firms. Since summer 2022, the stock of domestically-issued corporate loans has grown briskly. Even with soaring interest rates, Russian banks granted about 20 % more corporate loans last year than in 2022. Some ruble loans have been used by companies to pay down foreign debt. The ratio of total corporate debt to GDP is still slightly less than the pre-invasion level.

While domestic debt has increased, Russia’s foreign debt has shrunk

Source: Central Bank of Russia.

The conundrum of large firm reliance on the domestic bank sector

From a Russian company’s standpoint, shifting from international financial markets to domestic financiers implies a sharp increase in interest costs. The average adjustable-rate corporate loan in Russia has risen over the past year from 9.2 % p.a. to 16.8 % (as of April 1, 2024). About half of corporate loans are adjustable-rate loans. At the same time, the government has created a variety of the support programmes for “strategically important” firms and branches. Subsidised fixed-rate loans can be less than half the prevailing market rate. While no current data is available on the rates of new subsidized loans, the CBR reports that at the beginning of 2024, 6.5 % of loans to large firms and 14.6 % of loans to small and medium-sized firms qualified for government loan-support programmes. The construction sector is also supported by support to households in the form of subsidised-interest housing loans. In the first three months of this year, only 30 % of new housing loans were granted on the basis of prevailing market rates. Due to the popularity of the interest-subsidy programmes, about a quarter of all household loans qualify for official government support programmes.

From the perspective of the banking sector, the phenomenon of large export firms turning to domestic credit institutions for financing comes with both benefits and risks. Large export firms, which typically enjoy excellent credit ratings and good debt-servicing capabilities, make attractive bank customers. On the other hand, the situation has led to a pile-up of credit risks. The ratio of bank loans of Russia’s five largest firms to total equity of the domestic banking sector was 36 % at the end of 2021. Despite rapid growth in the capitalisation of the banking sector, the debt-to-equity ratio hit 56 % in end-March 2024. The share compares to about 14 % of the corporate loan stock of the entire banking sector. In addition, a few large commercial banks are specialised in lending to large firms. This means that the problems of just a few large firms would be sufficient to destabilise the whole banking system. As lender of last resort, the Russian government claims it can turn to large firms in which the state has a stake or large commercial banks if it must mitigate the effects of an unexpected systemic shock. Observers note, however, that such assistance might not be forthcoming in a crisis. For this reason, the CBR wants to clarify its banking supervision and capital adequacy requirement to deal with this concentrated lending arrangement.

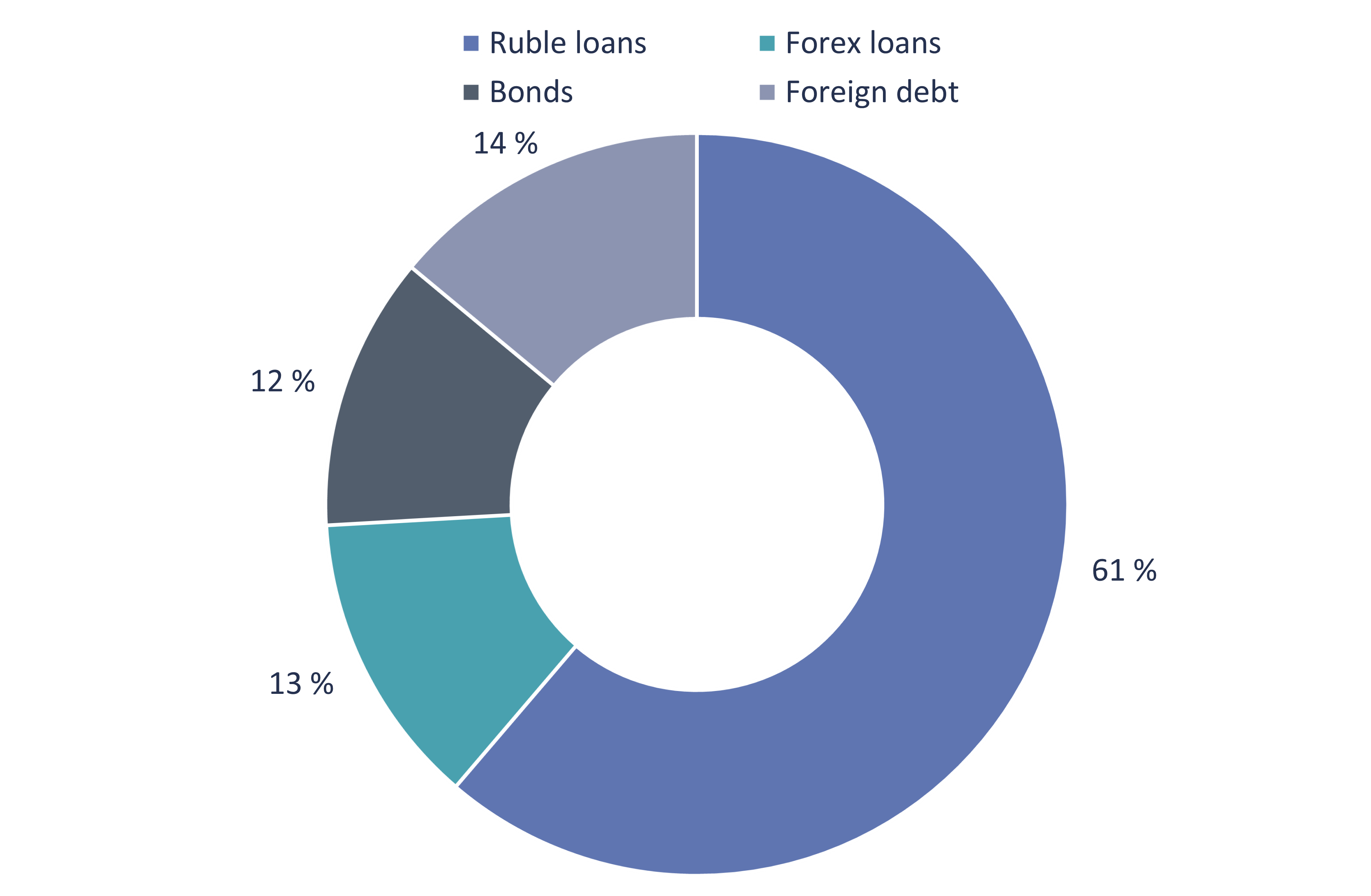

From the standpoint of the overall economy, the end of foreign financing and the return of export firms to the domestic market could raise critical issues about the availability of financing. Companies fund the lion’s share of their fixed investment either out of pocket or with government-provided budget support. In the corporate sector, however, about three-quarters of all external financing is provided in the form of bank loans. Companies involved in the war effort or import substitution should continue to benefit from government support programmes or direct budget subsidies. In contrast, the access of private firms not involved in the war effort to inexpensive financing for their own investment projects could weaken. Because the domestic banking sector is also a significant purchaser of government treasury bonds, competition for credit could become fierce if government financing needs increase in coming years.

Bank loans from domestic banks represent about three-quarters of the external financing to Russia’s corporate sector

Source: Central Bank of Russia.

Despite rapid growth in borrowing, the overall capital adequacy of the Russian banking sector remains good. Bank fundraising has been supported by wage hikes and increased interest rates on bank deposits, which is reflected especially in the growth of household deposits. According to media reports, growth in bank deposits has also been supported by certain Russian firms and wealthy private individuals repatriating their assets in the West to Russia. A budding domestic recovery may also be contributing to the slowdown in growth of Russian household deposits in foreign banks. A modestly positive economic outlook and rapid growth in the loan stock has kept the amount of non-performing loans relative to the total loan stock quite low.

Use of Western currencies declines dramatically

Sanctions have complicated many aspects of using foreign currency in Russia. With the exception of Gazprombank, all large Russian-owned banks remain on the US sanctions list, which in itself is sufficient to make operating in Western currencies practically impossible for most of the banking sector. In addition, ten large Russian banks and four Belarussian bank have been denied access to the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system for transmitting international payments. Sanctions do not apply to all banks in Russia, however. For example, a number of foreign-owned banks such as the Austrian Raiffeisen Bank and the Italian Unicredit Bank still operate in Russia.

The impacts of sanctions on the financial sector can be seen in the dramatic shift in currency allocations. Traditionally, a significant share of both corporate loans and corporate deposits were denominated in foreign currencies. The share of forex loans had been declining before February 2022, but post-invasion firms rushed to pay off dollar- and euro-denominated loans to convert their debt to rubles. The overall share of forex loans in the total bank lending stock has fallen to just over 10 %.

Because the use of Western currencies carries significant sanction risks, the use of such currencies as an invoicing currency in foreign trade transactions has collapsed. At the end of 2021, 85 % of exports and 68 % of imports were invoiced in dollars or euros. At the end of last, those shares were just 32 % for exports and 34 % for imports. While the ruble’s share has increased slightly, use of the Chinese yuan has climbed from zero to around 30 %. Foreign payments are increasingly transmitted by Russia’s SPFS (System for Transfer of Financial Messages) and the Chinese CIPS (Cross-border Interbank Payment System). The use of cryptocurrencies in foreign payments is also reported.

China’s foreign currency regulations and Chinese banks’ fear of secondary sanctions has reduced the attraction of providing yuan-denominated financing to the Russian market. A number of banks have granted their corporate clients yuan loans, but these are largely financed with domestic deposits. For this reason, yuan loans only comprise a small slice of the loan stock and play only a minor role in corporate bond issues. The yuan’s importance, however, has grown considerably in forex markets. In the first months of this year, about half of the Moscow Exchange’s forex trade involved ruble-yuan pairings. The yuan market does not offer the same opportunities for dispersion of risk like dollar- or euro-based markets, so excess or lack of yuan liquidity occasionally causes problems.