BOFIT Weekly Review 22/2024

Despite sharp rise in Chinese industrial output, growth in domestic consumption still weak

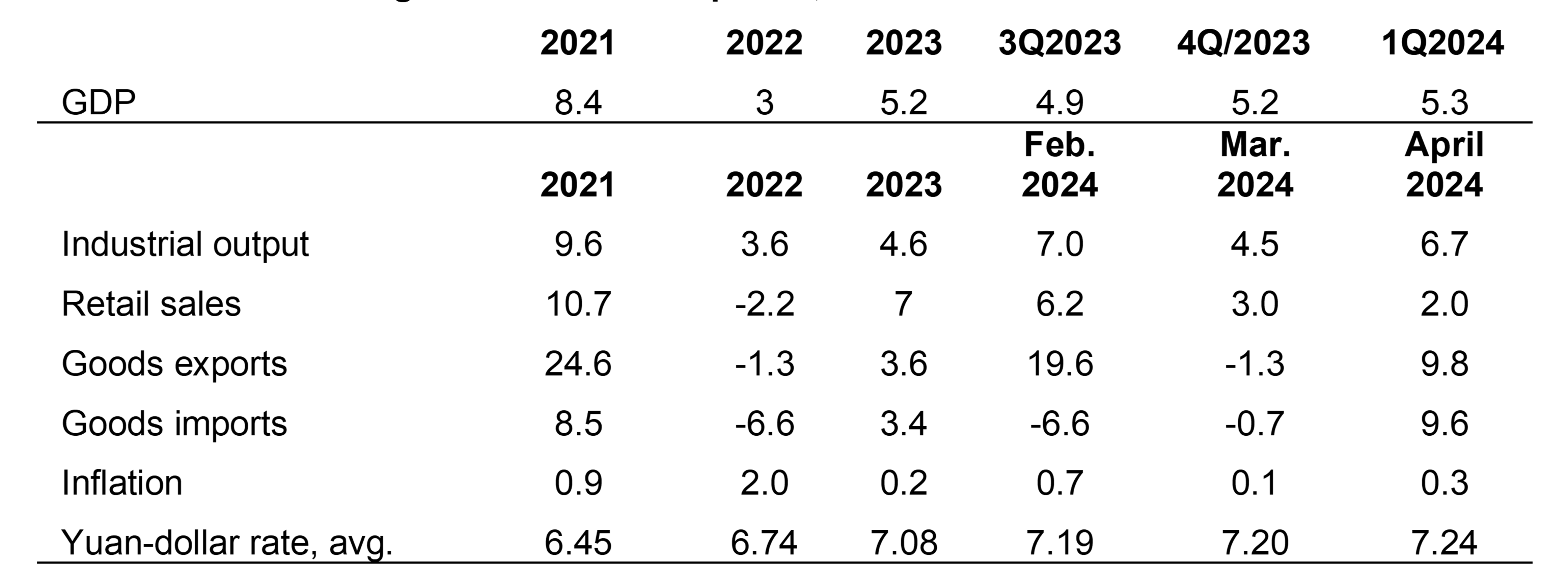

China’s economic picture remains mixed. Government stimulus policy has kept industrial activity brisk, with real industrial output rising by 7 % y-o-y in April. Production growth in the automobile industry was particularly robust (up 16 % y-o-y). Fixed investment growth has also been dominated by the manufacturing sector. Medium- and long-term loans issued by banks to industrial firms slowed a bit in the first four months of this year, but were still up by over 20 % y-o-y. Even with manufacturing growth surging, domestic consumption growth was tepid. Real on-year growth in retail sales slowed to just over 2 % in April. Slack demand also evidenced in subdued inflation.

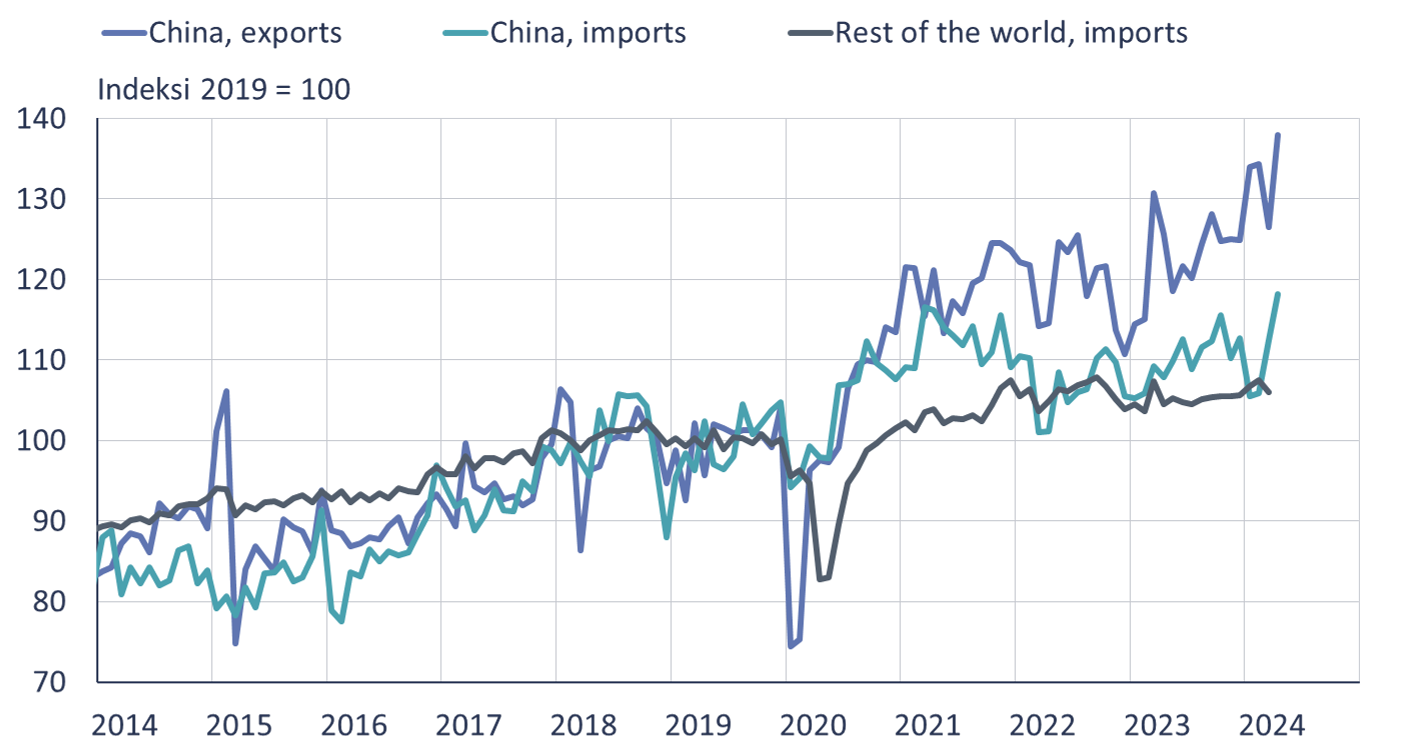

Export growth has been supported by a rapid increase in domestic production, weak growth in consumer demand, as well as a slight improvement in global demand and pricing advantage due to a weak yuan. The volume of Chinese exports grew by 10 % y-o-y in the first four months of this year, but only by slightly over 1 % in dollar terms. Some 17 % of China’s exports went to ASEAN countries, 15 % to EU countries and 14 % to the United States. The low growth in Chinese domestic demand hurt imports, however. The volume and dollar-value of goods imports increased in the first four months of this year by just 3 % y-o-y. As of the end of April, China had amassed a trade surplus of 256 billion dollars, or nearly as much as in the same period last year.

Volume of Chinese goods exports and goods imports

Sources: China Customs, CPB, CEIC, Macrobond and BOFIT.

More support for the real estate sector

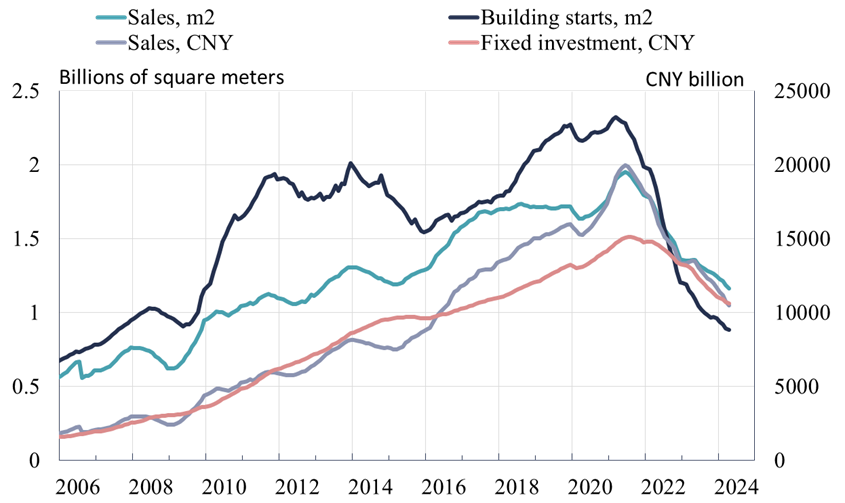

Even after nearly three years, there is no sign that the collapse of China’s real estate sector is slowing. Measured in terms of floorspace (m2), apartment sales in January-April were down by more than 20 % y-o-y and new building starts by more than 20 %. More than 10 % fewer apartments were under construction and more than 20 % fewer apartments were completed in the first four months of this year. Since late 2022, officials have resorted to a range of measures to halt the collapse of the real estate sector. The latest rescue package, introduced in mid-May, cuts the minimum downpayment on an apartment purchase to 15 % for first-time apartment buyers and eliminates the minimum interest rate on housing loans. Chinese cities decide on the downpayment requirement and minimum interest rate on housing loans. With the announcement of national measures, many cities have themselves announced cuts in their downpayment requirements and minimum loan rates. In addition, the People’s Bank of China intends to offer banks 300 billion yuan (40 billion euros) in low-interest loans (1.75 % p.a.) specifically earmarked for acquisition of unsold apartments. Eligibility is limited to companies owned by local governments. The PBoC’s three previous attempts at channelling money to developers flopped as banks were less than keen to further increase their exposure to real estate sector. The ongoing drop in apartment prices has also diminished general interest in purchasing apartments. While transfer of empty apartments from developers to local governments relieves some of the burden on developers, it does nothing to resolve apartment oversupply. Beyond national measures, some cities have announced their own measures to promote apartment sales. Shanghai, for example, is offering a 30,000 yuan (3,800 euros) reimbursement to people who trade in their old apartment for a new apartment.

The collapse of real estate sector is now in its third year

Sources: China National Bureau of Statistics, CEIC and BOFIT.

Aggregate financing shrank in april

Aggregate financing to the real economy (AFRE), a broad debt measure used by the PBoC, measures total domestic funding to the economy (includes households, state entities and non-financial firms). At the end of April, the total AFRE stock was 72 billion yuan less than in March, a first decline since 2005. The stock still grew 8 % y-o-y in April and was 390 trillion. The biggest drop in the April figures was the decline in banker's acceptance bills. The stock of bank loans grew by 730 billion yuan from March, largely on increased corporate borrowing. The stock of household loans contracted by 360 billion yuan. Demand for bank loans has been hurt by real estate problems and weak consumer confidence. Growth in the stock of bank loans slowed in April to still just under 10 % y-o-y.

The rise of consumer prices in April was just 0.3 % y-o-y, while producer prices continued to fall (down by 2.5 %). The PBoC has kept its policy rates and reserve requirements for banks unchanged for several months. With growth in the lending stock slowing and low inflation, the central bank is under pressure to ease monetary policy to support the economy. This was also mentioned in quotes released to the media following the politburo meeting at the end of April. The central bank is likely to start to buy and sell government loans in the secondary market as part of open market operations. The discussion on this possibility began this spring with the publication of excerpts from president Xi Jinping’s speeches and writings on the economy and financial markets. Xi suggested this approach as a way to increase the range of available monetary policy tools, and the finance ministry has endorsed the idea. Official comments argue that this would depart from quantitative easing in that the central bank would both buy and sell government bonds and that the policy would be primarily aimed at influencing market liquidity and balancing the yield curve.

The PBoC this spring has dampened yuan depreciation against the dollar by keeping its daily fixing rate (fix) virtually unchanged. With the dollar strengthening, the yuan’s nominal exchange rate has gained slightly against several other currencies. Some observers have suggested that China should devaluate the currency to support exports. Allowing the yuan to lose value against the dollar would also make it possible to loosen monetary policy. This is still unlikely as China’s officials bear the scars from the PBoC’s 2015 decision to allow a sudden devaluation in the fixing rate. The move triggered a panic in financial markets and caused capital to flee the country. An important difference between the situation in 2015 and today, however, is that China’s real effective (trade-weighted) exchange rate (REER) is currently weaker than it was a year ago.

Real 12-month changes and consumer prices, %

Sources: China National Bureau of Statistics, China Customs, WTO, CEIC and BOFIT.