BOFIT Weekly Review 20/2024

Putin goes to China; US sanctions affect Chinese and Russian bilateral trade

Russian president Vladimir Putin flew to Beijing on Thursday (May 16) to begin a state visit hosted by Chinese president Xi Jinping. Putin today (May 17) travels to Harbin, a city in northeast China with long history of Russian influence. China-Russia relations have become closer since Russia’s full-scale invasion of Ukraine. Putin’s previous visit to China was in conjunction with a forum on the Belt & Road initiative held last October. Russian media said the leaders would discuss innovation cooperation in such areas as advanced technologies, space and renewable energy. Notably, none of the press releases on the state visit mention the Power of Siberia 2 pipeline project. Russia has long strived to finalise the pipeline deal, which it sees as critical. Russian gas giant Gazprom plans to commission the pipeline in 2030, even though no agreement with China has yet been reached.

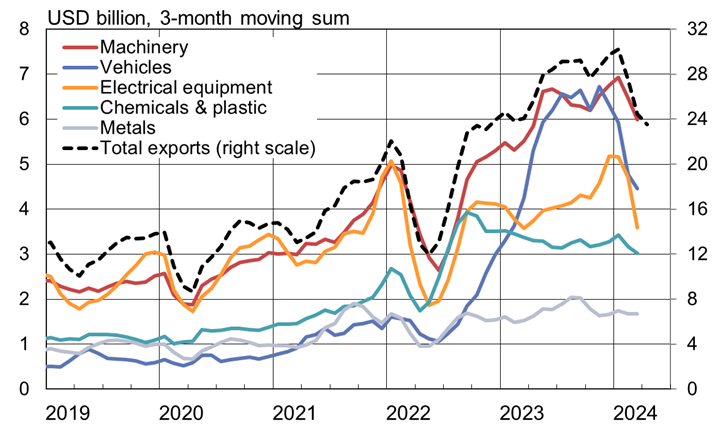

Trade between the two countries has declined. China Customs reports that the value of goods exports to Russia was down by 3 % y-o-y in the first four months of this year, while the value of imports increased by 11 %. Exports of vehicles to Russia have declined significantly, due in part to a sales boom last year, when Russians bought Chinese cars on the news that Russia would eliminate in April 2024 a loophole allowing the import of Chinese cars via the Eurasian Economic Union at a reduced tax rate.

Most of the growth in China’s imports from Russia reflect increased crude oil imports, which were up in the first quarter by 13 % y-o-y (China’s total oil imports grew by 1 %) and up in dollar terms by 20 % y-o-y. Imports of petroleum products and natural gas from Russia were also up in the first quarter, while coal imports sank. Russia is China’s most important oil supplier, accounting for 20 % of China’s total oil imports. China Customs figures show that the price of a ton of oil imported from Russia in the first quarter of this year came at a 3 % discount compared to the average price of imported crude oil and was 7 % cheaper than crude oil imported from Saudi Arabia.

Bilateral trade between Russia and China have been dominated in recent months by Western sanctions on Russia. Late last year, the US introduced second-tier sanctions on foreign financial firms engaging in transactions to assist Russian entities skirt Western sanctions. According to media reports, China’s three large state banks (BOC, CCB and ICBC) are refusing to accept payments from Russian firms subject to sanctions, and the banks are more skittish about handling Russian payments that might have the slightest connection to sanctions. Banks have begun to demand that both sellers and buyers provide extensive documentation as to the goods or services covered by the payments. According to media reports, this has caused long delays in payment traffic between Russia and China. Some Russian firms have resorted to paying via third countries, even if this approach increases transaction costs. Chinese firms this year have been encouraged to shift to using the yuan in their trade with Russia. Nearly a quarter of Russia-China trade was conducted in yuan last year (BOFIT Weekly 29/2023). According to media reports, many Chinese banks (including ICBC) have this spring ceased to accept also yuan payments from Russian firms, while some have terminated their Russia business altogether. Small banks with no other international operations have grown their market shares.

Russia’s war of aggression on Ukraine and Western sanctions have increased Russia’s dependence on China. China (including Hong Kong) now accounts for about 40 % of Russia’s goods imports (BOFIT Weekly 33/2023). Russia has also increased its importance as a trading partner of China, accounting for 5 % of China’s goods imports and 3 % of exports. Travel between countries, however, has fallen significantly from pre-pandemic years. Russia’s statistics office Rosstat figures show that only a quarter of the number of Chinese tourists visited Russia last year compared to 2019, while the number of Russian tourists visiting China was less than a third of the number of visitors in 2019.

China’s goods exports to Russia have declined this year

Sources: China Customs, CEIC and BOFIT.