BOFIT Weekly Review 20/2024

Challenging as they may be, relations between China and the EU are important to both sides

At the beginning of May, Chinese President Xi Jinping made his first trip to Europe since 2019. The visit, which included stops in France, Hungary and Serbia, was generally portrayed in the media as an effort on China’s part to patch up relations with Europe. China-US relations are currently in a fragile state, and China fears that Europe may increasingly side with the US against China. Xi’s brief European tour at least provided the EU with an opportunity to engage in dialogue with China.

On May 6, Xi met in Paris with French President Emmanuel Macron and European Commission President Ursula von der Leyen. The trilateral discussion focused on geopolitics, climate change and economic relations between the EU and China. According to a European Commission press release, the discussions on economic and trade relations focused mainly on three areas: 1) China’s structural overcapacity and state-supported industries, 2) easing access of foreign firms to the Chinese market and 3) improving resilience of supply chains. Despite large differences in the views of Europe and China on these matters, both sides conceded that bilateral relations and keeping open channels of communication are important.

China’s industrial policy that favours and subsidises domestic firms, is seen to create an unfair competition arrangement in international markets. This issue has lately received broad attention in Europe. Unlike the US, the EU has recently refrained from imposing new punitive tariffs on Chinese products, leading to colourful debates on the matter. Nonetheless, the EU has launched an investigation into possible competition violations in several fields, including Chinese medical equipment, wind turbines, solar panels and electrical vehicles. The results of these investigations are expected to impact trade policy decisions.

Differing views and China’s challenging business environment are apparent to firms operating in China. According to the survey released by the Chamber of Commerce of the European Union in China on May 10, confidence of European firms operating in China continues to fade. China’s structural problems such as weak domestic demand, industrial overcapacity and the real estate sector’s downturn – not to mention market access and regulatory barriers – complicate the activities of European firms operating in China.

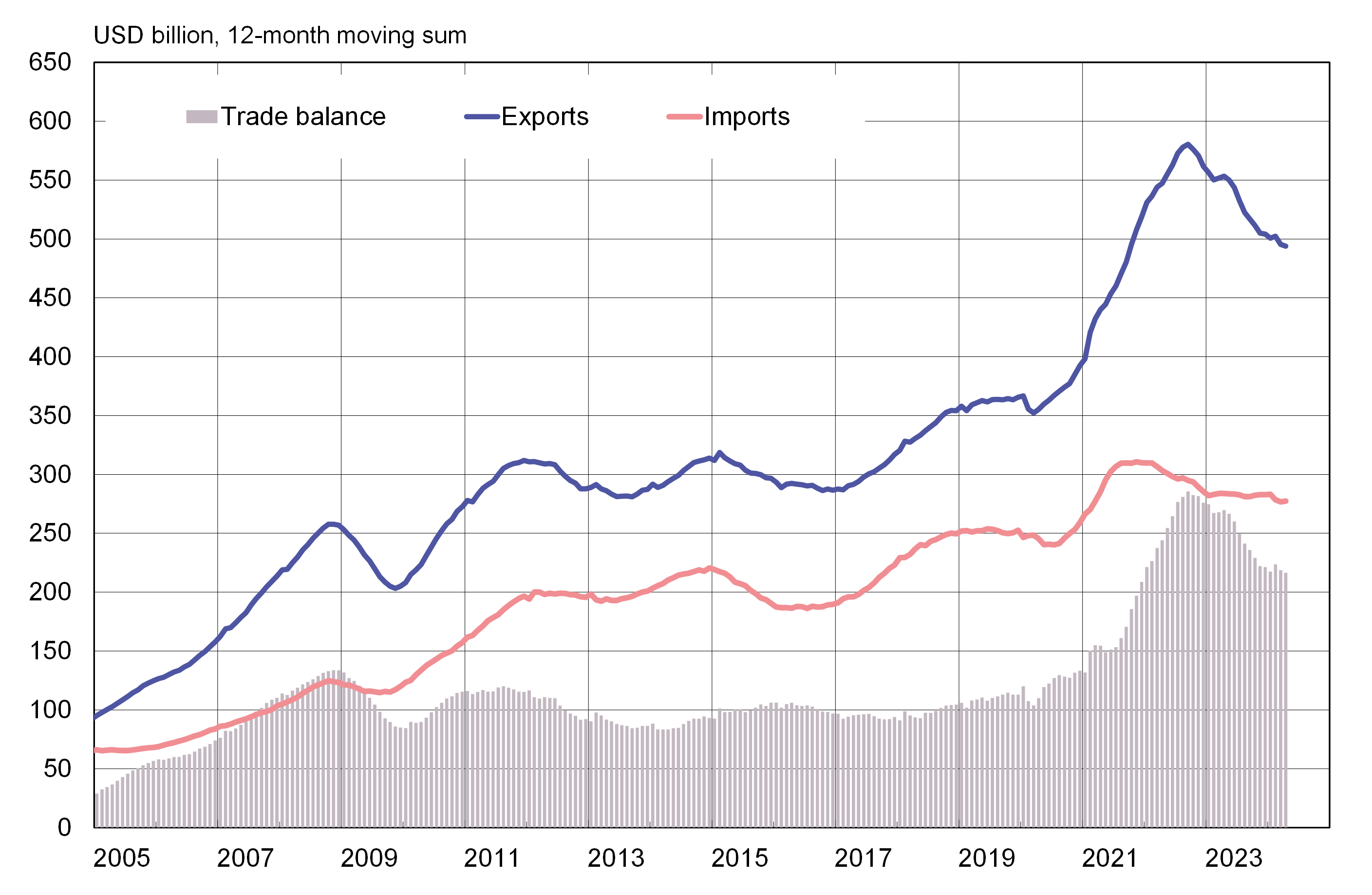

Figures from China Customs show that goods trade between China and the EU in the first four months of this year contracted by 6 % y-o-y. The value of China-EU trade fell by 7 % last year. The biggest drop was in EU exports to China (down 10 %), while imports from China only contracted by 1 %. The value of Chinese exports to the EU amounted to 504 billion dollars in 2023, while the value of imports was 283 billion dollars. As a result, China’s trade surplus with the EU amounted to 221 billion dollars.

China is an extremely important export market for the EU. China, for example, was the destination for 9 % of the EU’s exports outside the union in 2023. The EU, like the US, is also an extremely important export market for China. The EU and the US each account for about 15 % of China’s total exports. Top EU exports to China include motor vehicles and parts, pharmaceuticals, as well as electronic devices and parts. EU imports from China include telecommunications devices, computer technology and various electrical devices.

China-EU goods trade dipped last year from historical highs

Sources: China Customs, Macrobond and BOFIT.