BOFIT Weekly Review 18/2024

New BOFIT forecast sees several factors slowing China’s economic growth

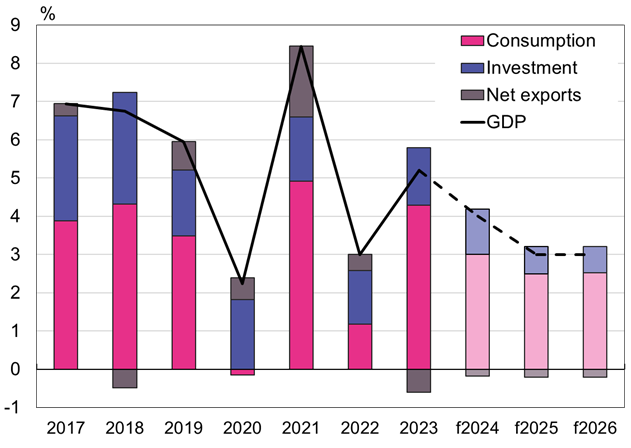

In our latest BOFIT Forecast for China 2024–2026 released last week, we note a number of cyclical factors restraining growth, including the ongoing real estate sector crisis and sagging consumer confidence. We expect that the contraction in real estate construction and housing sales will continue during the forecast period. The outlook for export industries remains weak due to tensions between China and many of its main trading partners. In the presence of such factors, we expect GDP growth to undershoot last year’s growth and the government’s “about 5 %” target this year and come instead at around 4 %. Structural factors such as the rapid ageing of the population and excessive indebtedness are expected to slow growth over the longer term. In the out years of our forecast (2025 and 2026), annual growth should fall to around 3 %, a level close to the pace of global growth.

There are no major changes to the outlook for the Chinese economy overall since our previous October 2023 forecast. Driven by strong industrial output, China’s first-quarter growth was surprisingly strong, with official GDP up by 5.3 % y-o-y (BOFIT Weekly 16/2024). March growth, however, was lower than in the previous two months, and we expect economic growth to slow further in the remainder of this year. Official figures, however, do not provide a complete picture of economic trends in China. BOFIT’s own alternative calculations indicate that real GDP growth in China has come in somewhat below official figures in recent years. The deteriorating quality of Chinese statistical data not only complicates our assessment of the actual current economic situation, but adds to forecast uncertainty.

With the continued decline in the construction sector (BOFIT Weekly 18/2024), China has sought to shift its economic policy emphasis to manufacturing, particularly high-tech manufacturing. The goal is to raise productivity overall. Shifting the policy emphasis away from fixed investment in construction and infrastructure projects to increasing productivity is definitely a welcome policy move, but it is still too early to judge the Communist Party of China’s new tack or its potential impacts on productivity or how will this translate to overall economic growth. There is a very real risk that boosting state-backed production could encourage wasteful investment and overcapacity in many branches, particularly as domestic demand is already subdued. Increasing productivity would require greater operational freedom for private firms and improvements in the business environment. This is at odds with the CPC’s latest efforts to further tighten its grip on the economy. In any case, anticipated investments in production capacity should enhance China’s outstanding export price competitiveness, a fact that could increase tensions between China and its trading partners.

China has failed to address the fundamental issues needed for sustainable fiscal policies, and in coming years the costs of dealing with a rapidly ageing population will only increase. Thus, balancing public finances requires new revenue sources, particularly from increased taxation. The fiscal constraints are most acute at the provincial level as provincial governments are responsible for providing the bulk of economic support and hold majority of public-debt. At the same time, room for economic stimulus is shrinking. This year’s budget anticipates only slight growth in revenues and spending, which provides essentially no room for broad stimulus. Government support instead is targeted at few problem areas such as helping provinces and the real estate sector. On the monetary policy front, the possibility of broad-based easing is limited by depreciation pressure on the yuan and capital flight.

Our forecast comes with a litany of risks. It is difficult to form a comprehensive assessment of banking sector conditions, but hidden problems may lurk in smaller banks. If developer problems pile up and destabilise the banking sector, systemic problems could spread to financial markets and eventually hurt the real economy. China’s weakened public finances also strain fiscal policymaking and limit the government’s ability to tackle new challenges as they arise. In addition, China’s foreign relations remain inflamed at a time of heightened geopolitical risk.

China’s GDP growth, factors contributing to growth and BOFIT Forecast for 2024–2026

Sources: China National Bureau of Statistics and BOFIT.