BOFIT Weekly Review 16/2024

China official figures show strong first-quarter growth with a slowdown in March

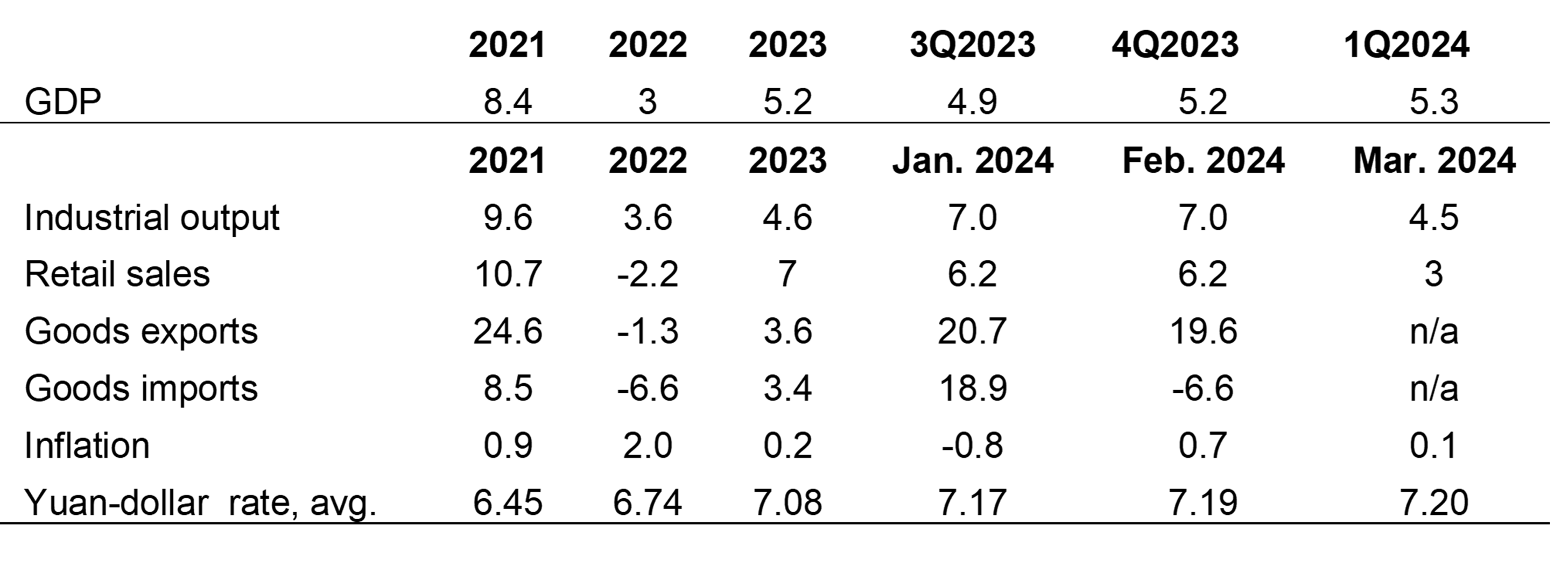

China National Bureau of Statistics (NBS) reports that GDP in January-March rose by 5.3 % y-o-y. The biggest contribution (3.9 percentage points) came from increased consumer demand, while net exports accounted for 0.8 percentage points of growth and fixed investment just 0.6 percentage points. In supply-side, secondary industry (manufacturing and construction) was up on-year by 6 %, while services grew by 5 %. GDP growth accelerated to 1.6 % q-o-q (annualised to 6.6 %).

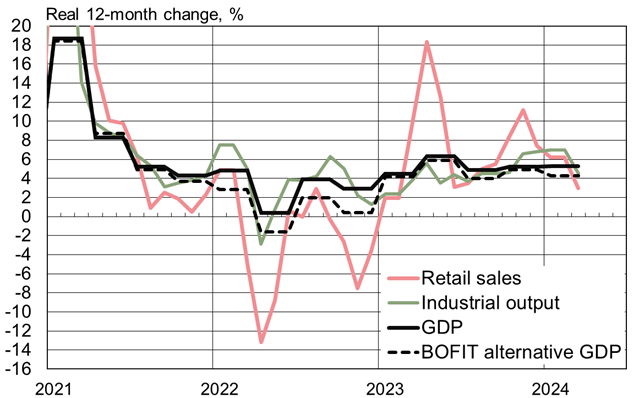

BOFIT’s alternative GDP calculation indicates that first-quarter growth was again somewhat lower than the official figure. Economic growth averaged 4.3 % y-o-y in the first quarter.

Monthly figures for both industrial output and retail sales show that March growth slowed substantially from January-February. NBS figures show that industrial output grew by 4.5 % y-o-y (7 % in January-February) and that the volume of March industrial output fell from February. Real growth in retail sales remained just at around 3 % in March (6.2 % in January-February).

Growth in retail sales and industrial output slowed in March

Note: Real retail sales growth based on consumer price inflation where data series unavailable.

Sources: China National Bureau of Statistics, CEIC and BOFIT.

Export demand contracted in March. The value of China’s goods exports in dollar terms fell 8 % y-o-y (up 2 % in January-March). The value of goods imports was down 2 % (up 2 % in January-March). The yuan has lost ground on-year against the dollar, which makes the picture rosier when the value of trade is measured in yuan. The value of exports in March fell by 4 %, while the value of imports increased by 2 %. China Customs reports that export prices in January-February have been substantially lower than a year earlier, which translates to rapid growth in export volumes.

Income growth in the first quarter continued to outpace economic growth overall. The NBS reports that per capital disposable incomes rose by 6.2 % y-o-y in real terms. The overall urban unemployment rate released by the NBS typically show only minute changes, coming in at 5.2 % in March. China late last year adopted a new methodology for determining the youth (16–24-year-olds) unemployment rate, which was reported as 15.3 % for February and March (14.6 % in January).

Domestic price trends remained subdued in March, with consumer prices slowing to 0.1 % (0.7 % in February). In the first quarter, consumer prices were at the same level as in 1Q23, while producer prices fell by 2.7 % y-o-y.

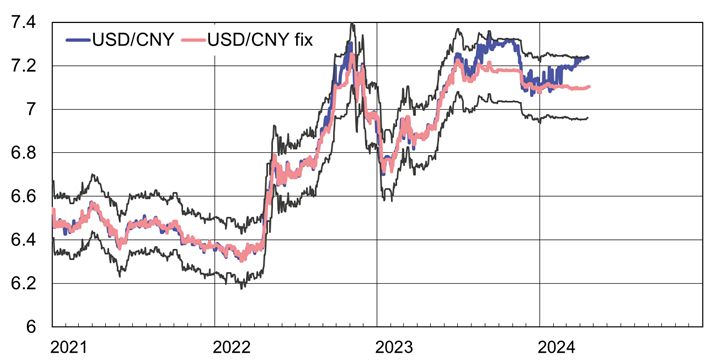

Central bank strives for stable yuan-dollar rate despite increased depreciation pressures

The yuan’s exchange rate against the dollar is facing similar depreciation pressures as in last autumn. Factors pushing down the yuan include the dollar’s appreciation against other major currencies, the huge interest rate difference between the US and China, uncertainty surrounding China’s domestic economy and geopolitics. On Thursday (Apr. 18), one dollar bought 7.24 yuan. The exchange rate is now much weaker than Chinese are used to. The yuan plumbed similar lows against the dollar last autumn, but before that yuan was as weak against USD in 2008. Depreciation pressure has also been signalled since the start of this year by the persistent weakness in the yuan’s offshore rate (CNH) compared to the onshore (CNY) rate in mainland China. On Thursday (Apr. 18), the CNH-USD rate was 7.25. The yuan-euro exchange rate has remained relatively stable since late summer, but last week the yuan gained against the euro. On Thursday (Apr. 18), one euro bought 7.73 yuan. The yuan’s real effective (trade-weighted) exchange rate, REER, has remained fairly stable over the past nine months.

China’s central bank possesses a large toolbox with which it can affect the yuan’s exchange rate. Although the yuan’s exchange rate is officially set relative to a currency basket, forex market operations are geared to the dollar-yuan rate. The PBoC kept its daily fixing rate at 7.10 yuan to the dollar, even as the yuan rate in the past weeks bumped against the top (i.e. weakened) of the permitted fluctuation band (excursions of less than 2 % in either direction from the daily fixing rate do not invoke a central bank intervention). In other words, the PBoC has not allowed the yuan to weaken as much as markets would have. While the PBoC so far does not appear to have dipped into its currency reserves to any large extent in propping up the yuan, China’s large state-controlled commercial banks have actively participated in currency operations. As a result, government interventions in the currency markets remain fairly opaque. Commercial banks also manage the CNH rate with the support of the PBoC and the Hong Kong Monetary Authority (HKMA).

The yuan has recently tested the upper band limits for the PBoC’s CNY-USD daily fixing rate

Sources: PBoC, Macrobond and BOFIT.

Real 12-month change and consumer prices, %

Sources: China National Bureau of Statistics, China Customs, WTO, CEIC and BOFIT.