BOFIT Weekly Review 14/2024

Taiwan’s economy showing signs of recovery; impacts of this week’s 7.4 earthquake still somewhat uncertain

The export-oriented Taiwanese economy is now emerging from a couple of challenging years. Taiwan’s statistical bureau currently expects real GDP growth of 3.4 % this year, a substantial improvement from last year’s 1.3 % expansion. Meanwhile, the Central Bank of the Republic of China (CBRC) expects economic growth to reach 3.2 % this year. Taiwan, which averaged annual real GDP growth of 3.1 % in the past decade, ranks among the most advanced economies in Asia. Its GDP per capita (32,000 US dollars in 2023) is roughly that of Japan or South Korea.

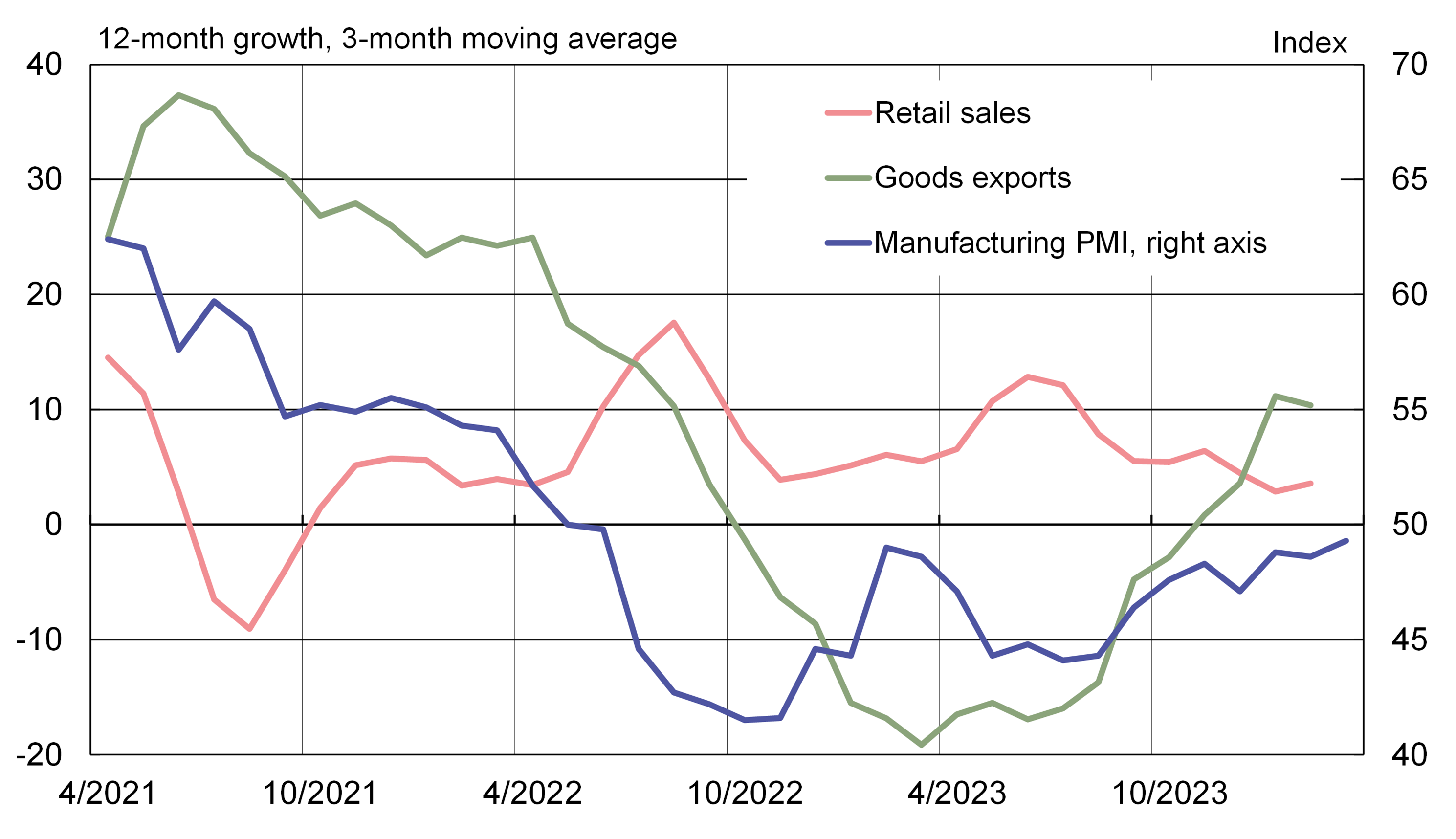

Supported by a low reference base and robust private consumption, the Taiwanese economy grew by 4.9 % y-o-y in the fourth quarter of 2023 (up from 2.2 % y-o-y in the third quarter). Labour market conditions and consumer confidence have improved in recent months. Thanks to public education and strict building codes, it also appears that the impact of this week’s earthquake on the east coast of the island, the most powerful in 25 years, has been surprisingly benign; nonetheless, the impact on sentiment is still uncertain. Fixed investment, however, remains weak, as do readings of the manufacturing purchasing managers’ index (PMI), suggesting that business conditions continue to be challenging.

With regards to foreign trade, Taiwanese exports are showing signs of improvement with the stabilisation of global demand and the explosive growth of artificial intelligence (AI) and related high-tech businesses. Higher net exports support Taiwan’s positive economy growth as imports remain fairly slack. Taiwan, a leader in the manufacture of advanced microchips, holds a critical position in global technology supply chains. In addition to microchips, Taiwan’s top exports include other types of critical information technology. Taiwan’s main export markets are mainland China, the United States, Hong Kong, the European Union, and Japan.

On March 21, the CBRC surprised the financial markets by raising its benchmark discount rate by 12.5 basis points to 2.0 %. The central bank began to tighten its monetary policy stance in March 2022, eventually raising its reference rate by a total of 87.5 basis points. The CBRC’s latest move sought to tamp down inflation expectations ahead of this month’s scheduled hikes in administratively-set electricity rates (average increase of 11 %), as well as the usual inflationary pressure that come with accelerating economic growth. Headline consumer prices in Taiwan rose by 3.1 % y-o-y in February, up from 1.8 % in January. Meanwhile, the 12-month core inflation rate rose from 1.6 % in January to 2.9 %. Taiwan’s 12-month inflation overall has remained fairly contained in recent years, peaking at just 3.6 % in June 2022. The central bank, which expects price pressures to moderate in coming months, forecasts price pressures to average 2.2 % y-o-y in 2024 (core inflation 2.0 %), virtually in line with the central bank’s price stability target. In its assessment of Taiwan’s economic conditions in the months ahead, the CBRC noted that it will be paying particular attention to events in the global economy such as monetary policy decisions by major central banks, risks facing the mainland Chinese economy, prices of internationally traded commodities, geopolitical risks and extreme weather events.

The Taiwanese economy has begun to show cautious signs of recovery in recent months

Sources: Bloomberg and BOFIT.