BOFIT Weekly Review 13/2024

Latest BOFIT Forecast for Russia sees lower economic growth ahead

In the March update of our Forecast for Russia 2024–2026, we highlight capacity constraints as a major cause of Russia’s economic slowdown this year. However, brisk growth in the second half of 2023 should be sufficient to lock in on-year growth in 2024 at around 2 %, even with zero growth during this year. In coming years, Russian economic growth will remain low and largely driven by state spending. Russian growth will decelerate further nearing its long-term potential growth rate, which has been lowered somewhat due to conditions emerged after Russia’s pursued its war of aggression against Ukraine. Barring some surprising event, the Russian economy should only grow at about 1 % a year during 2025–2026.

Russian GDP growth should slow in the coming years

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | |

| On-year change, % | 5.9 | −1.2 | 3.6 | 2 | 1 | 1 |

Sources: Rosstat data for 2021–2023 plus this year up to February 7; BOFIT forecast estimates for 2024–2026 starting March 25, 2024.

It is quite unlikely that relatively high growth would continue in 2025–2026. Based on the current medium-term budget framework, real public sector demand is expected to decrease in 2025. Market-based private investment is also unlikely to make up for this drop in demand. Large cuts in public-sector spending are, however, uncertain, especially since government spending today plays such a dominant role in sustaining growth. The adjustments in public-sector demand in 2025–2026 will be strongly influenced by the course of the war, which remains difficult to predict.

Even buoyed by higher wages in Russia’s tight labour markets, growth in private consumption demand is now on track to slow. Net exports should have a neutral effect on future economic growth, while the impacts from sanctions on Russian oil exports are expected to remain during the forecast period approximately at the same level as in recent months (a discount to Brent of roughly $14 a barrel). Based on the oil future markets, the average price of Brent crude should remain on average around $83 a barrel in 2024.

The unavailability of important statistical data series has increased the uncertainty in our current forecast. Russia has ceased to publish, among other things, detailed breakdowns of realised budget spending, oil production figures or itemised foreign trade figures. Our current forecast is subject to many risks. Small quarterly growth in the first half of 2024 could boost on-year GDP growth this year. Moreover, continued robust growth in private demand could drive higher-than-expected growth in both 2024 and 2025. The outlook could be substantially weaker with a sudden degradation of the war situation as spending in the war would crowd out other sectors of the economy.

Economic overheating and spiking inflation

Russia’s 2023 economic growth exceeded the expectations of most forecasters. Growth in the capital stock and private consumption accelerated faster than expected. The significant increase in the capital stock largely reflects heavy investment in defence industries, as well as firms stocking up their inventories in anticipation of component shortages. Due to the low basis reference of 2022 and hefty wage increases, private consumption grew rapidly last year.

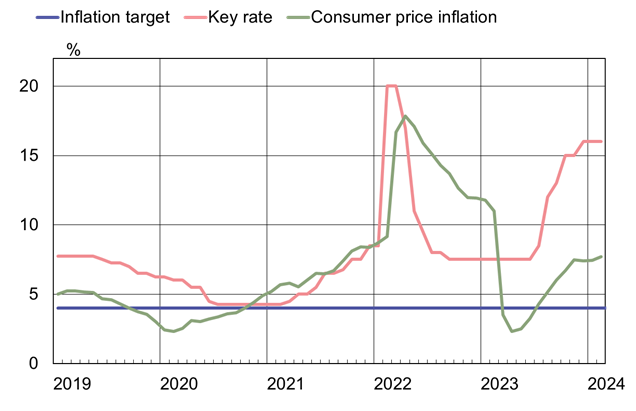

The pick-up in inflation in 2023 suggests that domestic production of goods and services struggled to keep up with rising demand and resulting in overheating in some parts of the economy. Inflation has accelerated rapidly since spring 2023. The CBR’s key rate has been hiked several times and currently stands at 16 %. Further evidence of overheating is seen in Russia’s historically high levels of capacity utilisation and ultra-low unemployment rate (below 3 % in December 2023). However, Russia’s government budget spending is set to rise sharply this year led by war spending. The heavy government outlays make it more difficult to restrain inflation.

The Central Bank has swiftly raised the key rate to curb accelerating inflation

Sources: Macrobond, Central Bank of Russia.

Even modest growth becomes elusive in coming years

Labour shortages have become a major bottleneck to higher Russian economic growth. Russia’s unfavourable demographic situation is the biggest problem as the working-age population has been declining for years. The partial mobilisation of reserves and brisk emigration have only worsened the situation. Unemployment in Russia has fallen to historical lows, with labour shortages for both highly-skilled and low-skilled workers. Immigration to Russia is unlikely to improve the situation.

Capacity utilisation rates are at all-time highs and sanctions restrict imports of machinery & equipment. Russia’s own import-substitution plans are insufficient to make up for the production capital deficit.

Improving the growth potential of Russian economy would require a combination of capital investment directed at the civilian sector and productivity gains to offset the effects from the shrinking labour force. A large share of fixed investment has centred on military production, which has been consumed or destroyed rapidly and done little to boost longer-term growth potential. Our Russia briefing event (in Finnish) this week included a review of the highlights of our newest forecast, expert commentary on the outlook for Russia’s finances and longer-term growth prospects, as well as the outlook of Finnish-Russian trade.