BOFIT Weekly Review 11/2024

Russian growth fades, budget spending up sharply

Total output growth slowed in recent months

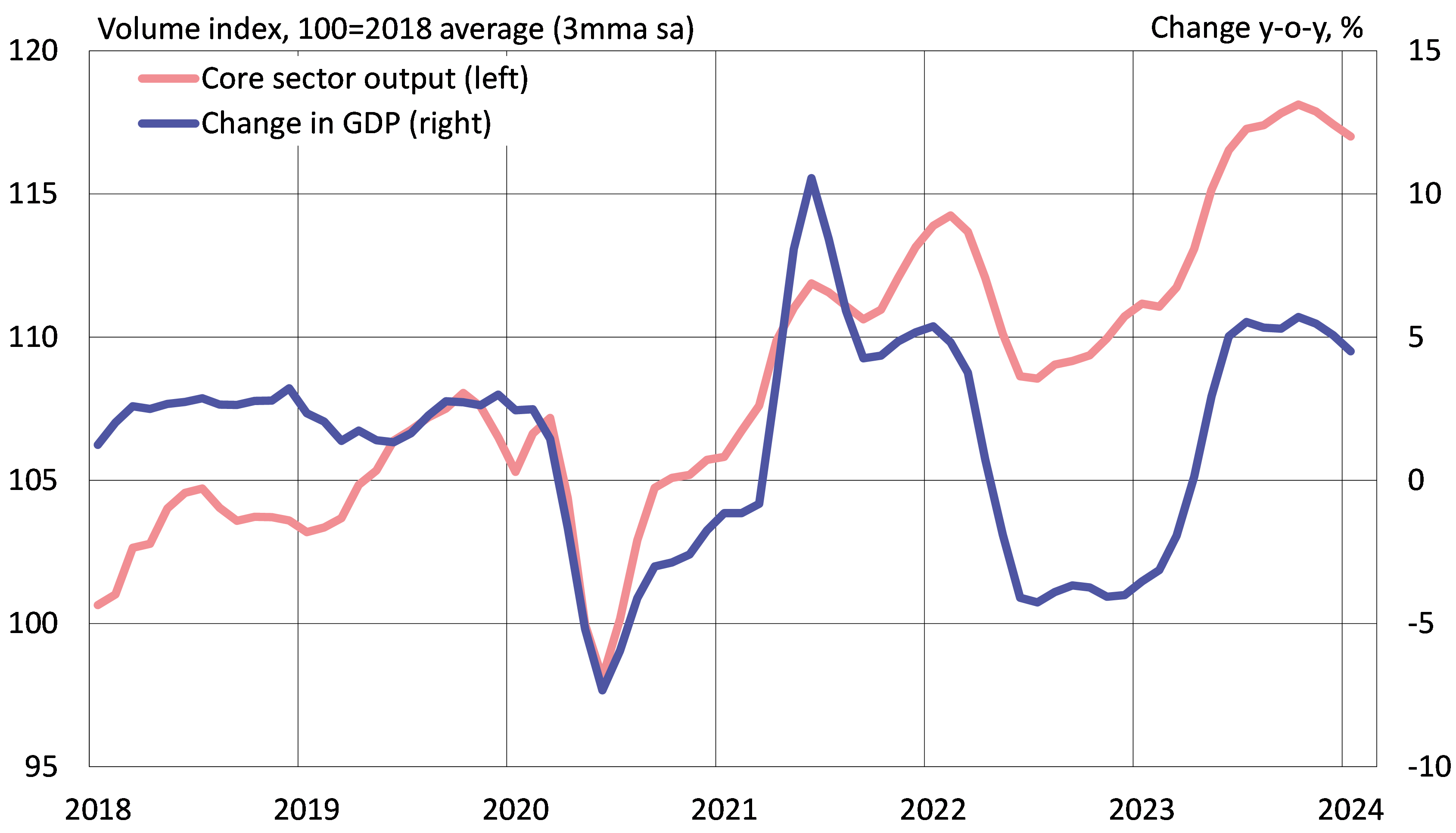

Based on the monthly estimate released by Russia’s ministry for economic development, on-year GDP growth has slowed in recent months. Rosstat’s composite indicator of Russia’s five core production sectors suggests that the volume of total output (seasonally adjusted) has turned to a slight decline in recent months.

Output of both the mining sector and manufacturing (seasonally adjusted) in January remained near the same level as in previous months. Similarly, the level of retail sales has remained virtually unchanged for several months in a row. The long stretch of construction growth also appears to have ended in January.

The combined output volume of Russia’s five core production sectors has turned to decline

Sources: CEIC, Rosstat, Russian Ministry of Economic Development, BOFIT.

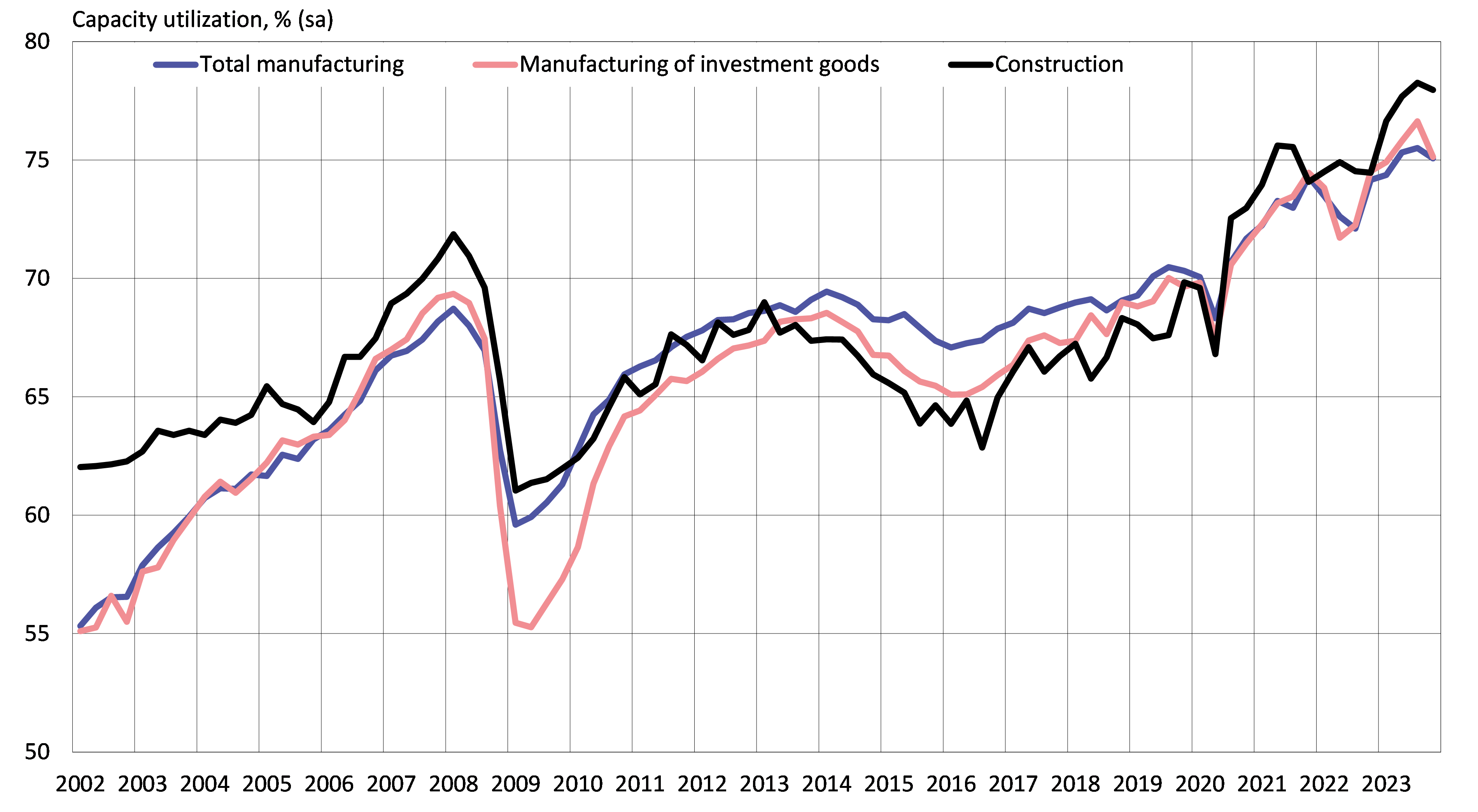

The Central Bank of Russia’s latest company survey shows capacity utilisation in the total economy remains at its highest levels recorded since the launch of the survey in 2002. Growth in capacity utilisation in both industry and construction, however, has stabilised in recent months. The tightening of capacity constraints is reflected in higher inflation in recent months. Consumer prices rose by 7.7 % y-o-y in February. The central bank’s January survey also noted a weakening of demand in many branches, including retail trade and industry. Expectations about future demand were also slightly more pessimistic that earlier for many branches.

Capacity utilisation in Russia remains at record high levels

Sources: Central Bank of Russia, BOFIT.

Russian oil production expected to decline slightly in the months ahead

Russia banned publication of oil production figures last spring and the ban was recently prolonged by one more year, which means that official figures on the country’s oil output are unavailable. Both the International Energy Agency (IEA) and the Organization of Petroleum Exporting Countries (OPEC) estimate that Russian oil production contracted in 2023 by about 1 %. January production is estimated to have remained at the same level as in previous months.

Russia has announced additional cuts in oil production within the framework of the OPEC+ agreement. The latest forecasts from the IEA and OPEC see Russian oil production falling by roughly 1–1.5 % this year. The current assumptions for Russia’s budget framework expect a similar decline.

The IEA further estimates that the volume of Russian oil exports remained unchanged in January. According to the IEA, Russia’s earnings on oil exports in January were up slightly from previous months due to slightly higher global oil prices. The difference between the average export price for a barrel of Russian oil and Brent crude, however, increased to around 15 dollars.

Preliminary CBR figures also indicate that Russia’s current account surplus recovered in January from its December dip. Russia’s current account surplus (seasonally adjusted) has averaged around 5 billion dollars in recent months. Although it is significantly smaller than at its peak in 2022, the surplus is roughly the same as in an average month during 2017–2018.

Sharp increase in budget spending in the beginning of the year

Preliminary data from Russia’s finance ministry show that federal budget spending increased by 17 % y-o-y in January-February. Spending seems a bit front-weighted as the budgeted growth in federal spending for all of 2024 is 13 %.

Driven by higher oil & gas earnings, federal budget revenues grew sharply compared to a year earlier. Some of the growth came from changes in the timing of tax payments, but revenue growth was also supported by higher oil prices. Revenues from exports other than oil & gas also increased substantially. The finance ministry attributes some of this gain to last year’s low reference basis and certain one-time payments to the government.

Despite the hefty growth in revenues, the federal budget remained deeply in the red in the first two months of this year. The January-February deficit amounted to approximately 1.5 trillion rubles (0.8 % of GDP according to finance ministry estimates). Under the budget framework, the expected deficit for this year should be roughly 1.6 trillion rubles.

Putin’s speech puts industrialization and self-sufficiency as goals of economic policy

Russia’s presidential election, which takes place this weekend, will seal the deal on president Vladimir Putin’s next term as president. Putin laid out his economic goals for the coming 6-year term in a speech to the Federation Council at the end of February.

Putin’s speech devoted attention to the issues of families with small children, including promises of increased support in a variety of forms. The Russian leader, however, also requested increased taxation on the incomes of wealthy Russians. The president noted that the country’s elite in the future would consist of people who had served as soldiers in the war on Ukraine. These fighters, he noted, deserve leading posts in government administration, state-owned enterprises and the education system. A separate training programme would be established to accomplish this transition.

Putin characterised the main features of Russia’s future economy as accelerated industrialization, greater technological sovereignty and reduced dependence on imports. For example, manufacturing output should increase by 40 % by 2030. Over the past decade, manufacturing output grew by about 20 %. In addition, the share of imports in GDP should decline slightly further from 19 % in last year to 17 % by 2030.

Putin reiterated many of the familiar goals contained in all Russia’s earlier economic development programmes and strategies of the current millennium, including significant increases in research & development spending, capital investment, labour productivity and exports of non-energy commodities. So far little progress has been made on most of these objectives. For example, Putin’s 2012 May Decree called for increasing R&D spending to 1.8 % of GDP by 2015. Now the target is an increase in R&D spending to 2 % of GDP by 2030. Over the past decade, Russian R&D spending has hovered at 1 % of GDP. Russia’s war in Ukraine makes it ever more difficult for Russia to achieve any economic development goals.