BOFIT Weekly Review 08/2024

Hong Kong’s economic situation remains challenging despite cautious signs of recovery

Even with the lifting of covid restriction at the start of last year, a number of factors continue to weigh down the Hong Kong economy. Higher interest rates have strongly affected domestic demand and forced the real estate sector into recession. While Hong Kong’s own inflation has remained at tolerable levels, interest rates have been pushed up due to the US Federal Reserve’s rate hikes. US monetary policy shifts are reflected immediately in Hong Kong Special Administrative Region (SAR) due to its currency board mechanism, which is essentially a fixed peg of the Hong Kong dollar to the US dollar. The fixed peg obviates the need for Hong Kong’s monetary officials to practice any independent monetary policy. With the appreciation of the US dollar, the Hong Kong dollar has gained against mainland China’s yuan. Hong Kong’s relative priceyness depressed mainland China tourist numbers last year, and drove locals to shop on the mainland.

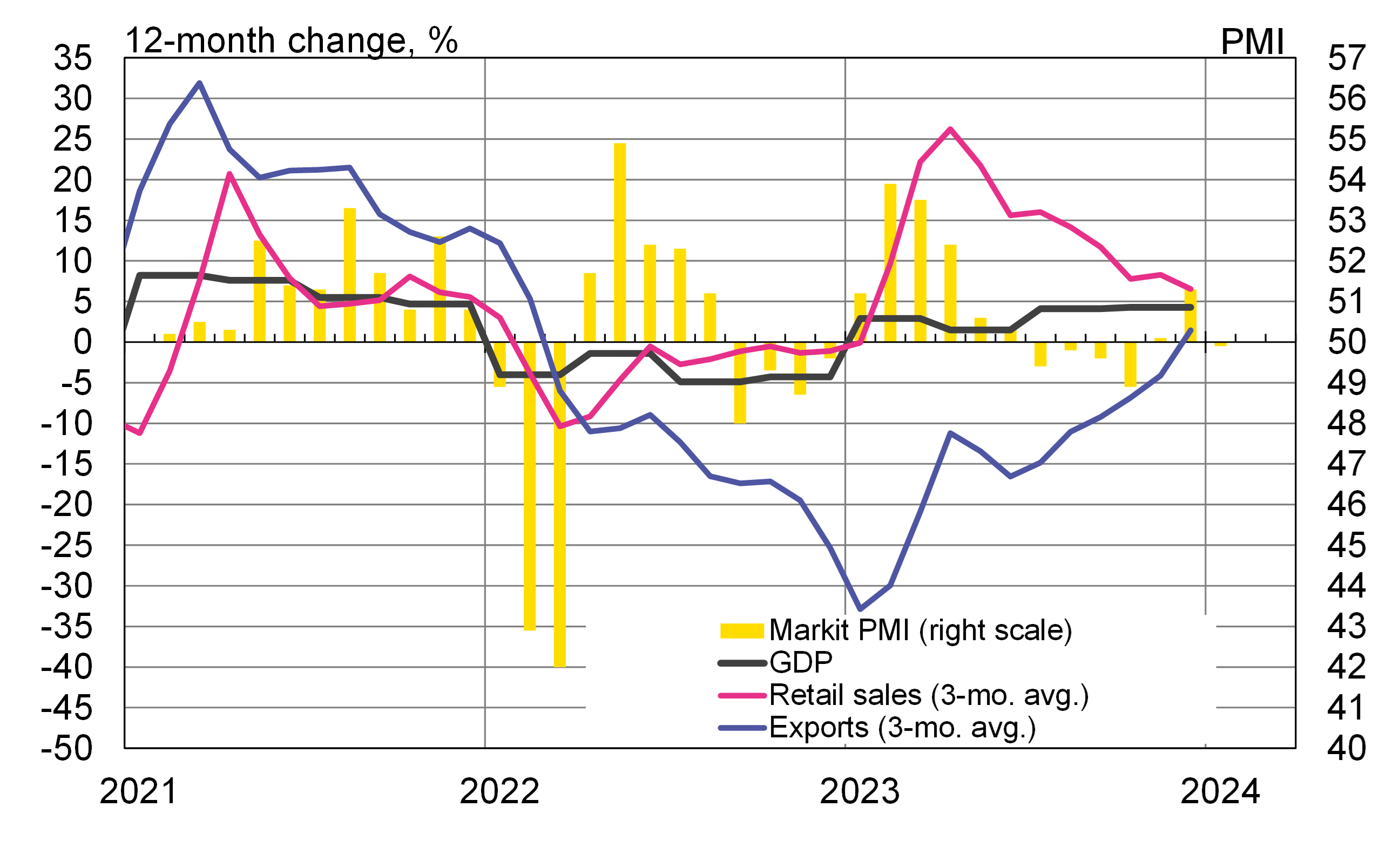

According to preliminary figures from Hong Kong’s statistics office, the SAR’s GDP in the fourth quarter of 2023 accelerated to 0.5 % q-o-q, up from 0.1 % in 3Q23. In year-over-year terms, growth in 4Q23 accelerated to 4.3 % from 4.1 % in 3Q23. It should be noted, however, that the strong on-year growth partly reflects the low reference basis of 2022, when Hong Kong was still heavily subject to covid restrictions. During 2023, the Hong Kong economy grew by 3.2 %, compared to the previous year’s contraction of 3.7 %. The IMF expects the Hong Kong economy to grow by 2.9 % this year and next.

The volume of Hong Kong retail sales increased by 4.8 % y-o-y in December, a significant drop from 12.4 % in November. Growth is expected to keep slowing in coming months as the favourable base effect fades. Nevertheless, private consumption should be underpinned by the return of tourism. The number of tourists visiting the SAR last autumn rebounded to 2019 levels. Over the past three months, tourist numbers have been already 22 % higher than in the corresponding period before the pandemic. Moreover, anticipation of US rate cuts and their impact on consumer confidence are likely to boost consumption this year. Businesses can only dream about such a recovery as the purchasing manager index, a measure of business confidence, fell below 50 (49.9) in January. A below-50 reading puts business activity in contractionary territory.

Hong Kong’s deep integration with the global economy is evident in its export statistics. The value of goods & services trade is nearly four times GDP, and re-exports play a huge role in Hong Kong’s foreign trade. After two tough years, Hong Kong’s exports have started to recover. Exports contracted last year by about 9 % y-o-y, but over the past two months have clambered back to the growth track. China naturally is Hong Kong’s most important trading partner, so China’s economic trends are well reflected in Hong Kong’s foreign trade. The impact of mainland China can also be seen elsewhere in the Hong Kong business environment. Like in mainland China, the behaviour of Hong Kong stock markets has diverged from market trends elsewhere. While US stock markets, for example, have been breaking all-time records, the SAR’s main Hang Seng index has continued to slide this year. The index is currently off by 2 % year-to-date, extending last year’s 14 % decline. Many Chinese firms are listed on the Hong Kong bourse. At the start of this year, they accounted for 76 % of the market capitalisation of companies on the Hang Seng index and the GEM index of growth firms.

Hong Kong’s economy has struggled back post-pandemic, but challenges remain

Sources: Macrobond and BOFIT.