BOFIT Weekly Review 2023/50

Chinese stock markets down for the year

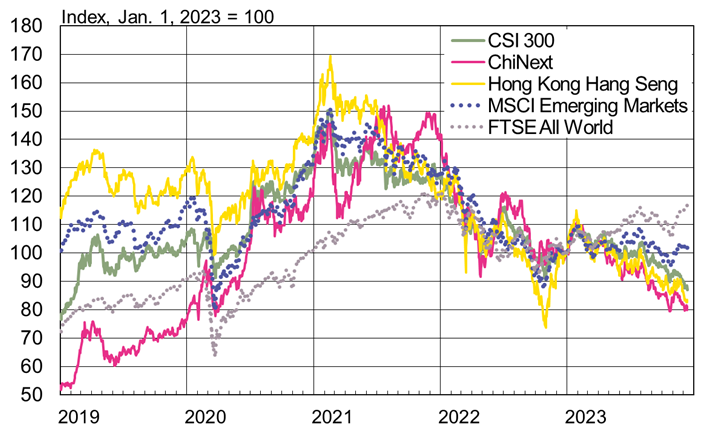

Despite a bump in share prices following the lifting of covid restrictions at the start of this year, share prices have drifted downward for most of 2023 due to ongoing troubles in the real estate market and China’s disappointing economic performance. In addition, rate hikes in advanced economies, particularly the US, have led to an investor exodus from China and other emerging markets. The large firms listed on mainland China’s CSI 300 index are down 13 % from the start of the year. The Hong Kong exchange’s Hang Seng index has also fallen by 17 % since the start of the year. Growth and technology firms have been hit particularly hard by the downturn. Share prices of companies included in the Shenzhen stock exchange’s ChiNext list of growth firms have fallen by 21 % this year. In the same period, shares included in the US S&P 500 index are up by 23 % on average, while the MSCI Emerging Markets index of developing countries is up by 4 % on average.

Share listed on mainland China and Hong Kong exchanges have underperformed the global average this year

Sources: Macrobond and BOFIT.

Officials have tried to encourage share trading after the State Council in July called for “invigorating the capital market and boosting investor confidence.” In August, tax officials halved to stamp duty on share transactions. For its part, the China Securities Regulatory Commission (CSRC) in September eased the use of borrowed funds in share purchases, and followed up in October by tightening short-selling rules to support the market. In addition, new stock exchange listings (IPOs) have been more restricted. In November, the finance ministry changed its regulations to allow insurers to make longer-term investments in publicly traded stocks.

Large investors have also been asked to chip in with the CSRC encouraging significant shareholders to take a more balanced approach to share sales. In October, the government financing firm Central Huijin said it had invested in the country’s four largest state-owned banks for the next half year. At that time, the announced overall increase in its holdings was still marginal (Central Huijin holds stakes of 35–64 % in China’s four giant state banks). Several dozen large state-owned firms (including Sinopec and China Mobile) have announced share buy-back programmes. According to media reports, the CSRC is also preparing a state-backed fund of at least 1 trillion yuan (0.8 % of GDP) to support China’s stock markets. Perennial pressures to downplay poor market performance in China has increased. For example, media reports suggest that partially state-owned investment bank CICC has forbidden its employees from using a negative tone when commenting on the state of the Chinese economy or its markets.

Efforts of officials have failed so far in restoring investor confidence. Trading volumes on Chinese stock markets, however, were up somewhat in November compared to the previous two months. About 40 % of share trading volume took place on the Shanghai exchange and about 60 % on the Shenzhen bourse. A tiny sliver of trading (about 0.5 % of value traded) also occurred on the Beijing stock exchange created in 2021. Notably, Beijing bourse trading volumes have skyrocketed over the past six weeks. The Beijing bourse now lists 236 firms (up from 142 a year ago) and has a market capitalisation that represents 0.4 % of the total market cap of all stocks listed on mainland Chinese exchanges.

Foreign investors have reduced their holdings of shares traded on the Shanghai and Shenzhen exchanges. Share sales via the Stock Connect programmes between Hong Kong and the mainland exchanges have exceeded share purchases since August. The net holdings of foreign investors on China stock markets under the programmes have fallen by 200 billion yuan (28 billion dollars) since August, which in turn has dragged down the overall performance of China’s stock exchanges. Although the holdings of foreign investors acquired under the Stock Connect programmes represent just 2 % of the value of shares listed on the Shanghai and Shenzhen stock exchanges, trading under the Stock Connect programme accounts for 13 % of the total share trading volume of the two exchanges.