BOFIT Weekly Review 49/2023

Inflationary pressures in Russia still on the rise

Retail sales and war-related industries drove output growth in October

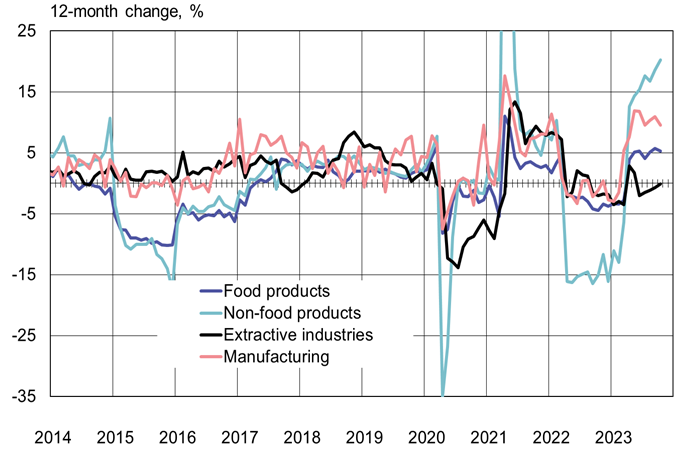

Russia’s ministry for economic development estimates that GDP grew by 5 % y-o-y in October. As in previous months, October manufacturing maintained high growth (up 9.5 % y-o-y), especially those branches that are associated with the military-industrial sector such as production of metal products and transport vehicles other than passenger cars. October output of extractive industries, which includes oil & gas, was unchanged from 12 months earlier. Growth in retail sales was particularly strong (12.7 % y-o-y), reflecting both last year’s low reference basis and the large wage hikes of recent months.

Sales in non-food trade soared in October.

Sources: Rosstat and BOFIT.

Labour shortages, record-low unemployment and soaring nominal wages

Inflation has accelerated partly due to high wage hikes in many branches. In nominal terms, the average wage rose by 13.6 % y-o-y in September. The average real (inflation-adjusted) wage was up by 7.2 %. The hefty wage increases reflect an extremely tight labour market. This is also seen in Russia’s record low unemployment rate (2.9 %). Wage hikes have been particularly large in manufacturing (up 18.8 % y-o-y on average in September) and especially in branches linked to the military-industrial sector (up over 20 %).

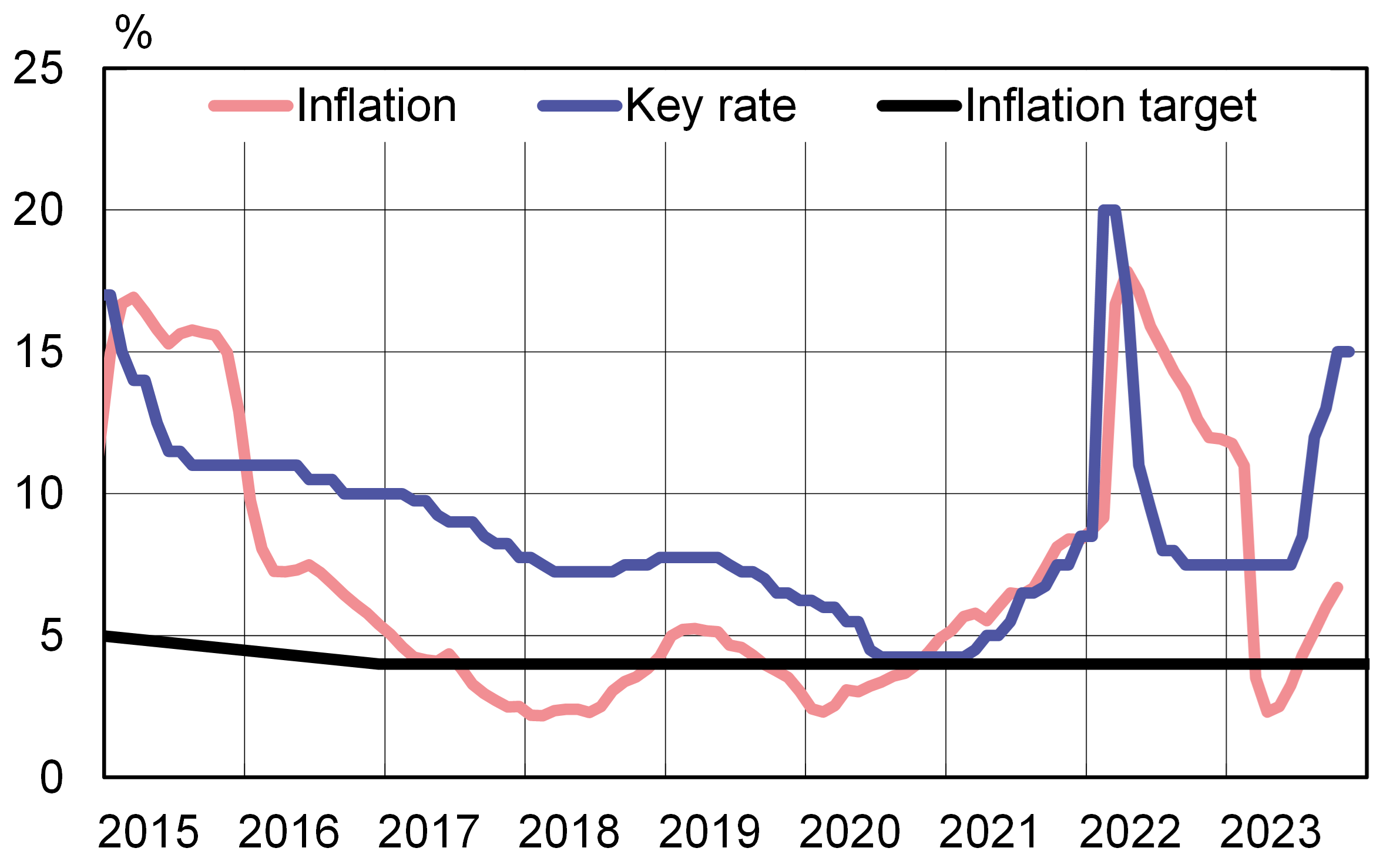

Accelerating inflation and increased inflation expectations

Consumer price inflation accelerated in October and was 7.5 % y-o-y. As part of its inflation-fighting efforts, the Central Bank of Russia has raised its key rate several times since July. Household inflation expectations soared to levels close to the 2022 peak, indicating that Russians still expect inflation to accelerate further. Corporate inflation expectations have climbed along with soaring labour costs. Therefore, most analysts expect that the CBR will again hike the key rate from its current level of 15 % when it meets next week on December 15. The key rate was last at such an elevated level in May 2022.

The CBR has had to raise its key rate in response to high inflation.

Sources: Central Bank of Russia, Rosstat and BOFIT.

Loose fiscal policies making it hard to corral inflation

Growth in government spending has also increased inflation pressures. In January-October, federal budget spending increased by 12 % y-o-y. In addition to spending on the war, Russia’s upcoming presidential election in spring 2024 has added pressure for the government to boost spending in coming months. The index increases for pensions next year have already been announced.

The relaxation of spending discipline represents a big change from Russia’s pre-invasion fiscal policies. With ongoing war spending, government expenditures next year are set to rise significantly. Given the tightening of Russian monetary policy and the uncertain outlook for the global economy, critics see the government’s revenue projection for the 2024 budget as overly optimistic.