BOFIT Weekly Review 48/2023

Yuan’s depreciation trend likely over; Chinese currency’s internationalisation progresses slowly

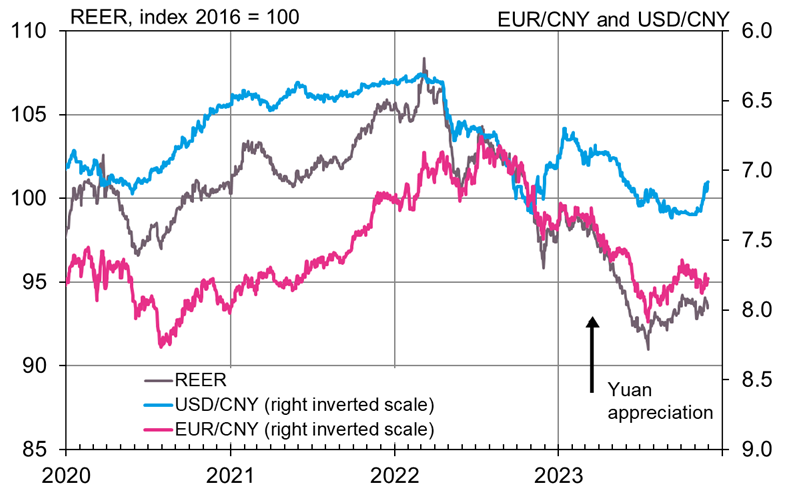

The yuan’s persistent weakening bias, which have lasted for most of this year, appears to have ended. The yuan strengthened against the US dollar last month as part of a larger trend of the dollar losing ground against major currencies. The USD/CNY rate reached 7.08 by end-November from 7.32 a month earlier, representing a 3.3 % gain for the yuan. Nonetheless, the Chinese currency is still down by 2.6 % against the dollar from the start of this year. The yuan-euro rate also appears to have stabilised, even if there is still a slight downward trend as the euro has strengthened against other major currencies. The EUR/CNY rate is currently at 7.77, down 5.3 % from the start of this year and 0.5 % weaker than at the end of October. China’s real effective (trade-weighted) exchange rate, or REER, has weakened by 4.8 % since the start of this year, but has remained relatively stable over the past month.

The yuan’s recent gain against the dollar follows a multi-month period in which the yuan faced notable depreciation pressures on the back of interest rate hikes by the US Federal Reserve and China’s weak economic outlook. The yuan’s weakness forced the People’s Bank of China to go on the defensive. The PBoC regulates the yuan’s exchange rate through daily publication of a fixing rate, around which the yuan may fluctuate by up to 2 % in either direction. The setting of the fixing is based on estimates by large commercial banks that take into account the yuan’s market moves against a basket of currencies. The yuan’s weakness became too much for the PBoC this autumn and it stopped allowing market forces to guide the currency further down. Between mid-September and mid-November, for instance, the PBoC kept the daily fixing extremely stable, within USD/CNY 7.17–7.18, regardless of the exchange rate’s market closing level for the previous day.

The dollar’s appreciation trend appears to have ended, reflecting market expectations regarding the US Fed’s monetary policy bias. As US inflationary pressures abate, market participants now believe that the Fed no longer has incentive to raise interest rates further. Accordingly, the yuan has appreciated against the dollar, and China’s central bank no longer needs to defend the yuan. This situation gives China greater monetary policy flexibility, allowing for a more accommodative monetary policy stance should the Chinese leadership assess the economy to need further support.

The internationalisation of the yuan is a long-term strategic goal of China’s leadership. Nevertheless, as the currency’s use globally increases, steering the yuan’s exchange rate will become harder for the PBoC. The process of international acceptance of a new major currency, however, is slow and circuitous. Indeed, progress this year has consisted of steps forward and backward. Use of the yuan in China’s foreign trade increased, especially after Russia launched its war of aggression against Ukraine. As a consequence of Western sanctions, the yuan has been used more particularly in Russia-China trade. The yuan’s share in China’s foreign trade settlement has risen from about 15 % before the war to 19 % a year ago and 25 % currently. The yuan now is the fifth-most-used currency in the international SWIFT payment system. It was used in 3.6 % of all international transactions in October (up from 2.1 % in October 2022). At the same time, international use of the yuan as an investment currency has declined, likely due to China’s own economic problems and the decision by many foreign investors to pull their capital out of China. Central bank reporting to the IMF on currency reserve allocations shows that the yuan only comprised about 2.5 % of global foreign reserves as of mid-year, down from a 2.8 % share a year earlier. Even if mainland China’s stock and bond markets are currently the world’s second largest after the United States, foreign investors hold only a tiny fraction of Chinese securities. Just 4.0 % of mainland China’s stocks are currently held by foreigners (compared to 4.2% a year earlier), while the holdings of Chinese bonds by foreign investors fell to 2.2 % (from 2.6 % a year earlier).

The yuan’s depreciation trend against the euro and dollar appears to have ended

Sources: BIS, Macrobond and BOFIT.