BOFIT Weekly Review 47/2023

Russian financial markets seek new equilibrium

Foreign investors have abandoned the Moscow stock market

As a result of Western economic sanctions imposed on Russia in March 2022 after the invasion of Ukraine, Russia’s financial markets have changed in many respects. A critical change is the exit of foreign investors. Prior to the war, foreign investors – mainly large Western investment funds – accounted for about half of the trading volume on the Moscow stock exchange and hold about 20 % of government treasuries. Western sanctions and Russia’s own measures to restrict the sale of securities have effectively driven foreign portfolio investors out of the market.

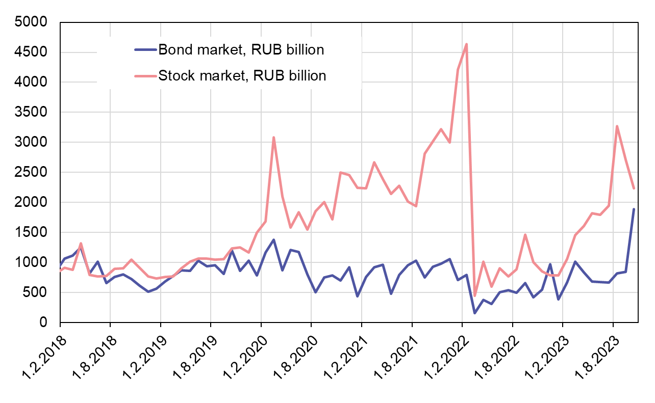

The fallout from all this is a very different market. Russia has essentially no large domestic institutional investors, so the share of private individuals trading on the Moscow stock exchange since the invasion of Ukraine has been around 80 %. The volume of trading contracted sharply in spring 2022. By the end of last year, the average daily trading volume had fallen to around 30 billion rubles. Thanks to positive wage trends this year as well as gradual adjustment to the new reality, the appetite for owning shares has begun to return. The average daily turnover has increased by about 50 % from end-2022 levels, but the volume of trading is still below the pre-war level. The exceptionally large participation of private individuals in the market makes forecasting stock market developments very difficult.

Milder changes in the bond market

Trading volumes in corporate and government bond markets have been smaller than in the stock market. Domestic commercial banks are important counterparties in the bond market, and the share of foreign investors was smaller even before the invasion of Ukraine. Based on Central Bank of Russia data, about 9 % of total banking sector assets are held in government treasuries and about 5 % in other bonds. Overall, these shares have remained essentially unchanged during the war, but bank-specific data on total assets or the main balance-sheet items of banks are no longer available.

In total, about half of ruble-denominated bonds on issue are government bonds, with the remaining half split equally between bonds of financial institutions and other corporate bonds. While the amount of new government treasury issues in 2023 has been lower than budgeted, there has been a flood of new corporate bond issues (particularly by financial institutions). There was an exceptional spike in trading in October as companies sought to exploit relatively low interest rates. The recent bump in interest rates, however, is likely to put back bond issues planned for the end of this year.

As a consequence of sanctions, the share of domestic foreign currency-denominated bonds has increased slightly. According to a presidential decree from May 2023, all eurobonds must be converted by the end of this year into “replacement” bonds pegged to foreign currency, but with all settlements done in rubles. At the beginning of 2022, the stock of of corporate eurobonds on issue was valued at roughly 110 billion dollars. As of end-October, the outstanding eurobond amount after repayments and conversion of some eurobonds to replacement bonds was still 52 billion dollars. The value of replacement bonds on the Moscow exchange today is roughly 16 billion dollars. Some firms last year issued yuan-denominated bonds on a trial basis, but investor interest in this product seems to have evaporated this year. Yuan bonds have yet to replace eurobonds by any measure.

While the volume of stock trades on the Moscow exchange has decreased in recent months, bond trades are up strongly.

Sources: Moscow Exchange, CEIC, BOFIT.

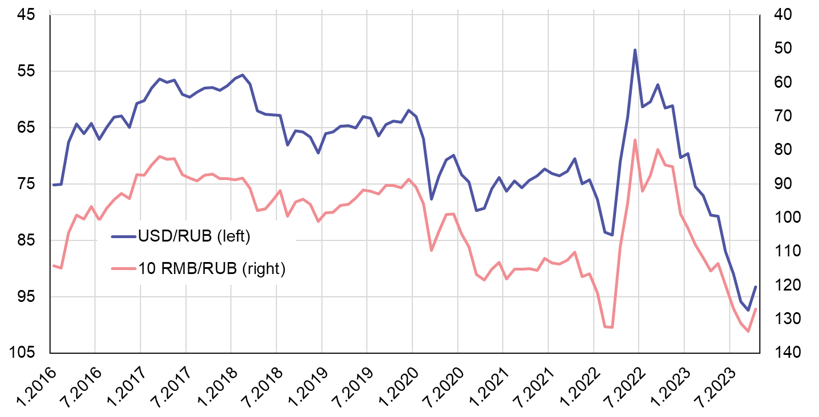

The reshaping of Russia’s forex market reflects the exit of foreign participants and tighter Russian capital controls

Before the war, foreign investors and foreign banks were major participants in Russia’s forex exchange. Today, almost all counterparties at the Moscow currency exchange are domestic banks. Besides export prices, administrative restrictions affect foreign currency exchange rates far more than earlier. Although use of currencies of countries considered “friendly” to Russia is supported in many contexts, the ruble-dollar rate remains the key indicator of Russia’s economic performance in many circles. The rapid weakening of the ruble against the dollar since early autumn has forced the government to tighten many capital controls. Government efforts to prop up the ruble include regulating the financial activities of foreign-owned firms, repatriation requirements of export earnings, increased reporting requirements concerning foreign bank accounts and central bank forex operations. These measures, however, do not address any of the underlying reasons for ruble’s weakness. The ruble’s decline reflects a loss of confidence in the ruble as an investment currency and an incessant demand of importing firms for Western currency.

The ruble-dollar pairing now only accounts for about a third of trades on the Moscow currency exchange, while the share of yuan-ruble pairings has risen to nearly 40 %. The rise of the yuan reflects the rapid increase in the role of the yuan as an invoicing currency in foreign trade. The yuan is involved in less than 10 % of currency transfers by private individuals. In October, the euro accounted for 12 % of forex trading, roughly the same level as in January 2022. The dollar’s share in currency trading outside the exchange has only diminished slightly and still accounts for over half of total trading volume.

In fear of Western sanctions, companies and banks currently enjoy looser rules on mandatory reporting of ownership relations and economic performance. Foreign analysts, credit-rating agencies and auditors have also left the Russian market. As a consequence of the exodus of Western investors, demand for transparency and good governance practices has evaporated. In its place, the state has an ever-increasing role, not just as owner of large firms and the largest banks, but also as owner of domestic systems for payment and settlement to assure that domestic financial intermediation continues. In any case, Russia’s financial markets today are significantly more isolated, smaller and riskier than before the war.

The ruble has been losing value against the US dollar since summer 2022.

Note: The y-axis is inverted, so a falling trend indicates ruble depreciation.

Source: Central Bank of Russia.