BOFIT Weekly Review 43/2023

Ruble sinks even as Russia’s current account surplus grows

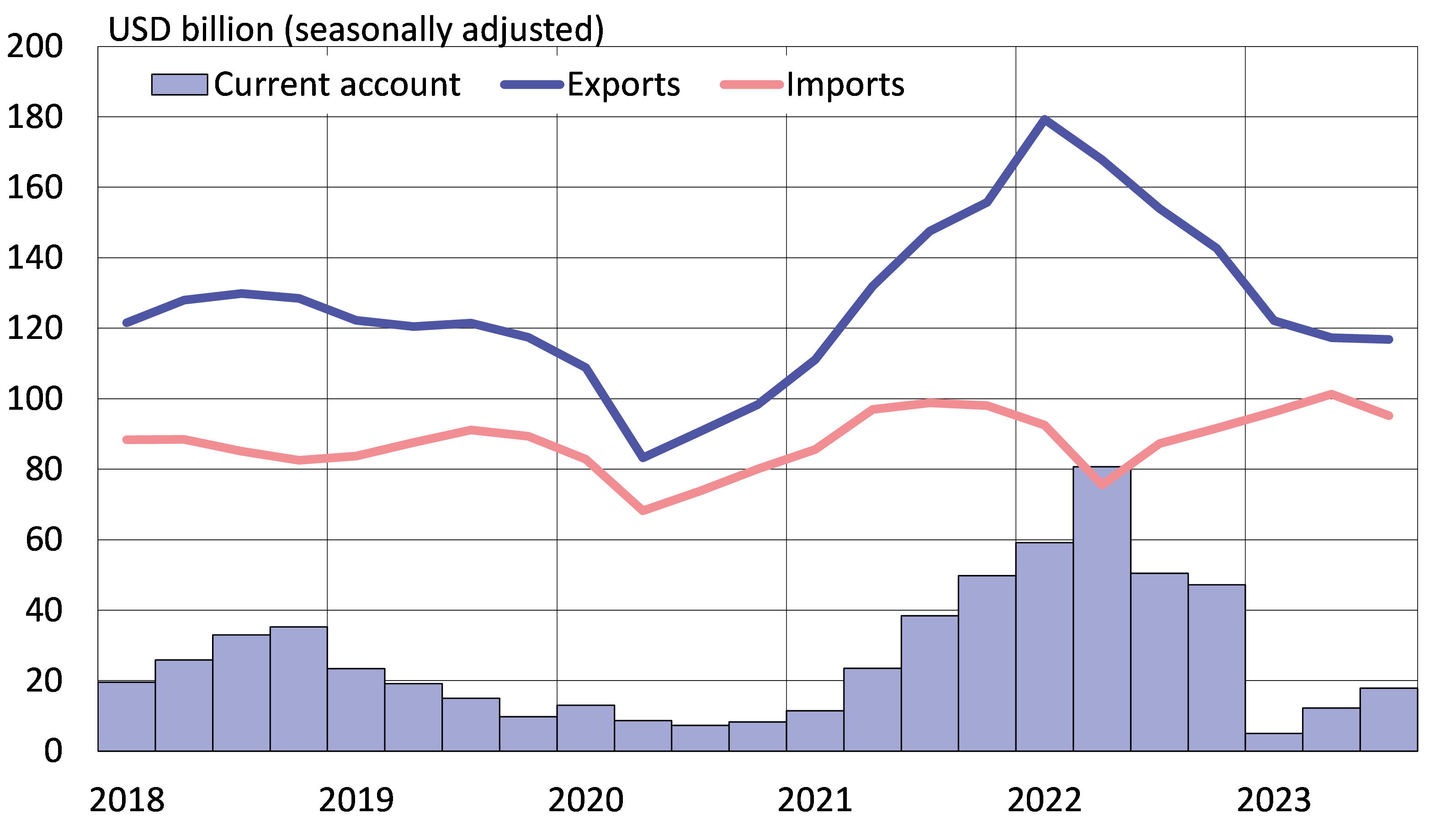

Current account surplus increased in the third quarter

Preliminary figures released by the Central Bank of Russia show the country’s third-quarter current account surplus amounted to 16 billion dollars. After a sharp decline in the first months of this year, the current account surplus turned to a slight growth in July-September. The cumulative surplus for the first nine months of this year was 41 billion dollars.

Following a sharp drop in the first half, the value of Russian goods & services exports stabilized in the third quarter and was 116 billion dollars. Export earnings were mainly supported by higher oil prices. The International Energy Agency (IEA) reports that the average export price of Urals blend crude in the third quarter was 71 dollars a barrel, up from an average of 48 dollars a barrel in the first half of this year.

The value of Russia’s imports of goods & services has declined in recent months. The value of imports in the third quarter was about 95 billion dollars, or 4 % less than in 3Q21 (i.e. before Russia’s invasion of Ukraine). Imports of tourism services, however, were up substantially.

The flow of capital out of Russia continued in the third quarter. Russia received some foreign capital inflows in the form of other investment, but foreign net portfolio investment was still outward bound. The outflow of capital of Russian firms was still greater than inflow.

The value of Russian exports of goods and services stabilised in the third quarter, while the value of imports declined

Sources: Macrobond, Central Bank of Russia, BOFIT.

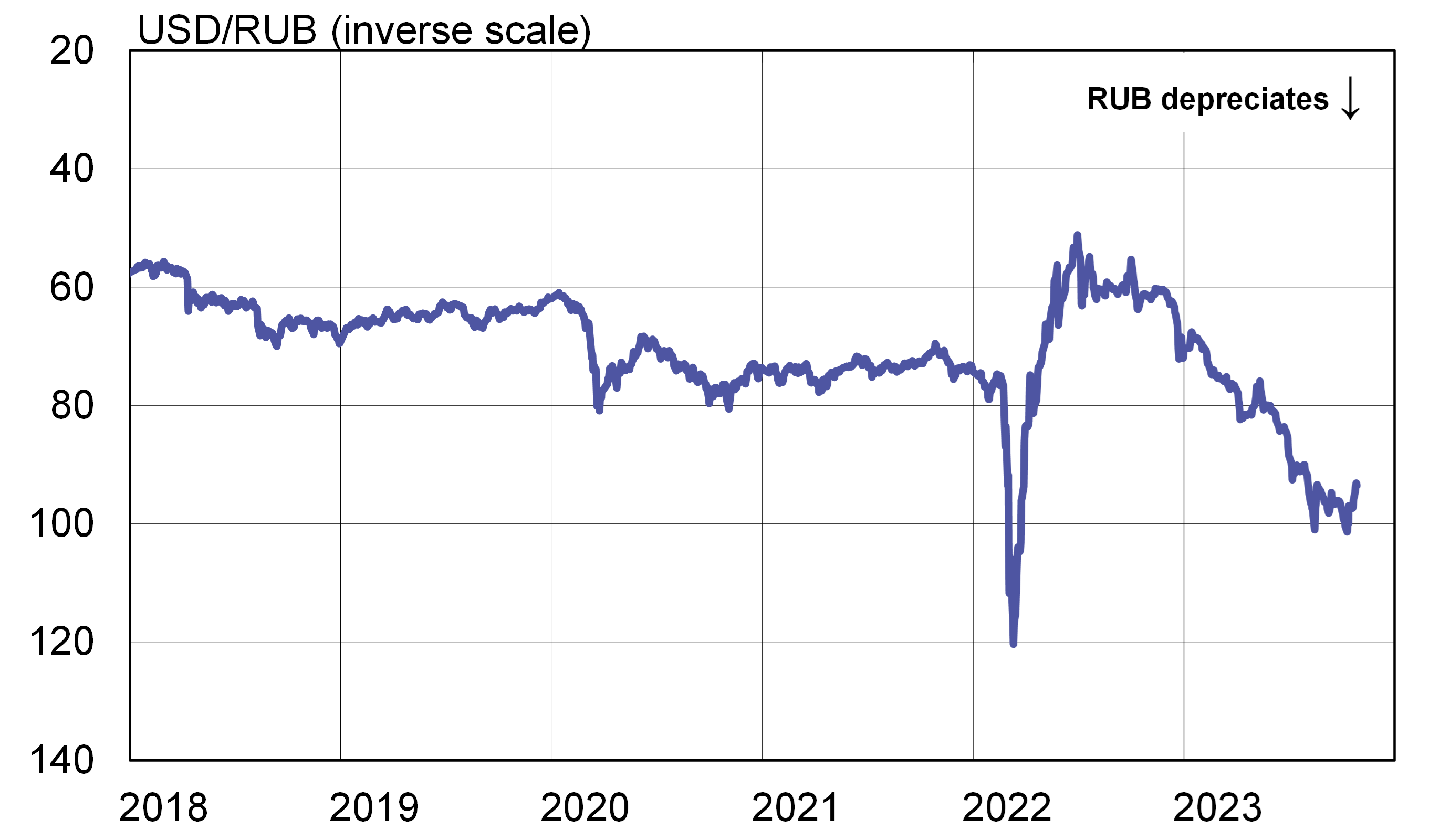

Ruble’s slide continues

Despite Russia’s growing current account surplus, the ruble’s exchange rate has been on a downward trend most of this year. At the end of June, the exchange rate was 87 rubles to the dollar. By early October, the rate flirted with a level of 100 rubles to the dollar. Concerned about the ruble’s slide, the Russian government has pondered a range of measures to prop up the floundering currency.

The government this month reinstated the requirement that firms convert repatriated export earnings to rubles (effective Oct. 16). The new rule applies to 43 corporate entities operating in major export branches such as oil & gas and metal industries. These firms are required to deposit at least 80 % of their forex export earnings in a Russian bank and then convert at least 90 % of such deposits to rubles.

One factor diminishing the supplies of dollars and euros in Russia has been the shift in export invoicing to other currencies. According to the CBR, about 40 % of exports in July-August were invoiced in rubles, nearly 30 % in Chinese yuan and 25 % in euros or dollars. The shares of other foreign currencies only amounted to a few percent. Russian firms have found that repatriating earnings from some countries is not straightforward. For example, Indian rupee-denominated export earnings are subject to India’s own currency controls.

The ruble has lost value for most of this year

Sources: Macrobond, Central Bank of Russia, BOFIT.

Weak ruble has boosted budget revenues

Federal budget revenues in January-September matched the level of the same period last year. Following a big decline in the first half of the year, oil & gas revenues rose in the third quarter, recovering to a level of their 2021 average. The boost to oil & gas revenues benefits from both the higher oil price and ruble weakness as the oil taxes are dollar-based.

A new export tax based on the ruble’s exchange rate also increases budget revenues when the ruble falls. The tax, which applies to many exporting firms, features a percentage that goes up if the ruble weakens. The tax’s ceiling rate of 7 % applies when the exchange rate exceeds 95 rubles to the dollar. No tax is required when the exchange rate falls below 80 rubles to the dollar.

Despite improved revenue performance, budget spending has stabilised in recent months. After brisk growth in the first half of the year, budget spending was down by 4 % y-o-y in the third quarter and the budget deficit narrowed. The finance ministry’s preliminary deficit estimate for the first nine months of this year is roughly 1.7 trillion rubles (1 % of GDP).

For the first nine months of 2023, budget expenditures were up by about 10 % y-o-y due to a spending boom in the beginning of the year. The lower-house Duma is currently considering a three-year budget framework for 2024–2026 that calls for large spending increases next year. While the biggest spending increases go to the war effort, the plans also call for increased social spending next year, including a 7.5 % hike in old-age pensions.

Inflationary pressures on the rise

Rapid credit growth combined with growth in government spending and the ruble’s depreciation have stoked inflation. In September, on-month growth in consumer prices reached its highest level since the peak of spring 2022. Consumer prices were up by 6 % y-o-y in September. In recent months, prices of food and petroleum products have risen rapidly.

The CBR raised its key rates by 550 basis points in July-September. The interest rate currently stands at 13 %, its highest level since spring 2022 (when the CBR raised the key rate to 20 % to curb the financial market panic caused by Russia’s invasion of Ukraine and new Western sanctions). Markets expect another hike in the key rate to be announced after the CBR board meets today (Oct. 27).

Russian economic growth expected to slow

According to preliminary figures, Russia’s economic development appears to have been stable in September. Growth is expected to slow gradually over the coming months. Seasonally adjusted industrial output for September remained at nearly the same level as in previous months. Manufacturing continued to support industrial output growth, while production of extractive industries remained subdued.

Subsiding growth in government expenditure in recent months and rising interest rates are expected to hinder Russian economic growth in coming months. The government, however, also aims to boost growth again next year through increased budget spending. The latest institutional forecasts for Russia see GDP growing by 1.5–2 % this year and about 1 % next year.