BOFIT Weekly Review 42/2023

Sluggish growth in global trade

Several international forecasters have revised their economic outlooks in recent weeks. The IMF’s World Economic Outlook (WEO) released last week now sees global economy growing by 3.0 % this year and 2.9 % next year. The forecast comports with those of other forecasting institutions such as the ECB and OECD. The forecast growth is well below longer term average annual growth of 3.8 % per year during 2000–2019. The IMF says that global economic growth recently has been hobbled by central bank tightening to bring down inflation, strict national fiscal policies, the long-term effects of the Covid-19 pandemic, implications of Russia’s attack on Ukraine, geoeconomic fragmentation and extreme weather events such as El Niño-Southern Oscillation weather pattern in the Pacific.

The IMF slightly lowered its growth projections for China for both this year and next from its July forecast. It now expects the Chinese economy to grow by 5.0 % this year and 4.2 % next year. China’s economic growth is held back by problems in the real estate sector. Because so much Chinese economic activity and household wealth are tied to property, the downturn affects consumption and consumer confidence. Corporate output and fixed investment also struggles with reduced export demand and geopolitical uncertainty. The IMF has raised its forecast for Russian growth this year to 2.2 % due to increases in public spending, fixed investment and private consumption. For next year, the IMF predicts the Russian economy will grow by 1.1 %.

The October WEO calls for growth in global trade of 0.9 % this year and 3.5 % next year. The global trade outlook of the World Trade Organization (WTO) released this month is quite similar to that of the IMF. The growth numbers are quite low from a historical standpoint. During 2000–2019, growth in global trade averaged 4.9 % a year. Growth has been affected by increased barriers to trade, weak global demand and a shift in consumption that favours domestic services since the lifting of covid restrictions.

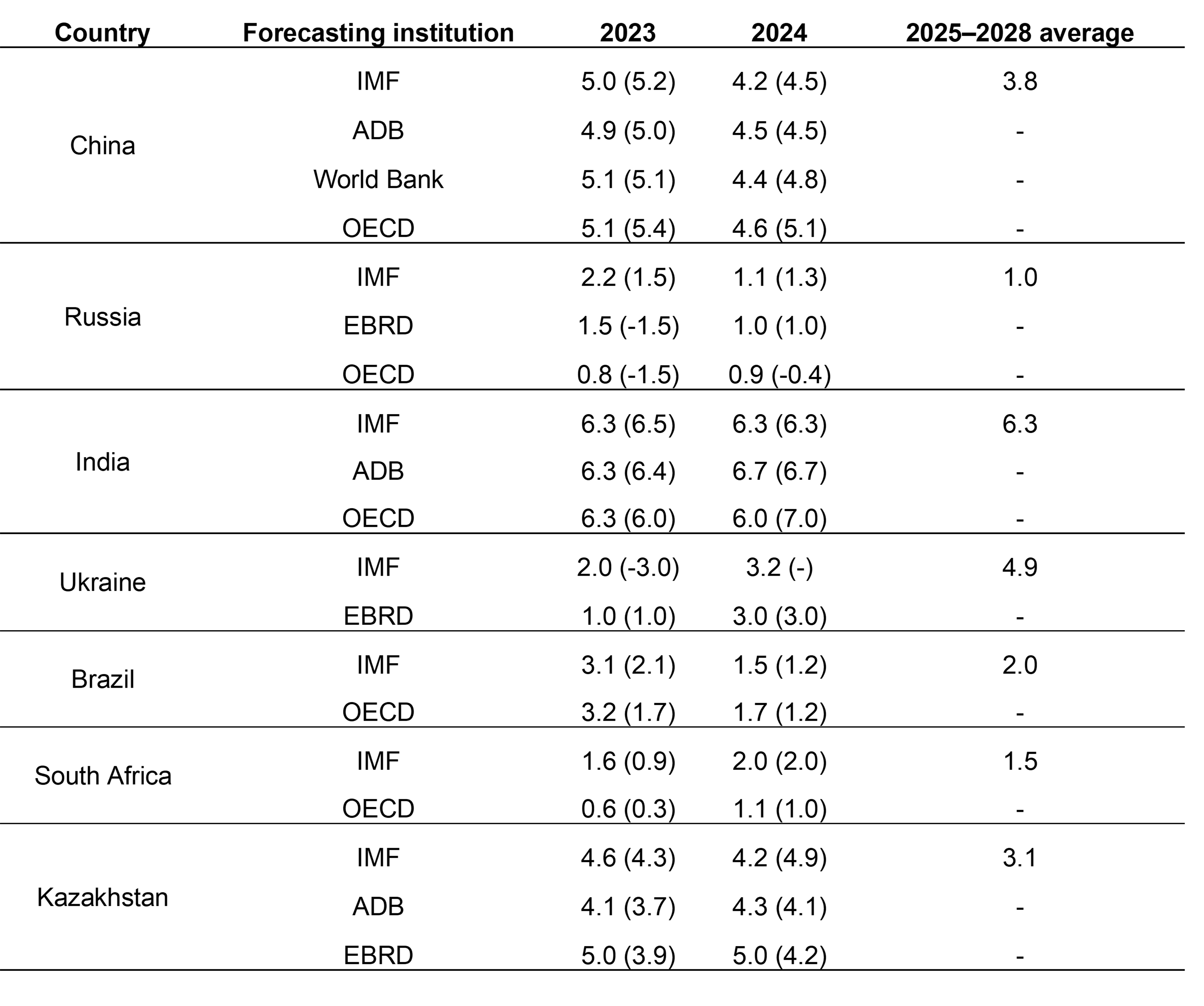

The table below presents recent growth forecasts for several emerging economies. The IMF’s forecasts extend through 2028. Such a long-range forecasts can be interpreted as estimates of the growth potential of these economies as cyclical effects of monetary and fiscal policy are moderated. The implications of the latest WEO are also considered in a recent Bank of Finland blog piece (in Finnish).

Institutional forecasts of economic growth, %. Spring and summer 2023 forecasts in parentheses.

Sources: Asia Development Bank (ADB); World Bank’s East Asia and Pacific Office; European Bank for Reconstruction and Development (EBRD); OECD and BOFIT.