BOFIT Weekly Review 39/2023

Russia plans for increased government spending, tighter monetary policy

Latest 3-year federal budget framework anticipates leap in military spending

The Russian government last week approved a draft version of the federal budget framework for 2024–2026. The budget framework now goes to the lower-house Duma for consideration. The framework anticipates significant increases of both spending and revenue compared to the earlier budget plan approved in December 2022.

Under the revised budget framework, total federal budget spending in 2024 and 2025 would be about 20 % higher than in the previous budget framework and more than double spending on defence in 2024 and 2025. The framework calls for raising 2024 defence spending to about 10.7 trillion rubles (roughly 110 billion dollars at the current exchange rate) and 8.5 trillion rubles in 2025. The draft budget framework also sees national security spending increasing by 13 % more than previously budgeted, while spending on social expenditure would increase by just 5 %.

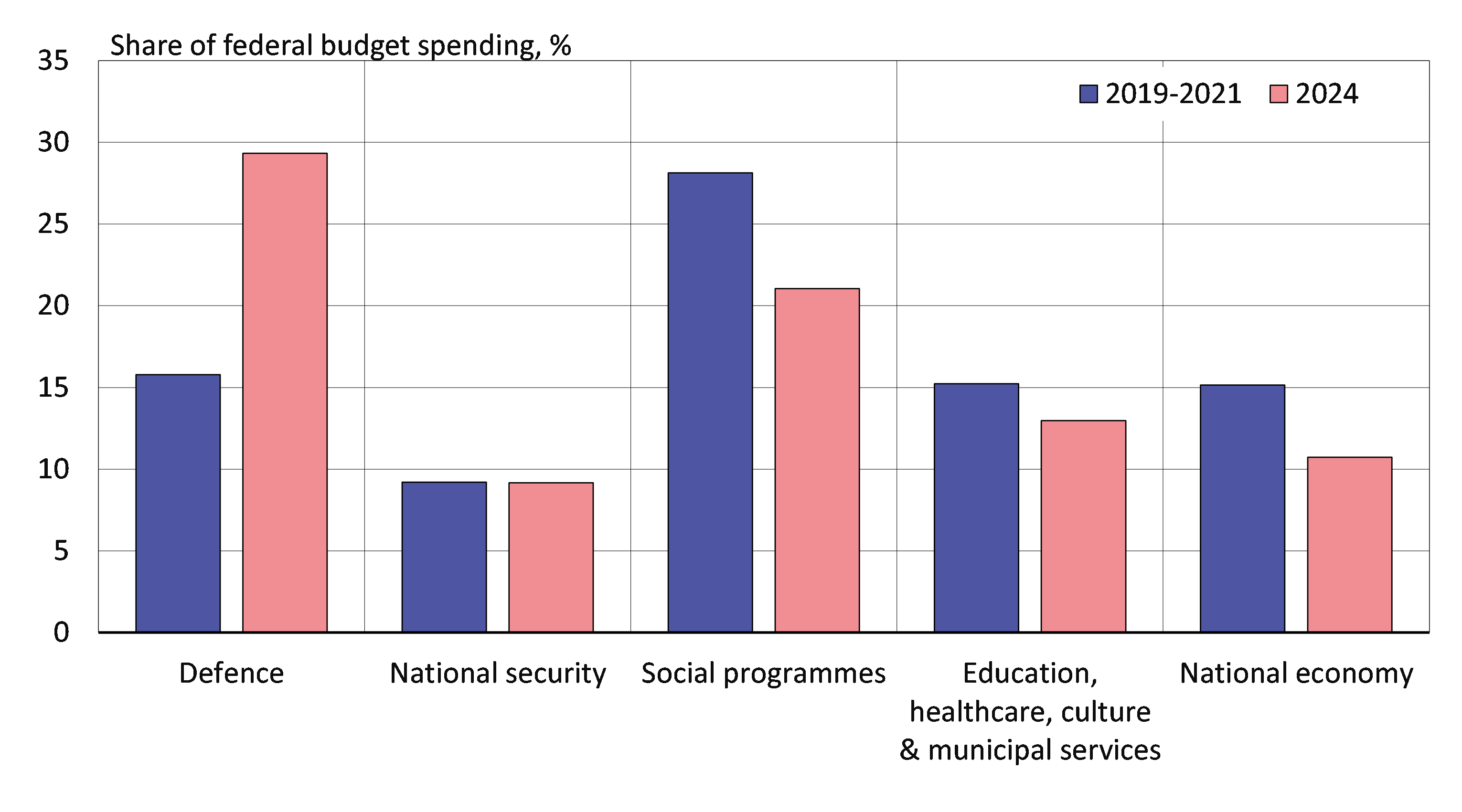

Under the budget framework, defence spending’s share of the federal budget would rise next year to an historical high of 29 %. Furthermore, 9 % of spending would go to national security. Spending on social expenditure, in contrast, would drop sharply from pre-invasion years to 21 % in 2024.

Based on this year’s updated spending projection, federal spending should grow by 16 % next year. The budget projections are based on the economic development ministry’s estimated average inflation of 7 % next year, meaning that spending will also climb in real terms. Hitting even the updated spending target this year, however, would require a substantial cut in government spending in the final four months of this year compared to a year earlier. It is thus possible that spending may exceed even the updated estimate this year and thus experience lower growth next year.

The budget framework also anticipates significantly higher revenues for 2024-2025 than the previous framework or the expected 2023 revenues. Higher oil prices and a weak ruble should increase tax revenues from oil & gas. The current budget assumes that over the 2024–2025 period the export price for Russian crude oil averages 70 dollars a barrel compared to 63 dollars in 2023. The ruble’s exchange rate is expected to average 90–91 rubles to the dollar compared to 85 in 2023. Revenues other than those from oil & gas are expected to increase by about 20 % next year. A large part of the revenue boost is expected to come from one-off items, including a new export tax that is set to remain in force to the end of 2024.

The federal budget is expected to be in the red this year and the following three years under the latest budget framework. This year’s deficit is still expected to be around 3 trillion rubles (2 % of GDP), but then decline to about 1.6 trillion rubles in 2024 and 900 billion rubles in 2025. The deficit shortfall would be made up with domestic debt. If the deficits remain within the framework projections, Russia should be able to fund its deficits without much difficulties. However, the revenue presumptions in the current framework appear quite optimistic. Moreover, the government may have to further boost spending as the war drags on and the 2024 presidential election next spring approaches.

Russia’s latest draft budget framework sees the share of military spending increasing sharply while the share of social spending declines

Sources: CEIC, Russian Ministry of Finance, BOFIT.

Sources: CEIC, Russian Ministry of Finance, BOFIT.

Tighter monetary policy in the face of rising inflationary pressures

At its September inflation meeting, the board of the Central Bank of Russia decided to again raise the key rate by 100 basis points, which now stands at 13 %. The CBR said inflation risks remain significant. It warned, for example, that if the budget deficit grows larger than expected, further monetary tightening may be necessary. The CBR noted that the large share of government-supported loans in the lending stock has weakened the impact of key-rate decisions on lending activity.

Russian inflation has accelerated in recent months, hitting over 5 % p.a. in August. The acceleration in inflation has been largely driven by growth in domestic demand supported by government spending. Domestic supply has not managed to keep up with demand due to capacity constraints. Labour shortages, in particular, have emerged as a major problem. Due to the scarcity of workers, rising wages have added to inflationary pressures. A particular worry for the administration recently has been the rise in retail fuel prices. In its latest effort to deal with situation, the government has imposed temporary export bans on gasoline and diesel fuel. This policy measure is discussed in our latest BOFIT blog posting (in Finnish).

Inflation pressures have also been exacerbated by the recent deterioration in the ruble’s exchange rate. The official ruble-dollar rate in late September is about 30 % below levels at the start of the year (96.5 rubles to the dollar as of Thursday, September 28). Russia’s finance ministry and the economic development ministry have proposed increased capital controls and, similar to the Chinese model, adoption of an offshore rate for the ruble. The CBR opposes both proposals.

In conjunction with its inflation meeting, the CBR released its latest economic outlook. The new forecast sees GDP growing by 0.5–1.5 % next year with inflation averaging in the range of 5–5.6 %. The economic development ministry’s projected GDP growth of 2.3 % and inflation rate averaging around 7 % are used as assumptions in the budget framework.

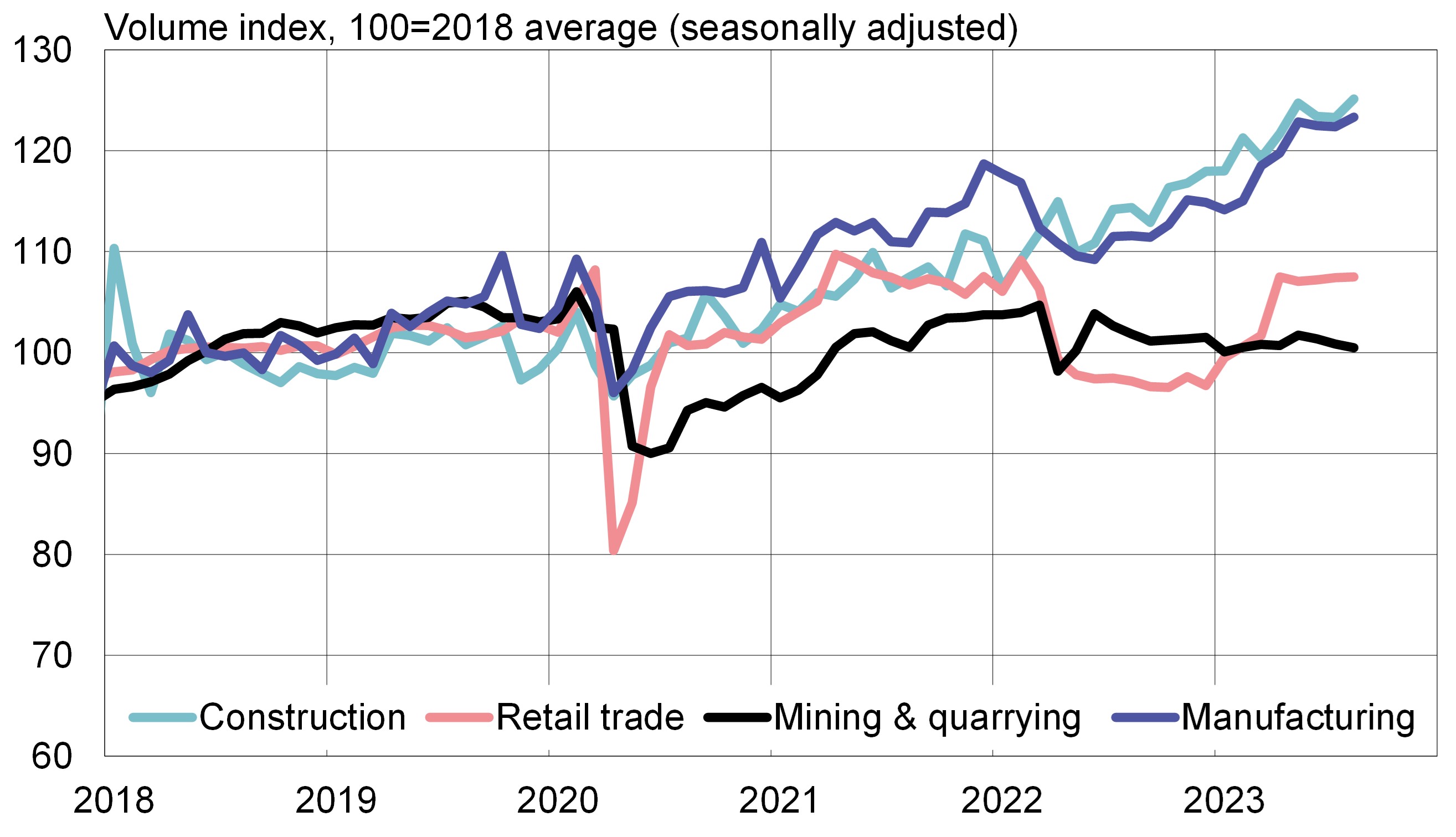

War-related industries still drive production growth

Russia’s economic development continued relatively stable in August. Construction activity continued growth, while the development of manufacturing has moderated in recent months. On-year manufacturing in August was still up by 10 % and construction by 9 %. Most growth came from branches somehow tied to the wartime economy.

In recent months, consumption-driven retail sales have been tepid despite substantial wage increases. In January-July, the average real wage increased by 7 % y-o-y. The unemployment rate in August remained at 3 %.

The development of extractive industries has been modest. The IEA estimates that Russian crude oil production has declined slightly in recent months. Russia has announced that it is cutting its production and exports of crude oil this year. The economic development ministry forecasts crude oil production to contract by about 1 % this year and next.

Russian production growth in most core sectors of the economy has stabilised in recent months

Sources: CEIC, Rosstat, BOFIT.

Impacts of war evident in regional trends for industrial output and construction

Industrial output has soared in those manufacturing branches in Russia servicing the war effort. In certain branches closely linked to the military-industrial complex, production has increased by several hundred percent from pre-war levels.

Growth has been particularly robust in many traditional military-industrial hubs such as the Sverdlovsk, Chelyabinsk and Kurgan regions and the Udmurt Republic. Local media in such regions often report increased military production, widespread recruitment efforts and factories moving to around-the-clock operations. In some regions, the strong growth in production is clearly associated with specific military-industrial plants and firms.

Many of the regions where economic performance has been weakest in Russia’s wartime economy are those hardest hit by the exodus of foreign firms from Russia, sanctions or both. Examples of regions suffering major economic losses include the Karelian Autonomous Republic, which has seen the loss of its forest industry export markets, and regions central to Russian automobile production, which suffer from the departure of Western carmakers.

The consequences of war can also be seen in the figures for construction activity in border regions. In several of the Russian regions near the Ukraine border, the pace of construction has clearly outstripped the pace of construction growth nationally. These areas have seen extensive construction of fortifications similar to the Ukraine regions currently occupied by Russia. The periods of extremely high construction growth seem to match the periods of reported extensive fortification work. Strong construction growth in Russia’s border regions may also reflect repair work after drone strikes and sabotage of railways and other infrastructure.

Our latest BOFIT Policy Brief considers these production adjustments in Russia’s regions since the invasion of Ukraine.