BOFIT Weekly Review 37/2023

Latest BOFIT forecast sees Russian GDP growing this year, but sustaining growth will be difficult

BOFIT forecast sees 2 % GDP growth for this year, but a gradual fading in growth is underway already

Russia’s economy is expected to grow this year due to robust first-half performance, even if the quarterly growth is set to slow towards the end of the year. The higher-than-expected growth in the first half of 2023 was largely the result of increased public spending that also supported private consumption and fixed investment to some extent. First-half growth also benefitted from last year’s low reference basis.

BOFIT’s latest Forecast for Russia expects Russian GDP to grow by 2 % this year. Growth mainly reflects higher public spending and increased bank lending. Strong growth in demand has boosted capacity utilisation in many branches to historical highs and driven unemployment to historical lows. Mobilisation and emigration have exacerbated Russia’s already chronic labour shortage due to demographic trends. Economic activity has recovered to near pre-war levels and sanctions continue to limit imports, particularly imports of investment goods. As Russia lacks the prerequisites for sustained growth, we expect GDP growth to slow to around 1 % next year.

Russia has essentially abandoned its earlier pillars of economic policy – balanced budgets, free movement of capital and development of a market economy. Prosecuting the war has become Russia’s top priority, and in this sense Russia has already shifted to a wartime economy. As a new post (in Finnish) on our BOFIT blog notes, the usual relationship of GDP growth and improved living standards breaks down in wartime.

The current Russia forecast remains subject to exceptionally high uncertainty. A major shift in the course of the war could significantly alter the trajectory of Russia’s economic development. The external operating environment for Russia has also become unpredictable due to Russia’s invasion.

Annual change in Russian GDP, realised and forecast

| 2020 | 2021 | 2022 | 2023F | 2024F | |

| On-year change | −3 % | 6 % | −2 % | 2 % | 1 % |

Sources: Rosstat, BOFIT Forecast for Russia 2/2023.

Current account surplus continues well below last year’s record-high level

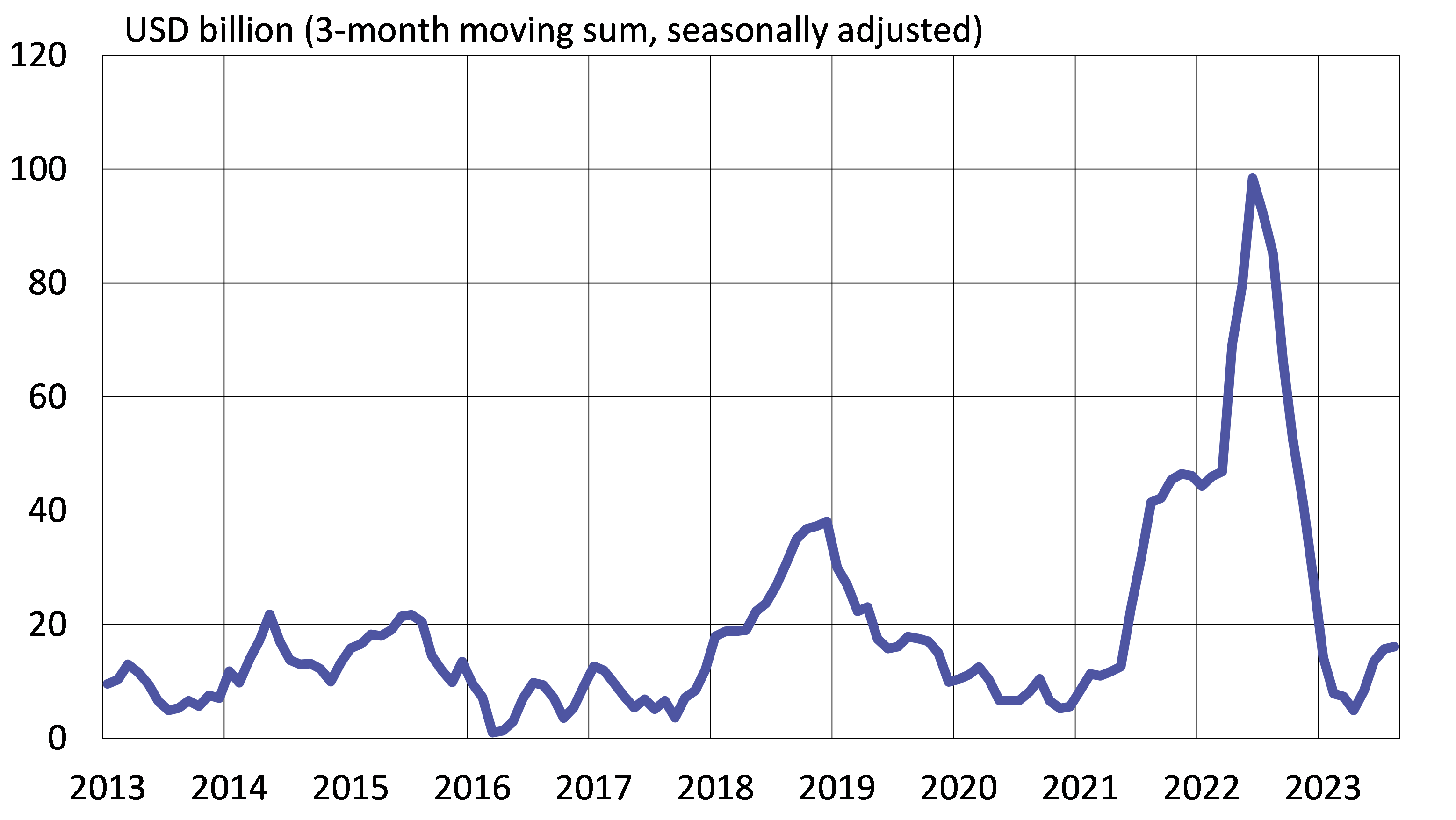

Preliminary CBR figures show that Russia posted a current account surplus of about 26 billion dollars for the first eight months of this year, a figure dwarfed by last year’s record surplus of 185 billion dollars in the same period. The shift in foreign trade is the biggest factor eroding the current account surplus. Spending on imports has risen, but export revenues have fallen sharply.

Preliminary CBR figures show that the value of goods exports contracted by 32 % y-o-y in January-August, while the value of goods imports rose by 17 %. The biggest factors reducing exports were Western sanctions banning the import of many Russian goods and lower commodity prices. The International Energy Agency (IEA) reports that the average export price for a barrel of Urals-blend crude oil in January-August was about 40 % lower than in the same period in 2022. Economic recovery has helped revive goods imports since their plunge in spring 2022. While the value of imports has returned to pre-invasion levels, growth seems to have plateaued in recent months due e.g. to depreciation of the ruble.

Russia’s goods trade balance still showed a surplus in January-August. In contrast, the services trade deficit doubled due to high growth in tourism imports. While the net capital outflow from Russia continues, it is more modest than last year’s record levels.

Russian current account surplus has remained in relatively moderate levels in recent months

Sources: CEIC/Central Bank of Russia, BOFIT.

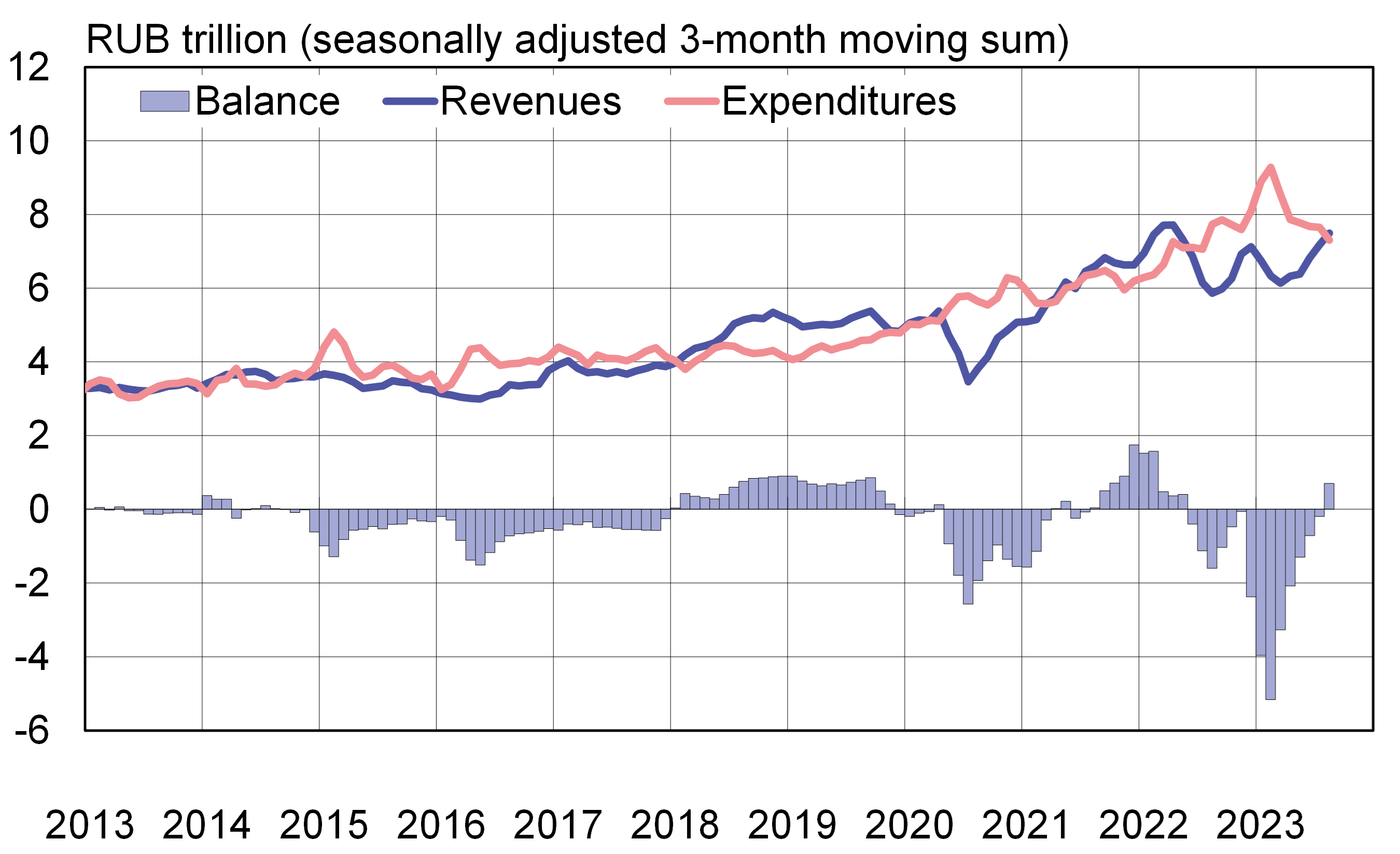

Growth in federal budget spending cooled in recent months

Although federal budget spending soared in the first months of 2023, it has decreased in recent months. For January-August, spending was up by 12 % y-o-y. In August alone, however, spending was down by nearly 8 % y-o-y.

Federal budget revenues have been on the rise in recent months. In January-August, revenues overall contracted by nearly 4 % y-o-y (but have been on the upswing in recent months). Revenues from oil & gas in January-August were down by 38 % y-o-y. Revenues in recent months have been bolstered by rising oil prices and ruble depreciation. Thanks mainly to increased value-added tax revenues, other federal revenues were up in the first eight months of this year by 24 % y-o-y.

The federal budget deficit has narrowed with decreased spending and improved revenue performance. In August, the cumulative 12-month federal budget deficit was 5.8 trillion rubles or about 4 % of GDP.

Under Russia’s approved 2023 budget plan, federal budget spending should contract by about 7 %. For the government to hold to its budget plan, it would have to cut spending for the rest of the year (September-December) by about 30 % from the same period last year. Such a pull-back in spending would significantly reduce economic growth. It is highly unlikely that Russia would cut spending dramatically as it has a war to pursue and a presidential election coming up next year. Russia’s finance ministry is currently preparing a new three-year budgetary framework.

Russia’s federal budget spending growth has cooled in recent months

Sources: CEIC/Russian Ministry of Finance, BOFIT.