BOFIT Weekly Review 34/2023

China posts modest July growth numbers; problems persist in real estate sector

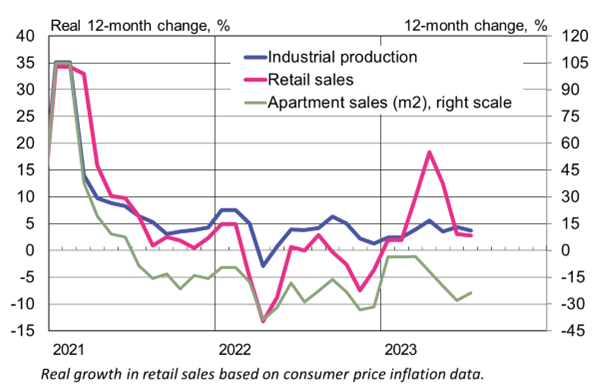

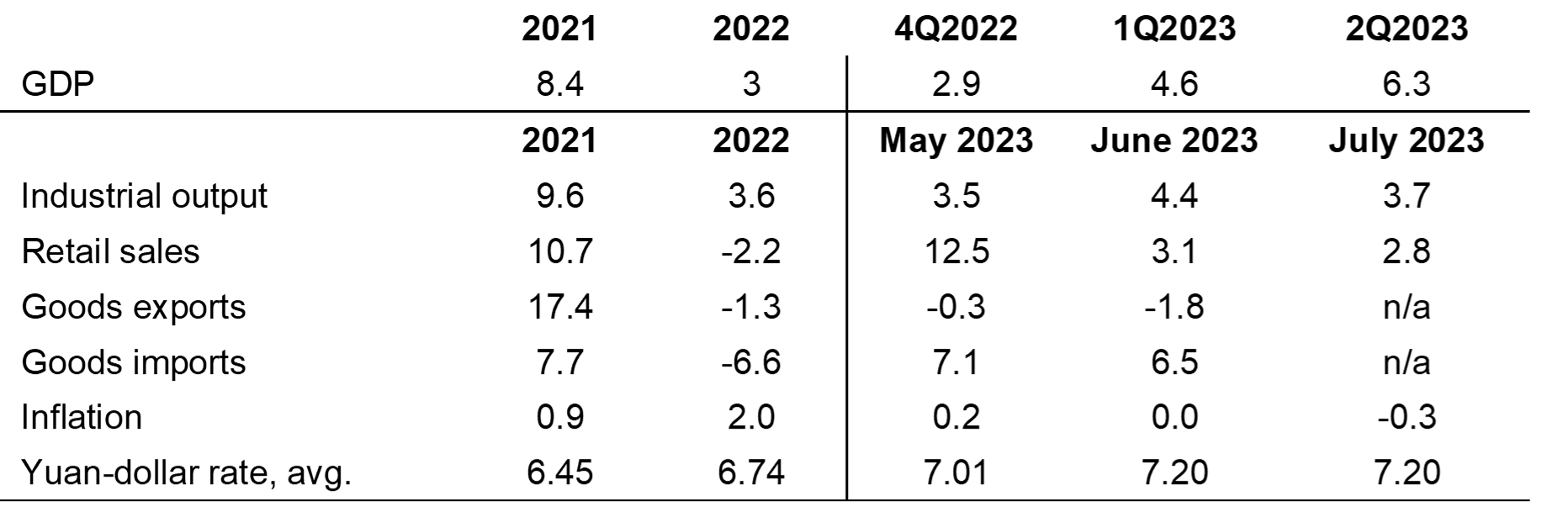

Nominal growth in retail sales slowed in July to just 2.5 % y-o-y. Real retail sales growth adjusted for consumer price inflation was below 3 %. The service sector purchasing managers indices (PMI) were still well above the neutral reading of 50 in July. Restaurant services, for example, grew by nearly 17 % y-o-y in nominal terms.

Industrial output was up in July by nearly 4 % y-o-y, roughly matching the average pace for January-June, but still a couple percentage points lower than the pre-pandemic levels of 2019. On-year growth above 10 % was posted for metal and chemical industries, as well as for production of electrical machinery & equipment. The largest declines were recorded for ore excavation and production of various consumer goods (clothing, houseware, sports equipment). The pace of industrial output growth is slow partly due to weak export demand, suggesting that foreign trade currently does not serve as an engine for economic growth. Exports contracted in July by 15 % y-o-y in dollar terms, while imports were down a bit less (- 13 %).

Even with nominal growth in fixed asset investment (FAI) of 3.4 % in January-July, seasonally adjusted monthly growth figures from the National Bureau of Statistics (NBS) showed zero growth in July (the second consecutive no-growth month). Real estate investment continued to decline (down by 18 % y-o-y in nominal terms).

The pace of growth of industrial output and retail sales slowed slightly in July

Sources: NBS, Macrobond, CEIC and BOFIT.

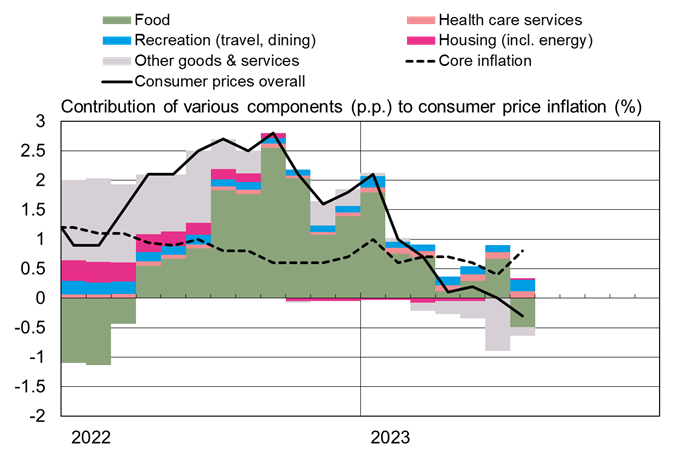

China’s consumer price inflation turned negative in July, mainly because of on-year declines in food and energy prices. Due to their high volatility, food and energy are excluded from the calculation of core inflation, which was up by 0.8 % in July (0.4 % in June).

China’s most important consumer price inflation category is food, tobacco and alcohol, which has a relatively large 29 % weighting in the computational basket of consumer goods. Food has a much greater weight in the Chinese consumer basket than e.g. in the euro area or the US. In contrast, the impact of energy prices is typically smaller in China, due to the fact that most domestic energy prices are regulated or subject to state guidelines (BOFIT Weekly 14/2023). Prices of pork and pork products, which account for about a tenth of the entire food category, have experienced wild price swings since the 2019 outbreak of African swine fever virus. Indeed, pork prices are one of the largest single factors affecting consumer price inflation in China. Producer prices fell by 4.4 % y-o-y in July (down by 5.4 % in June). The biggest drops in producer prices were registered in the mining & quarrying sector (- 15 %) and in raw material production (- 7.6 %). The drop in industrial producer prices was more modest (- 3.8 %).

Chinese inflation has been restrained by slack consumer demand and administrative price regulation, as well as reduced pressure to raise wages. Chinese labour markets currently have significantly more available workers that in Europe or North America. Following the announcement that youth unemployment hit a record high of 21.3 % in June, the NBS declared that it was suspending further publication of such figures. Internal migration of workers from the countryside to cities in search of work continues to serve as China’s largest domestic labour reserve and is the first to adjust to any shift in economic conditions (BOFIT Weekly 50/2022). Inflationary pressures for the rest of this year should be constrained by reduced overall demand and by the fact that the reference basis for the second half of 2022 was a period of relatively high food and energy prices.

The negative trend in Chinese consumer price inflation in July was largely driven by declining food and energy prices

Sources: NBS, Macrobond and BOFIT.

PROBLEMS OF CHINA’S REAL ESTATE SECTOR PERSIST; PBoC EASES MONETARY STANCE SLIGHTLY

Although real estate giant Evergrande became insolvent already a couple years ago, the company only sought bankruptcy protection in the US this month. Bankruptcy protection is meant to prevent US-based creditors from suing the company or confiscating assets. The declaration may indicate that the long-grinding negotiations on allocating Evergrande’s debts have neared completion. The financial problems of other large developers have also recently made headlines. Country Garden, still China’s largest developer as of last year, is currently struggling with serious payment issues. Even if Country Garden is carrying substantially less debt than Evergrande (often cited as the world’s most indebted firm), it has nearly four times more domestic construction projects. Moreover, the problems of the sector are not confined to private developers. Bloomberg analysts report that 18 of China’s 38 state-owned developers listed on the Hong Kong stock exchange have reported losses for the first half of this year. Eleven developers reported losses last year and just four in 2021.

With demand still withering, the government’s efforts to correct problems in the real estate sector appear increasingly daunting. Real estate sales, measured either in yuan or by volume of floorspace, were down by about 25 % y-o-y in July. Construction starts were down by 27 % y-o-y. On the other hand, developers have managed to complete many previously stalled construction projects. This is politically important as apartment sales before their completion is a standard practice in China. In July, 33 % more apartments were completed than a year earlier, while the volume of buildings under construction declined by 7 % y-o-y. On-year growth in the stock of household loans slowed to 2.9 % in July. Growth in the stock of corporate loans remained just under 15 %.

In conjunctions with July’s weak economic figures, the People’s Bank of China cut its one-year medium-term lending facility (MLF) by 15 basis points to 2.5 % and its 7-day reverse repo rate by 10 basis points to 1.8 %. The PBoC rate cuts are intended to reduce bank refinancing costs. The size of the MLF rate cut was the largest since April 2020. MLF adjustments are usually followed within a few weeks by changes in the lending prime rate (LPR) used in setting bank lending rates. However, the five-year LPR used in pricing housing loans was left unchanged at 4.2 %, while the one-year LPR mainly used as the reference rate for pricing corporate loans was cut by 10 basis points to 3.45 %. The modest drop in lending rates likely reflects the already historically narrow interest margins of Chinese banks that are hurting profitability and would be squeezed further by additional loan rate cuts. Policy rate cuts also increase devaluation pressure on the yuan at a time when monetary officials are otherwise seeking to curb the recent slide in the yuan’s external value.

Real 12-month change and consumer prices, %

Sources: NBS, China Customs, WTO, CEIC and BOFIT.