BOFIT Weekly Review 32/2023

China’s large current account surplus persists; capital outflow continues

According to preliminary balance-of-payments figures, China’s current account surplus in the second quarter was 65 billion dollars, a modest drop from the 82 billion dollars surplus of the first quarter. The goods trade surplus increased in the second quarter to 163 billion dollars. At the same time, the services deficit continued to widen (55 billion dollars in the second quarter), due in part to the recovery in international travel that has boosted the deficit in tourism and transport services.

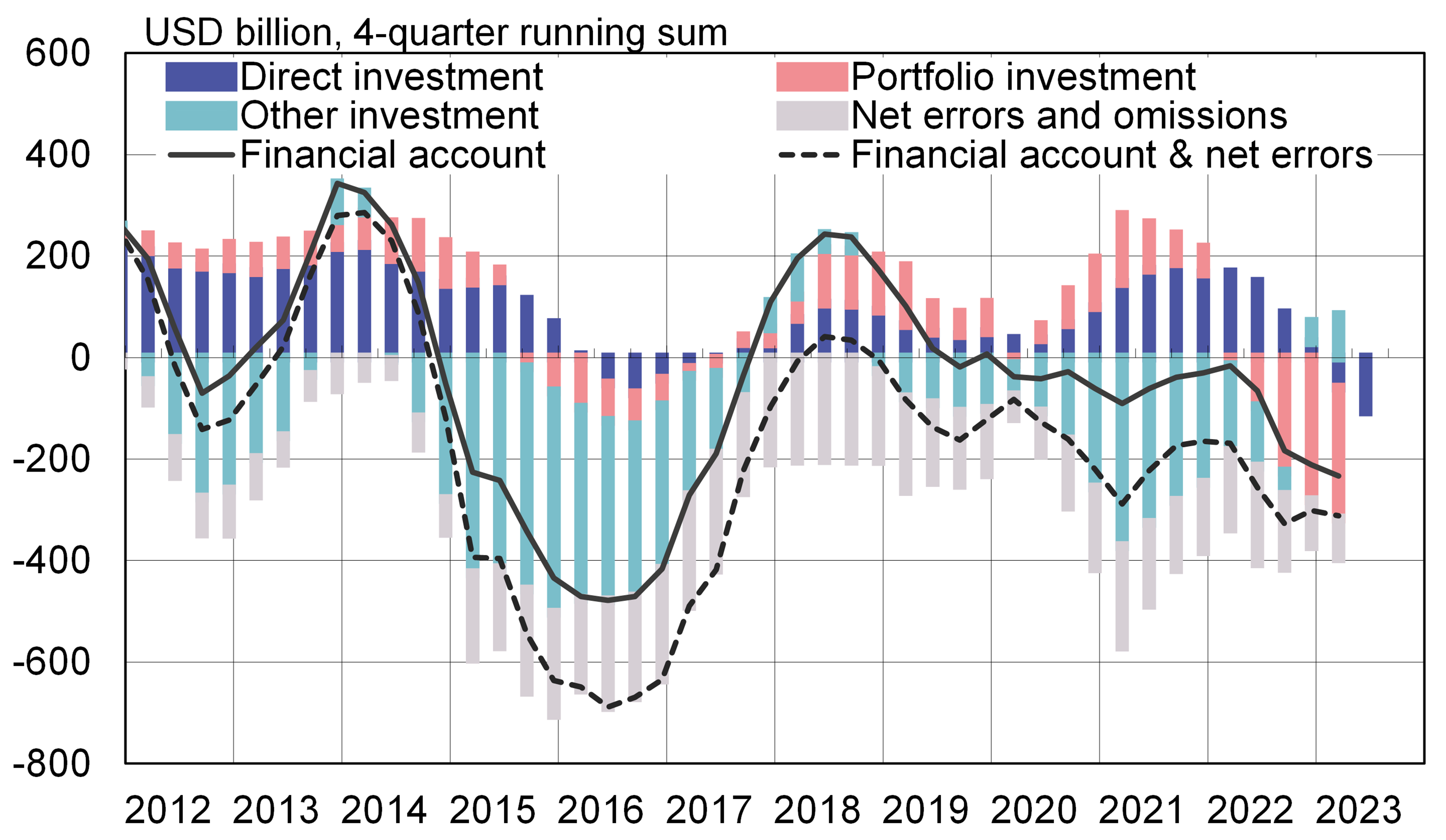

The balance-of-payments figures reveal that the outflows of direct investment from China surpassed the investment inflows in both the first and second quarters. Capital flight in the first quarter was also driven by portfolio investment, as the portfolio deficit increased to 56 billion dollars. As the current account remained in surplus, and there was little change in China’s foreign reserves (down by 16 billion dollars), it seems that capital continued to flow out of the country in the second quarter either through recorded (other items in the financial account) or unrecorded items (b-o-p “net errors and omissions” term). More granular second-quarter financial account data will be released later with revised figures for current account items.

For all of last year, China’s goods trade surplus rose to 669 billion dollars, an increase of nearly 20 % y-o-y. The services trade deficit in 2022 shrank by nearly 10 % (92 billion dollars) from year before. As a result, the overall current account surplus rose to 402 billion dollars or 2.2 % of GDP (the 2021 current account surplus was 353 billion dollars or about 2 % of GDP). Last year’s overall financial account deficit was 211 billion dollars. The largest deficit among financial account items was recorded for portfolio investment (281 billion dollars), while the derivatives balance was also slightly in the red (6 billion dollars). The direct investment account last year last year still ran a slight surplus (30 billion dollars).

Securities investment accounted for the single largest stream of capital outflow from China last year

Sources: SAFE, Macrobond and BOFIT.