BOFIT Weekly Review 31/2023

Russian production and imports recovered, government still posts large deficit

INCREASES IN PRODUCTION, CONSUMPTION, EMPLOYMENT AND IMPORTS

The Russian economy has recovered from the downturn of spring 2022. The latest forecasts point to recovery of GDP this year. The IMF’s forecast now sees GDP growth of 1.5 % this year, while the Bank of Russia forecast expects growth in the range of 1.5−2.5 %. The July forecast average published by Consensus Economics puts growth this year at around half a per cent.

After several consecutive months of recovery, growth in seasonally adjusted industrial output yet stalled in June. The situation was about the same in both mining & quarrying and manufacturing. Mining & quarrying output has increased slowly since the start of the year, while manufacturing output has grown considerably. Manufacturing output in May-June was up by about 8 % from the same period two years ago.

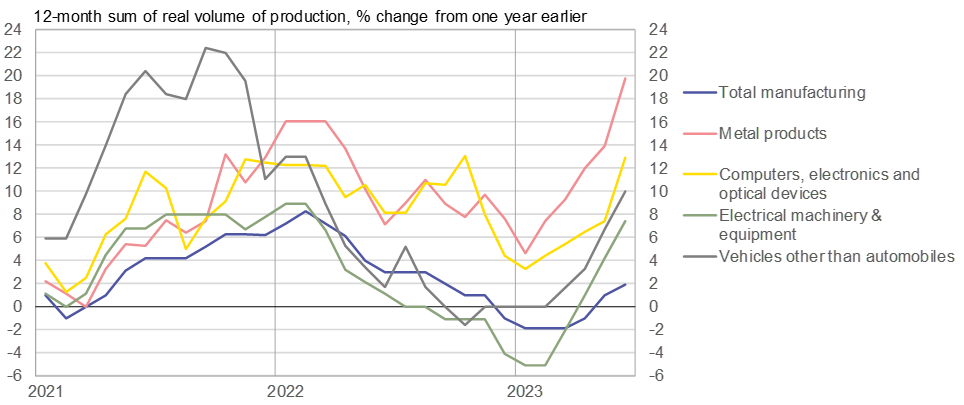

The rise in manufacturing has been driven by those industrial branches that benefit from higher military spending such as metal products, electronics, electrical machinery & equipment, and manufacture of vehicles other than automobiles. During the first six months of this year almost three quarters of the over 6 % y-o-y growth in manufacturing came from these four branches.

Growth in construction activity plateaued in June, but construction was still up 10 % y-o-y thanks to steady growth for over a year. The on-year volume of goods transport fell due to decreased pipeline transmission of oil & gas. Rail transport increased only slightly. In contrast, growth in road transport remained rapid as in 2022. Passenger ridership on public transport, which already grew last year, was up further this year for both bus and especially rail transport.

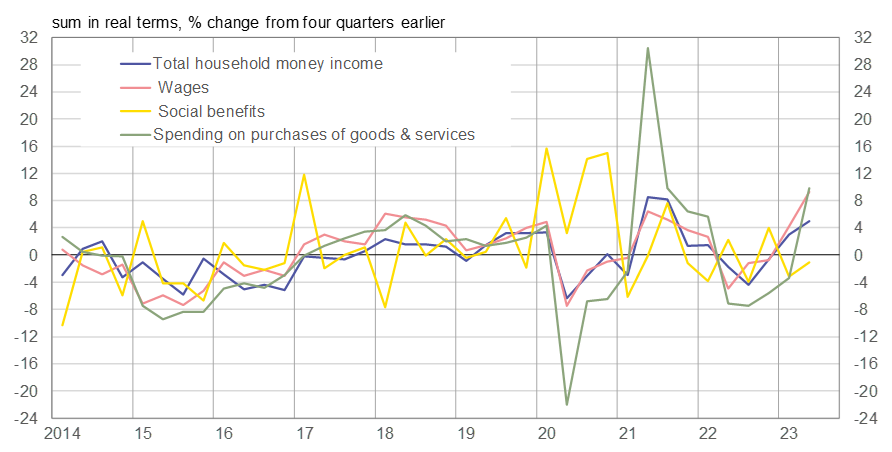

The recovery in private consumption from the spring 2022 slump has continued. In the second quarter of this year, household spending on purchases of goods and services, as well as retail sales, were up 9−10 % y-o-y in real terms from last year’s downturn and roughly at the same level as in spring 2021. Real household incomes continued to rise and were up a few percent from two years earlier. The rise in real wages accelerated.

Employment in the second quarter was up by over 2 % y-o-y (2Q22 saw a rise of 0.5 % y-o-y as well). The number of people in the labour force in the second quarter was also up by nearly one and half a per from 2Q22. People starting to work came not only from unemployed persons but to a significant degree from people outside the labour force. Thus, Russia’s employment rate has risen significantly.

Russia’s imports have bounced back on the economic recovery. Russian spending on imports was up by more than 30 % y-o-y in the second quarter and slightly higher than two years ago. The rise in the real volume of imports has been somewhat more moderate as import prices have risen quite a bit this year (export prices in many of the countries that export to Russia have risen rather quickly).

GOVERNMENT BUDGET REVENUES RECOVERED WHILE SPENDING GROWTH SLOWED; DEFICIT STILL SUBSTANTIAL

Government revenues have risen in recent months. Nominal revenues to the consolidated budget (federal, regional and municipal budgets plus government social funds) were up in March-May by over 15 % y-o-y. Budget revenues have increased significantly on higher output and wages, a rapid recovery of imports as well as corporate profits. In addition, the rise in budget revenues in real terms has been supported by an on-year slowdown in the rise of consumer prices and an on-year drop in producer prices for manufactures. Federal budget revenues in April-June were still down from twelve months previous as they remained depressed from the sharp slide in revenues from oil & gas taxes. The price of Urals blend crude oil has been much lower this year than a year ago, although oil tax revenues in ruble terms have been buoyed in recent months by the ruble’s low exchange rate compared to spring 2022.

On-year growth in consolidated budget spending slowed in late spring to around 10 %. Federal budget spending growth eased to a slightly lower pace. The budget deficit that accrues basically to the federal budget has remained for its 12-month running sum at around 4.5−5 % of GDP in recent months.

On July 27, the Bank of Russia raised its key rate by 100 basis points to 8.5 %. The Bank noted that production is not meeting the increase in domestic demand, which has added to inflationary pressure.

The increase in manufacturing output in Russia has been led by metal products and certain branches of the machinery & equipment industry

Sources: Rosstat and BOFIT.

Household wage incomes and consumption have recovered since last year’s decline

Sources: Rosstat and BOFIT.

Sources: Rosstat and BOFIT.