BOFIT Weekly Review 28/2023

China’s central bank ongoing digital yuan pilot project enters its fourth year

The People’s Bank of China launched its foray into development of a central bank digital currency (CBDC) already in 2014, and pilot-scale testing of the digital yuan or “digiyuan” (symbol e-CNY) commenced in four large cities at the end of 2019 (see e.g. BOFIT Weekly 14/2021). As the digiyuan roll-out continues, the opportunities for its use have increased geographically and commercially. The e-CNY is presently used in 26 cities in 17 provinces. No official launch date for nationwide use of the digiyuan has yet been announced.

China’s digiyuan pilot scheme is focused on domestic retail transactions (retail CBDC), but interbank wholesale transactions (wholesale CBDC) and cross-border payments are also currently under development. The digiyuan is fully controlled by the PBoC, and like cash, generates no interest. Commercial banks and payment institutions act as the payment intermediaries. The digiyuan is seen as an official alternative to digital payment solutions developed by private-sector actors (most notably the Ant Group’s Alipay and Tencent’s WeChat Pay). These private solutions currently dominate China’s vast mobile payments arena. The PBoC says it introduced the digiyuan in order to improve the efficiency and security of payment systems and to improve financial inclusion. Although the anonymity protections of digital currency transactions are weaker than for cash, CBDC is also harder to counterfeit, launder or use in illegal trade. The PBoC claims that in principle digiyuan transactions are anonymous in the case of low-value payments and that traceability only enters the picture in the case of high-value payments.

Use possibilities have been expanded beyond retail outlets to cover, for example, public transport, public healthcare services and financial services. School tuition and taxes can be paid in digiyuan, and social security benefits in some areas are distributed in digital currency. Changshu in the Jiangsu province made the news in May when the city began to pay its public sector workers entirely in digiyuan.

Just before the 2022 Beijing Winter Olympics, the central bank released an e-CNY app in cooperation with nine of China’s major commercial banks. The app allows users to transfer money between their digiyuan wallet and bank account, as well as make online and offline payments and transfers to the wallets of others using the app. Four types of wallets are currently available. The easiest form of registration only requires giving a phone number, in which case the central bank cannot (at least directly) identify the user’s identity. Such accounts can hold a maximum of 10,000 yuan and daily use is limited to 5,000 yuan (625 euros). The amount available for use increases if the registrant provides their government-issued resident identity card number or links their wallet to their physical bank account. Users can gain unlimited spending on their digiyuan account if they personally identify themselves at a bank branch. The PBoC says that digiyuan wallets collect less information about users than the digital payment solutions offered by private providers. In July, two of China’s largest banks (Bank of China and ICBC) announced they launched a feature in the app together with China’s teleoperators that exploits near-field communication (NFC) data transfers and enables making payments without being connected to the internet.

The digiyuan can be used for payments on Alipay and WeChat Pay, as well as on popular shopping platforms such as Taobao, Meituan and JD.com. Consumers seem reluctant, however, about changing their payment habits and switching to digiyuan. Several provinces have tried to support CBDC by offering discounts or simply giving digital money to consumers. As part of covid support measures, provinces distributed or raffled off digiyuan coupons which had to be used by a certain date and typically were subject to rules on where they could be spent. During this spring’s holiday week, there was news coverage of Shenzhen’s digiyuan coupons to support for local restaurants.

The government has not published comprehensive figures on the volume or use of e-CNY. According the PBoC, 261 million digiyuan wallets had been established as of end-2021. In August 2022, the PBoC announced that the value of digiyuan transactions had surpassed the 100-billion-yuan mark. Hitting that milestone involved over 360 million transactions in 15 provinces. CBDC transactions, however, are still dwarfed by the volume of mobile payments. The digiyuan was reported to be in use at nearly 6 million points of sale at that point. Central bank figures also show that the supply of CBDC in circulation at the end of last year totalled 13.6 billion yuan (1.7 billion euros). That amount corresponded to 0.13 % of the narrowest definition of money supply (M0), which includes cash in circulation, commercial bank reserves at the central bank and in China the amount of e-CNY in circulation.

China is also participating in international CBDC experiments. Along with China, the recent Bank for International Settlements (BIS) project (mCBDC Bridge) included the central banks of the United Arab Emirates, Hong Kong and Thailand. Several of China’s largest banks participated in pilot testing of wholesale cross-border use of CBDC last autumn. Cross-border digiyuan payments are seen as a way to possibly make the international use of the yuan easier and cheaper in the future. During the 2022 Beijing Winter Olympics, digiyuan was available to foreign visitors. Shenzhen this spring began to offer travellers coming from Hong Kong the possibility to set up a digiyuan account with a card that allows users to transfer money from their own Hong Kong Octopus card.

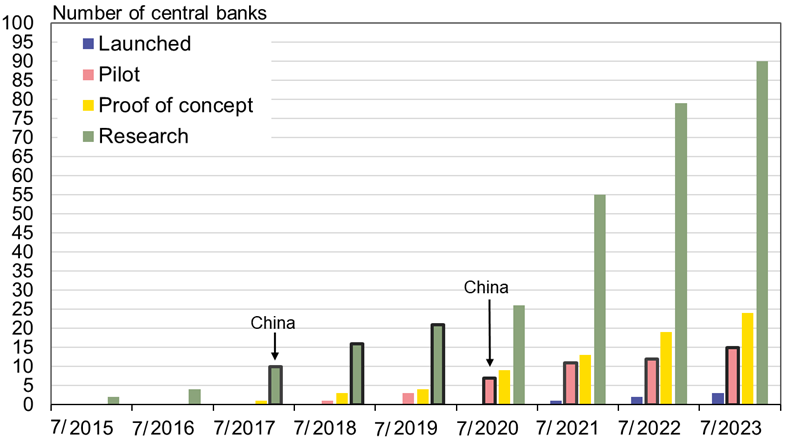

Interest in central bank digital currency is increasing around the world. The Atlantic Council reports that 130 countries, which together account for 98 % of global GDP, are either studying or planning to introduce their own CBDC. The European Central Bank, for example, launched an investigation phase on introduction of a digieuro in 2021. The digiyuan is overwhelmingly the world’s largest central bank digital currency experiment in terms of value and size of user base. The Bahamas, Nigeria and Jamaica have already launched their own CBDCs.

An ever increasing number of central banks have digital currency projects in the research or pilot stages

Sources: CBDCTracker and BOFIT.