BOFIT Weekly Review 25/2023

Significant weakening of Russia’s government finances

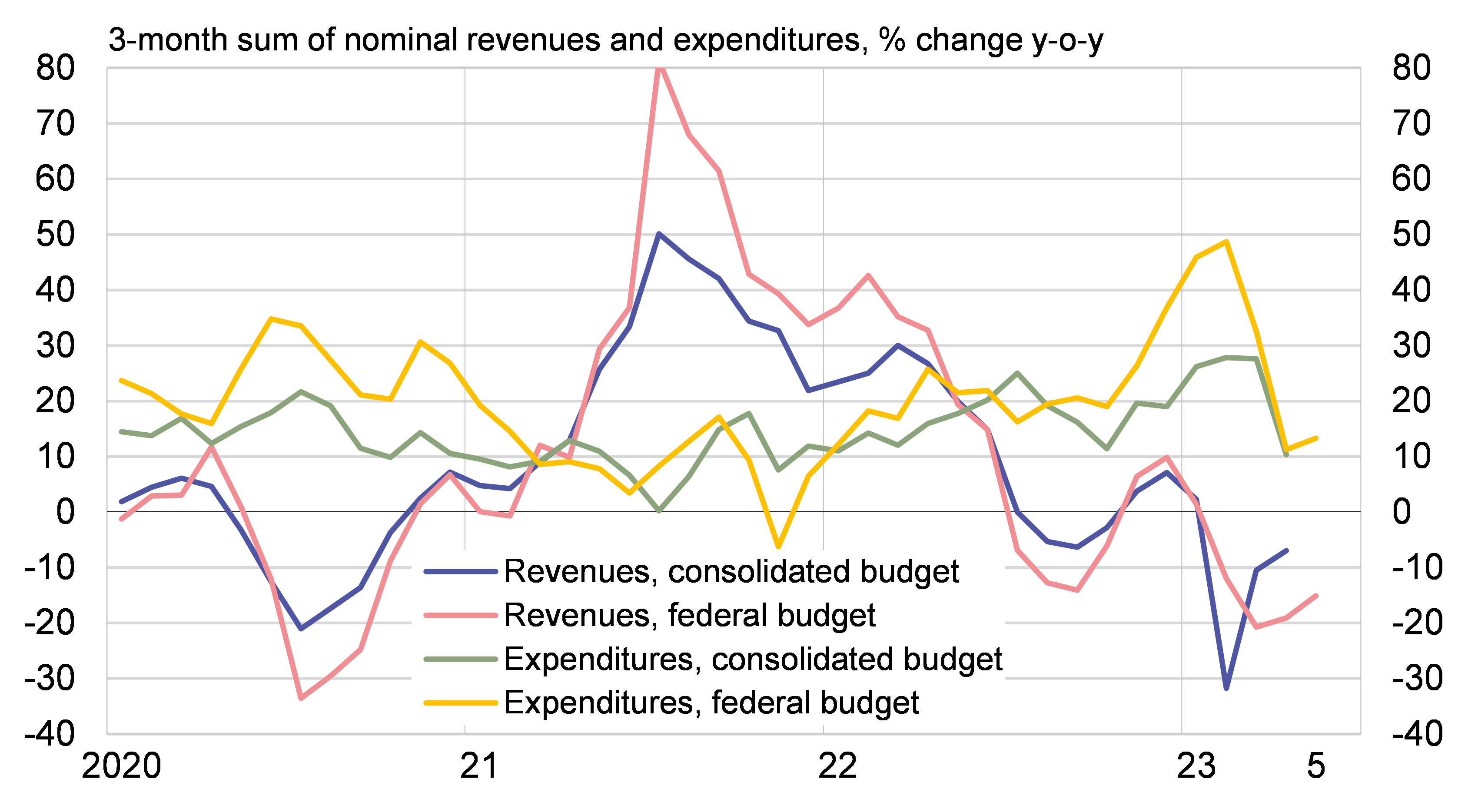

Budget revenues declined while spending still increased even after a pull-back

Russia’s government budget revenues have slipped in recent months. Nominal three-month revenues to the consolidated budget (federal, regional and municipal budgets plus budgets of state social funds) were down in April by 7 % from a year earlier. Government revenues were off by about 10 % in real terms. Purchasing power of government revenues is no longer eroding as quickly as last year because consumer and producer price inflation has slowed to 3–4 % y-o-y, mostly due to the on-year drop in producer prices of domestic supplies in recent months.

Russia’s government budget revenues are down and efforts to restrain spending growth have been made

Sources: Russian Ministry of Finance and BOFIT.

Revenues other than oil & gas tax revenues (nearly 80 % of consolidated budget revenues in 2022 and 86 % of revenues in January-April 2023) have recovered to levels higher than a year ago. VAT revenues from domestic production have increased and budget revenues from imports such as VAT and import duties have recovered. Revenues from labour income taxes and social taxes on wages, on the other hand, have withered.

Oil & gas tax revenues have dropped by half on-year in recent months. The price of Urals blend was down by about 25 % y-o-y. While taxation of crude oil continues to be based on the price of Urals, a lower limit for the price used for taxation, relative to the Brent crude, has been defined (more than 30 dollars a barrel below Brent in April-May and 25 dollars below Brent from the beginning of July). On the other hand, the slide in oil & gas tax revenues, which are measured almost entirely in dollars, has been constrained by the ruble’s depreciation. Crude oil production is also an essential factor as crude oil production taxes accounted for 80 % of total oil & gas tax revenues in January-May. Monitoring of Russian oil production by international agencies indicates that Russia has so far implemented only a small part of its announced crude oil output.

The rise in consolidated budget spending has slowed significantly in recent months to around 10 % y-o-y. Budget spending on fixed investments and inventories, however, jumped by nearly 80 % y-o-y in January-April as war and support to the economy require funding.

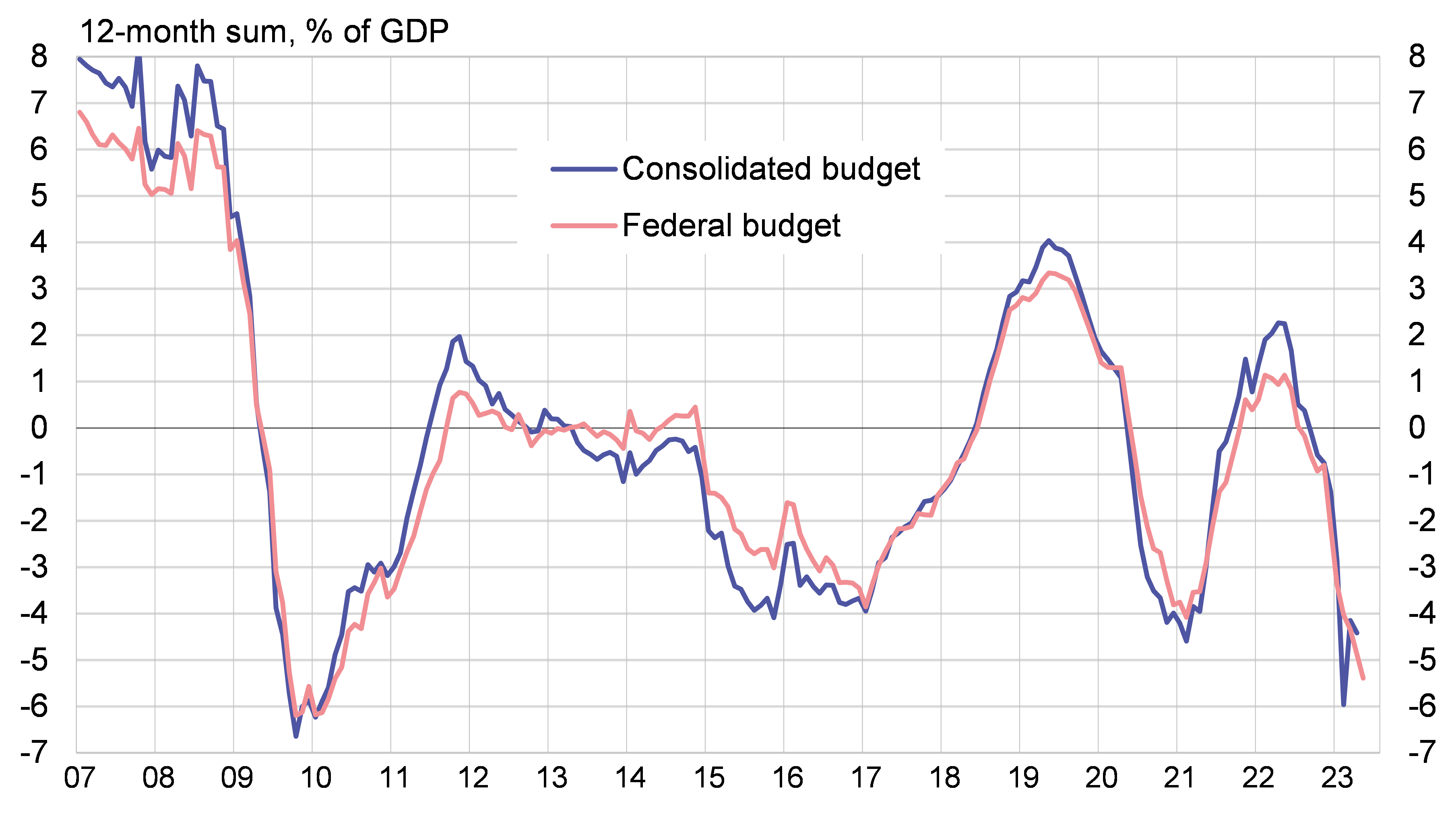

Budget deficit ballooned and budget revenues are supported with additional taxation

The decline in budget revenues, even with recent efforts to quell spending growth, has caused the budget deficit to widen. The running 12-month consolidated budget deficit grew to roughly 4.5 % of GDP in April. The federal budget deficit deepened to nearly 5.5 % of GDP in May. Russia’s deficit is currently its largest since the global financial crisis in 2009. The finance ministry says it is attempting to reduce the budget deficit based on the setup that this year’s spending has been unusually front-loaded. The deficit this year has been mostly funded out of government accounts. A relatively small amount of that has been taken from the liquid assets of the National Wealth Fund. The government has also relied moderately on bond issuance.

The state needs money and has increased its efforts to squeeze out additional revenues. The Duma is considering a bill that will apply a one-time windfall tax to firms with “excessively large” profits. The tax will not apply to small and medium-sized firms, firms operating in the oil & gas sector or coal producers. Companies included in the tax calculation will be those with a profit exceeding about 12 million euros for the period 2021–2022. The tax is defined as 10 % of a corporation’s profits in 2021–2022 in excess of its 2018−2019 profits. The determined amount must be paid in January 2024. If the tax is paid this year in October or November, the rate of taxation should drop to 5 %. The finance ministry noted earlier this year that this one-time tax could increase budget revenues by an amount equal to roughly 0.2 % of annual GDP. Firms in the oil & gas sector will face tax hikes, largely of production taxes. A higher tax on coal production has already been implemented. The finance ministry estimates that the government could raise considerable sums from these supplementary taxes, possibly more than 2 % of GDP.

Russia’s government budget deficit has increased sharply into depths not seen since the global financial crisis in 2009

Sources: Russian Ministry of Finance and BOFIT.