BOFIT Weekly Review 24/2023

Hong Kong economy recovering from a tough year, but much depends on external factors

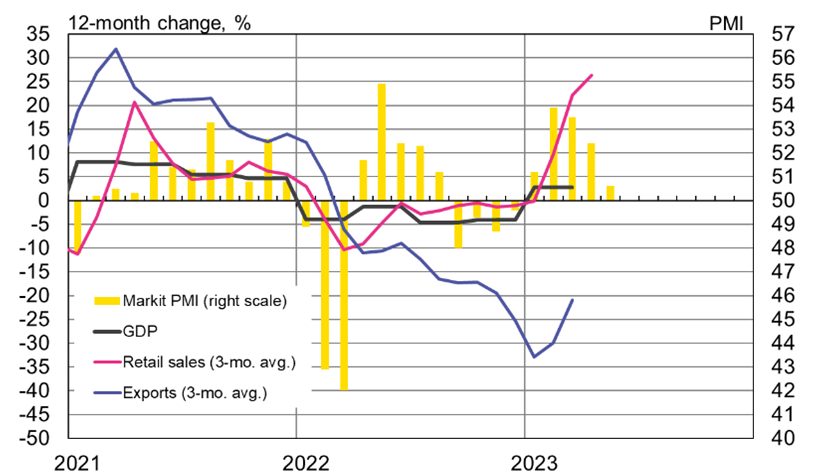

Hong Kong’s economy last year had to deal with severe covid lockdowns and interest rate increases in the US that increased financing costs also in Hong Kong. Hong Kong’s GDP contracted by 3.5 % last year. The reopening of the economy early this year helped revive private consumer demand and lifted Hong Kong’s main purchasing manager index above a neutral reading of 50 points. In the first quarter of this year, GDP grew by 2.7 % y-o-y. The April IMF forecast expected Hong Kong’s GDP to rise by 3.5 % this year and by 3.1 % in 2024.

The Hong Kong dollar is pegged (fixed peg) to the US dollar, which forces the Hong Kong Monetary Authority to react immediately to any rate changes announced by the US Federal Reserve. Interest rates can thus rise in Hong Kong even if local economic conditions would warrant a more accommodative monetary policy stance. This happened last year when rates in the US went up just as Hong Kong was fighting the highly contagious omicron variant of the covid virus. Unlike in mainland China, where most covid support measures have been aimed at the business sector, the Hong Kong government has also supported households and private consumption throughout the pandemic. Electronic purchase coupons were distributed to households, employment supported and taxes on wage income reduced. As looser monetary policy is unlikely over the short term, fiscal stimulus measures have been extended.

Hong Kong’s service sector accounts for 94 % of GDP. Over the years, Hong Kong’s industrial production has gradually been offshored almost entirely to mainland China and manufacturing today only generates about 2 % of Hong Kong’s GDP. With the opening of the economy after the lifting of covid restrictions at the start of 2023, private consumption has returned to the growth track. The volume of retail sales in the first four months of this year rose on average by about 20 % y-o-y. The growth in private consumption has been boosted by the return of tourists, especially tourists from mainland China. Even if 2.9 million tourists visited Hong Kong in April (with 2.3 million coming from mainland China), the numbers remained well below pre-pandemic levels. In 2019, a monthly average of just under 4.7 million tourists visited Hong Kong, of which 3.6 million came from mainland China.

Hong Kong is also highly dependent on the global economy for its export demand. The value of goods and services trade is nearly four times larger than GDP and reexporting accounts for a huge part of Hong Kong’s foreign trade. Mainland China is still by far Hong Kong’s largest trading partner, although its share of imports has fallen from just under 50 % ten years ago to about 40 % last year. During the first three pandemic years (2020–2022), mainland China’s share of exports increased slightly, but has since dropped back to around 55 %. The volume of foreign trade last year was nearly 30 % below its 2021 peak. For the first months of this year the volume of exports continued to decrease, but the worst of the contraction in exports is likely to be over.

A total of 187,300 people emigrated from Hong Kong in 2020–2022, reducing the special administrative region’s population by 2.5 %. In January 2023, the UK’s Home Office announced that 144,000 Hong Kongers had moved to the UK on special (Hong Kong British Nationals Overseas) visas. As British nationals overseas, Hong Kongers can immigrate to the UK with little paperwork and have access to an accelerated citizenship path. The UK began to grant special visas in January 2021, a half year after Hong Kong’s draconian national security act went into force. Freedom of speech and freedom of the press have been sharply curtailed in Hong Kong due to China’s crackdown on dissent.

The Hong Kong economy has begun to show signs of a post-pandemic recovery

Sources: Hong Kong Census and Statistics Department.

Sources: Hong Kong Census and Statistics Department.