BOFIT Weekly Review 22/2023

China’s global car exports boom

China is both the world’s largest car market and the world’s largest car producer. Last year 27 million cars were produced in China, a 1-million-car increase from 2021, but still 2 million units fewer than in the peak year of 2018. The numbers of other car-producing countries pale against China’s numbers. The next-largest producer, the US, last year produced 10 million cars, followed by Japan with 8 million. Of the Chinese production, nearly 24 million were passenger cars and slightly over 16 million of them had combustion engines, over 5 million were fully electrical vehicles (EVs), and about 2.5 million were hybrids. The shares of EVs and hybrids continued to grow rapidly. In addition to the passenger cars, just under 3 million trucks were produced and about 400,000 busses.

While there are plenty of domestic carmakers in China, most large international car manufacturers also produce cars in China. For a long time Chinese officials required foreign manufacturers to establish joint ventures with a Chinese manufacturer, a policy intended to develop the capabilities of domestic car producers, but in 2022 foreign firms were finally granted the right to operate fully foreign-owned car production facilities in China. Many foreign operators have nevertheless opted to continue producing in joint ventures with Chinese partners. Moreover, the state has offered support in various forms to support the development of local carmakers. For example, one of the priorities of the Made in China 2025 industrial policy programme is development on “new energy vehicles.”

While China’s domestic car market is vast, sales have recently only grown by about 2 % a year in terms of units sold. Car sales picked up slightly in January-April this year, with a 7 % y-o-y increase for the period. Volkswagen was the top-selling make for passenger car, while China’s BYD, which is specialised in EVs, has also been popular. The top-selling model in China last year was the Tesla Model 3.

Sluggish growth in domestic car sales has been offset to some extent by booming car exports. Car exports averaged about 1 million units a year 2017–2020, jumped to 2 million in 2021 and last year exceeded 3.2 million. Growth in exports has remained strong this year too. Chinese media report that early this year the country surpassed Japan as the world’s largest car exporter. Of China’s car exports last year, nearly 2.7 million were passenger cars and their exports continued to rise quickly. Of the exported passenger cars, 1.6 million had a combustion engine, a 50 % increase from 2021. Nearly a million EVs were exported, a 90 % increase from 2021. In addition, exports of hybrid cars more than doubled to over 100,000 units. Besides passenger cars, China last year exported 500,000 trucks, 50,000 busses and 8,000 specialised vehicles. Sales of electrical models of trucks and busses also increased.

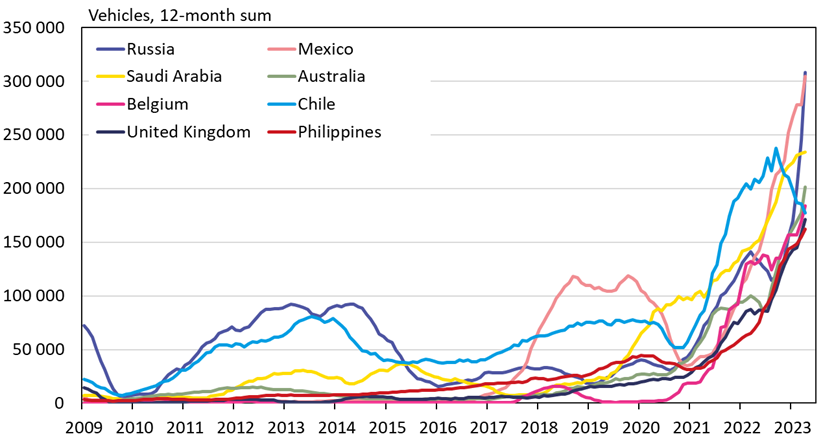

Chinese car exports have been traditionally focused on emerging economies. Over the past twelve months, Russia has become China’s largest car export market. China Customs reports that China exported 308,000 cars to Russia, which was just a few thousand more than car exports to Mexico. Chinese car exports to Russia have been booming since Western manufacturers pulled out of the Russian market due to the invasion of Ukraine. Unlike China’s vehicle exports generally, EVs remain a tiny part of exports to Russia, while exports of busses and trucks have grown significantly more than passenger car exports. After Russia and Mexico, China’s next most important export destinations over the past twelve months have been Saudi Arabia (234,000 cars) and Australia (201,000 cars). The biggest destinations for Chinese car exports to Europe are Belgium (184,000 cars) and the UK (171,000), while 69,000 Chinese-built cars were exported to the US.

Many European, American, Japanese and South Korean carmakers have plants in China. Available figures do not show how exports break down between foreign and Chinese manufacturers and across brands. Also Chinese carmakers have many plants abroad, most in emerging economies and Russia. Some of the assembly and product development is also in Europe concentrating much in England. Moreover, Chinese Geely has owned Volvo in Sweden since 2010. Also Swedish Saab was acquired by the Chinese carmaker NEVS, but it ran into financial trouble. It was recently announced that the old Saab factory in Trollhättan, Sweden will begin to produce EVs under the Polestar brand owned by Volvo.

Most Chinese car exports (including chassis) go to Russia and emerging economies, but the number of cars going to Western markets is also increasing

Sources: China Customs, CEIC and BOFIT.