BOFIT Weekly Review 22/2023

Chinese foreign direct investment declined last year, particularly in the US and Europe

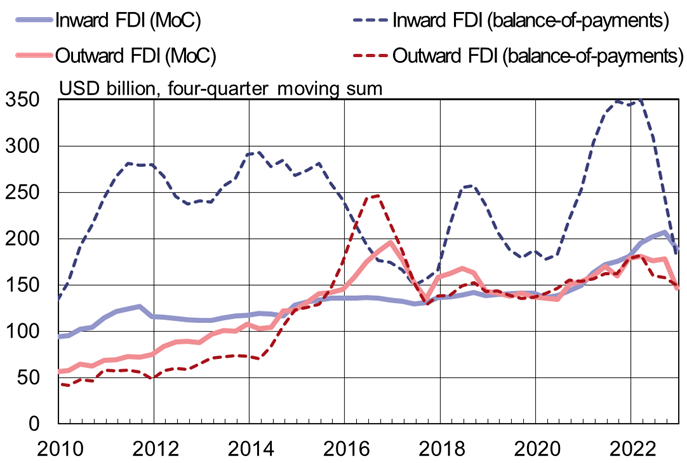

The official foreign direct investment (FDI) figures released by China’s Ministry of Commerce show that FDI outflows from the country amounted to 147 billion dollars, an 18 % drop from 2021. FDI inflows to China last year amounted to 189 billion dollars, a 5 % increase from 2021. The commerce ministry has yet to release a breakdown of FDI by country. Moreover, commerce ministry figures diverge considerably from China’s balance-of-payments FDI figures, which include e.g. disinvestments, reinvestment of earnings and financial flows between parent companies and their subsidiaries. China’s balance-of-payments figures show contracting FDI flows into and out of China last year. The outward FDI of Chinese firms amounted to 150 billion dollars (down by 16 % from 2021) while inward FDI to China was 180 billion dollars (down by 48 %).

Outward FDI flows from China declined last year. Inward FDI to China shows wide statistical discrepancies

Sources: China Ministry of Commerce (MoC), SAFE, CEIC and BOFIT.

Preliminary figures from the OECD show that global FDI flows decreased by 24 % last year. China was the world’s second-largest FDI destination last year after the US. In the rankings of FDI-source countries, China was the third-largest provider of FDI after the US and Japan. US FDI has risen since 2021, and accounted for almost a third of total global FDI. The OECD statistical data use China’s balance-of-payments figures. The UN Conference on Trade and Development (UNCTAD) uses the commerce ministry’s figures, creating significant differences in the FDI figures for China.

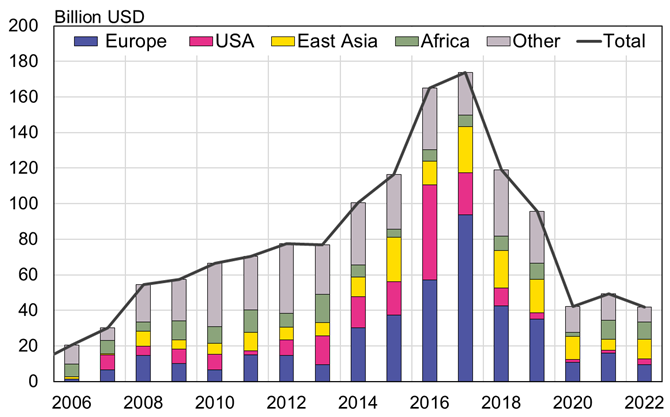

Other datasets are needed to break down Chinese FDI by country. China Global Investment Tracker (CGIT) compiled by the American Enterprise Institute and the Heritage Foundation attempts to list all Chinese FDI projects over 100 million dollars based on public information. The CGIT shows that Chinese firms made 86 such large investments worth a total of 42 billion dollars last year. The 2022 number was well below that of 2017, when large Chinese investments reached 174 billion dollars. About half of large investments last year, both in value and number, were greenfield investments and about half corporate acquisitions. Greenfield investment’s share of Chinese FDI has increased in recent years. Large investments of Chinese firms in the US have declined considerably. CGIT figures put the value at just a few billion a year since 2019 (a dramatic drop from 2016, when Chinese FDI in the US exceeded 50 billion dollars). Chinese investment in Europe has also dropped considerably from 2016 and 2017, amounting to only about 10 billion dollars last year.

The German China studies institute Merics and the Rhodium Group together produce comprehensive figures on Chinese FDI in Europe. The 2022 figures are well off the boom years of 2016 and 2017. Investments in the EU-27 countries and the UK last year amounted to 7.9 billion euros (8.3 billion dollars), a 22 % decline from 2021. Two-thirds of FDI flows went to three large countries: Germany, France and the UK. Only a few large Chinese firms continued to make the bulk of the investments in Europe. Just five large Chinese firms accounted for over 70 % of all Chinese FDI in Europe last year. Investments of European firms in China in recent years have also been concentrated with just a few firms (BOFIT Weekly 40/2022). Last year, over half of Chinese FDI inflows to Europe went to the automobile sector. Chinese firms have made large investments in recent years in battery factories, particularly in Hungary, Germany, France and the UK.

Chinese firms have lost their appetite for foreign investment in recent years due to weaker corporate balance sheets, tighter Chinese government regulation of FDI outflows and drag from the Covid-19 pandemic. The ongoing trade war between the US and China has also heightened awareness of China risks, bringing increased scrutiny to Chinese FDI projects, particularly in the US and EU. While only few of the investments are banned outright, investors see that the increased screening makes the investment process more complicated and may affect the keenness of Chinese firms making foreign investments in these countries. Survey responses from many multinational firms operating in China suggest they are also thinking harder about possible future investments in China.

Large FDI projects of Chinese companies has fallen sharply from the peak years of 2016 and 2017

Sources: China Global Investment Tracker and BOFIT.