BOFIT Weekly Review 20/2023

Strong annual growth numbers hide China’s April slowdown

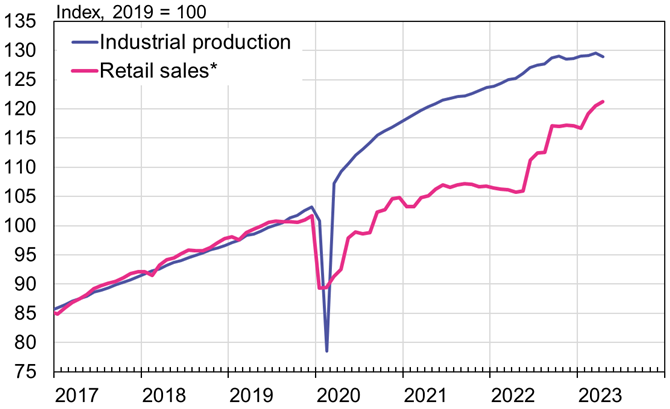

The dramatic 12-month change in retail sales growth in April reflects the fact that China was experiencing in the same month a year earlier widespread covid lockdowns that sharply reduced consumption demand. Although retail sales rose by 18 % y-o-y in April, growth was still below what many analysts had expected. Sharp recoveries were seen especially in restaurant sales (up 44 % y-o-y). April nominal retail sales were up by 0.5 % from March. On-month growth slowed compared to the February-March change.

12-month industrial output growth revived in April to nearly 6 %, and was also up from the first quarter of this year. Industrial output, however, was down from March, contracting by nearly 0.5 %. Growth in foreign trade also slowed from March. In April, exports were up by 8 % y-o-y and imports down by 8 % in dollar terms. During the first four months of this year, the value of China’s good exports rose by 2 % y-o-y and the value of goods imports shrank by 7 %.

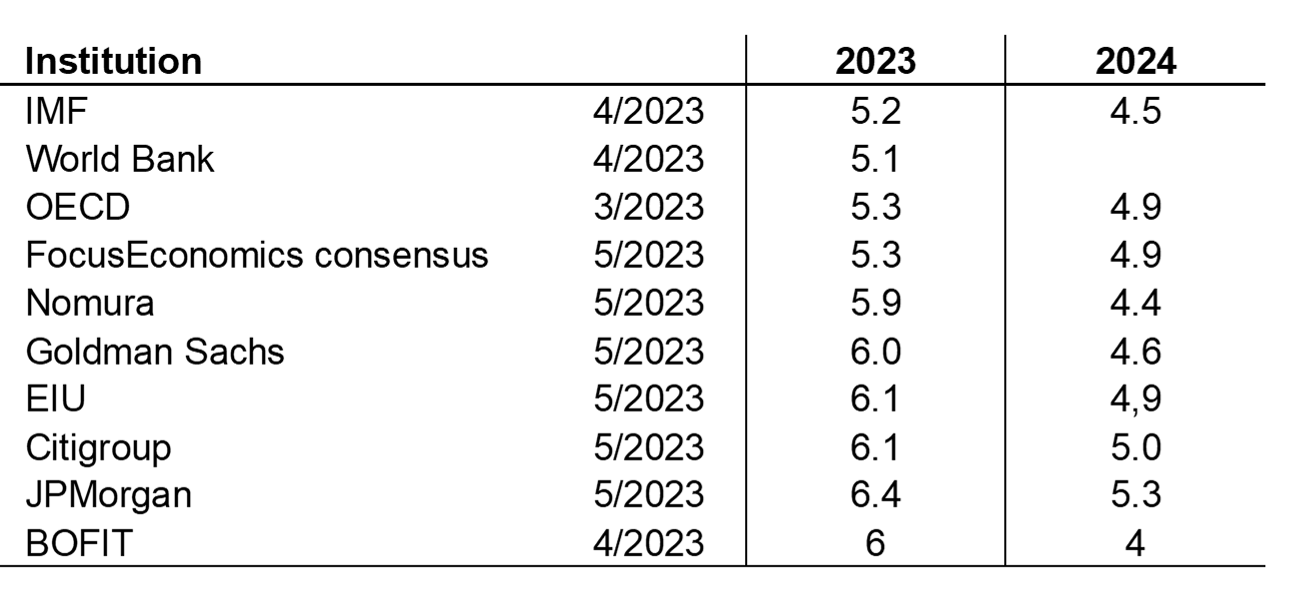

The level of industrial output in April was only slightly higher than at the end of last year, and the pace of retail sales growth slowed

Sources: China National Bureau of Statistics, CEIC and BOFIT.

*) Nominal growth in retail sales deflated by the consumer price index.

Lending restrictions imposed on the real estate sector in 2020 have been abandoned almost completely and banks are again encouraged to support the real estate sector through lending – particularly lending to distressed projects to assure that they are completed (BOFIT Weekly 6/2023). This has led to a decline in the current volume under construction. As of end-April, the floorspace under construction was down by 6 % y-o-y and by 21 % from its peak at the end of 2021. The number of new project starts continued to dwindle. In January-April, the number of new building starts (measured in floorspace) was down by 21 % y-o-y. The latest round of support measures to the real estate industry have yet to fire up apartment buyers on a broad scale. April apartment sales (measured in floorspace) were still down by 12 % y-o-y. Month-on-month, however, the drop in apartment sales is finally appearing to halt. In the first four months of this year, the volume of apartment sales was down by 5 % y-o-y (measured in floorspace), while the value of apartment sales in the same period was up by 5 %.

Bank lending has picked up a bit from last year. PBoC figures show that bank lending was up by about 12 % y-o-y in April, the same increase as in March. Again, most lending went to the corporate sector, while growth in the stock of household loans was only about 3 %, reflecting tepid housing sales. The stock of household loans declined between March and April. The PBoC has kept its main policy rates unchanged since last August. Inflation situation would give the government room to ease its monetary stance, counter to the global trend. The April rise in consumer prices was roughly zero and the decline in producer prices accelerated to 3.6 % y-o-y (down by 2.5 % in March).

Real on-year change and consumer prices, %

Sources: China National Bureau of Statistics, China Customs, WTO, CEIC and BOFIT.

Busy LABOUR DAY HOLIDAY week for Domestic travel; international travel REVIVES

The five-day Labour Day holidays, which ran from April 29 to May 3 this year, saw domestic travel and domestic tourism revenues well exceed pre-pandemic levels. China’s culture and tourism ministry reports that tourism revenues more than doubled from last year’s holiday week and were 26 % higher than in 2019. The number of people travelling during the holiday week was also up by over 40 % from 2019. The popularity of visiting Hong Kong has risen rapidly this year with the reopening of the border. Hong Kong’s tourism officials report that the number of mainland Chinese visiting Hong Kong in April was still down by 46 % from 2019, as was the total number of visitors (down by 37 % from 2019).

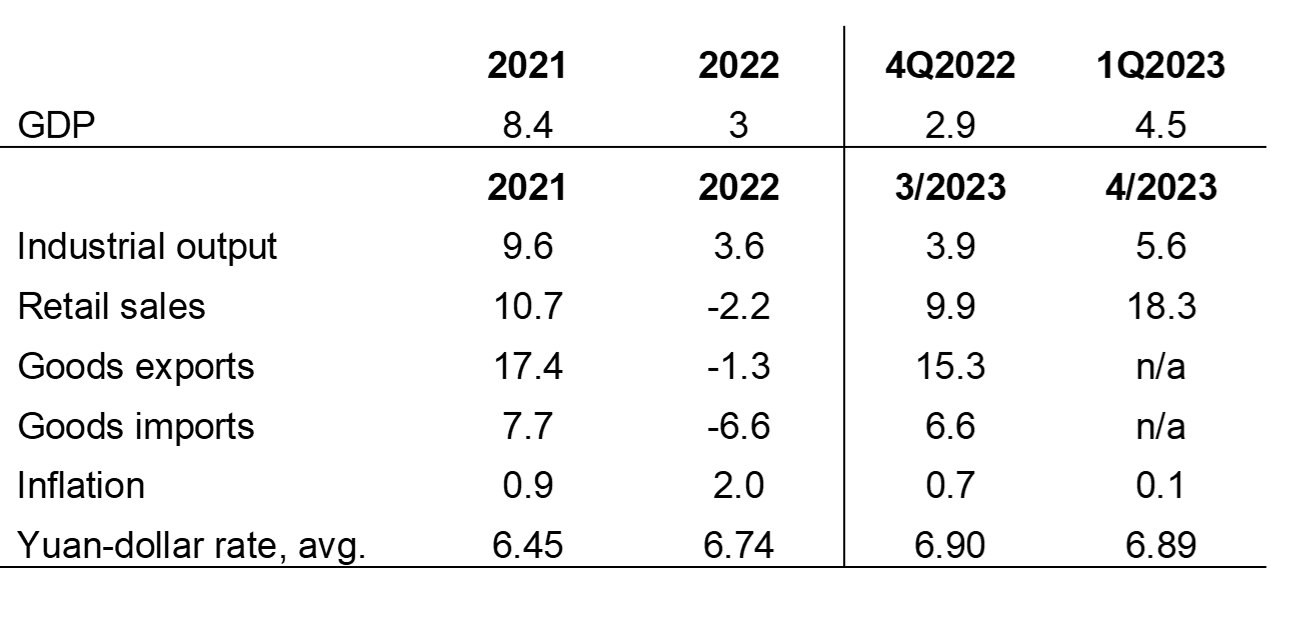

While the number of passengers on domestic flights returned to near pre-pandemic levels in March and April, the number of passengers on international flights in March were still just a fifth of the 2019 amount. China’s large airlines report that April passenger numbers were up sharply from March, but still only about a quarter of the 2019 level. International travel has been limited by the small number of flights, which in turn has pushed up prices. Chinese officials report that the number of international flights from China rose to 2,240 flights a week in mid-April, nearly five times more than the number of international flights at the start of this year. Before the pandemic, China averaged about 7,700 international flights a week. Officials report international flights from China to 59 countries in April (Chinese airlines flew to over 70 countries before the pandemic). The number of international flights has gradually increased in recent weeks. The United States announced in May that it would permit Chinese carriers to increase their flights to the US from the current 8 flights to 12 a week – the same number that China allows for US airlines. The tension in US-China relations is well reflected in flight restrictions. Before the pandemic, each side allowed over 150 flights a week between the countries.

The air travel passenger volume in China has recovered close to pre-pandemic levels even with few international flights

Sources: Civil Aviation Administration of China, CEIC and BOFIT.

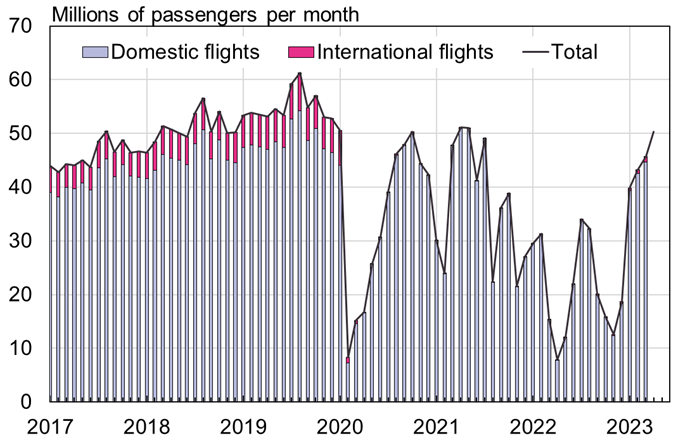

Forecasters raise their outlooks for Chinese GROWTH this year

With China’s decision to abandon its zero-covid policies and reopen the economy at the end of last year, as well as the epidemic’s subsequent minor impacts on the resumption of economic growth in the first quarter, a number of major institutional forecasters recently revised upwards their forecasts for Chinese growth this year. Several forecasts see growth reaching around 6 % this year (including our April BOFIT Forecast for China). While much of this growth stems from last year’s low reference basis, China is expected to surpass its official 2023 growth target of “about 5 %” set last March at the National People’s Congress without relying on broad-based stimulus measures.

Growth should begin to slow in the years ahead. Many institutional forecasters have also adjusted slightly downwards their predictions for Chinese growth next year. In its April World Economic Outlook, the IMF cut its forecast for China’s medium-term growth. The forecast, which extends out to 2028, sees China’s annual economic growth declining to around 3.5 % at the end of the forecast period, a significant reduction from its previous projection of 4.6 % growth. The IMF said that the reduction reflects, among other things, China’s shrinking population, lower productivity growth and the negative effects of geoeconomic fragmentation.

Institutional forecasts for the Chinese economy this year and next, %