BOFIT Weekly Review 19/2023

Despite falling inflation, inflation risks in Russia continue to mount

At its scheduled inflation meeting at the end of April, the executive board of the Central Bank of Russia left the key rate unchanged at 7.5 %, as it has been since last September. Although Russian inflation has slowed significantly in recent months, the CBR has been reluctant to further lower the key rate due to the risks of higher inflation in the months ahead.

Inflation has slowed…

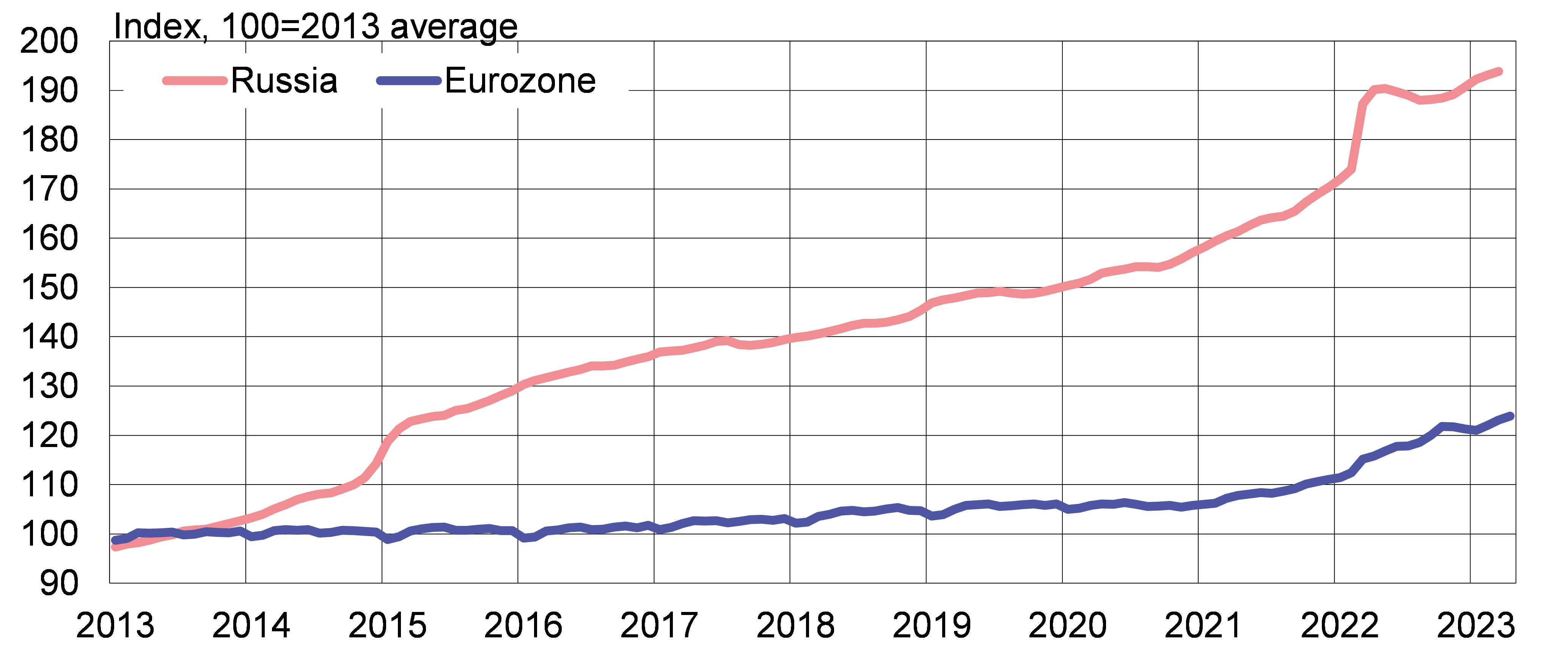

Russian consumer prices soared last spring following Russia’s invasion of Ukraine. 12-month inflation reached 17–18 % during March and April 2022, but gradually subsided thereafter. As of March 2023, consumer prices were up by just 3.5 % y-o-y, largely due to the basis reference. The slowdown in inflation reflects several factors, including reduced demand due to recession, a recovery in imports that has eased supply bottlenecks and a stronger ruble, which has negated some of the inflation pressures from import prices.

Russia’s economic recession, the result of war and sanctions, has diminished demand. According to the economic development ministry’s preliminary estimate, Russian GDP continued to contract in January-March at about 2 % y-o-y. The strong contraction in imports last spring limited the supply of many goods in Russia. Imports, however, have recovered gradually since last summer as Russia has found new import sources and built up new logistical chains. Russia has also managed to find substitutes for certain imported goods through increased domestic production. The rise in food prices has been dampened by last year’s bumper harvests.

Ruble appreciation has also quelled inflationary pressures. Russia’s invasion of Ukraine last year caused the ruble’s exchange rate to plunge to historical lows. The ruble’s exchange rate, however, has gradually returned to its pre-invasion level thanks to the government’s imposition of strong capital controls and a string of large current account surpluses. In January-March 2023, the ruble’s nominal effective (trade-weighted) exchange rate, or NEER, was 26 % higher than a year earlier.

...while inflation risks have been building

A number of factors could cause Russian inflation to accelerate in coming months. Government spending has skyrocketed and the government finances have gone into the red. Russia’s current budget plan assumes that federal budget revenues will fall by 6 % this year and that spending will diminish by 4 %. The deficit is forecast to be around 2 % of GDP. In January-April, federal budget expenditures were up by 26 % y-o-y and revenues contracted by 22 %. In the first four months of this year, the budget deficit already clearly exceeded the budget deficit planned for the entire year. If Russia expects to continue waging war in Ukraine, it will be challenging for the government to find ways to cut spending. Thus the budget deficit is likely to rise and inflationary pressures increase.

Inflation risks are also caused by Russia’s tight labour market. Russia suffered from a lack of skilled labour even before the Ukraine war, but the mobilisation of reserves and exodus of working-age people from the country have diminished the labour force further by hundreds of thousands of people. The lack of workers has created pressure to raise wages. Higher wages could, in turn, boost demand and add to inflationary pressures.

The ruble’s exchange rate can also become a source of inflation risk. The ruble has recently depreciated with Russia’s declining current account surplus. At the beginning of May, the official ruble-dollar rate was about 8 % lower than at the start of this year. The CBR reports that the roles of the US dollar and euro as payment currencies in Russian foreign trade have diminished considerably. While 65 % of Russian imports and 85 % of exports were still paid for in euros or dollars at the end of 2021, only about 50 % of payments were made in euros or dollars at the end of 2022. At the end of last year, the ruble’s share as an invoicing currency was 30–35 % and the yuan 15–20 %.

Slight downward revision of this year’s inflation forecast

The CBR released its updated economic outlook in conjunction with its inflation meeting at the end of April. The CBR raised its GDP growth forecast for this year to the range of 0.5–2 %. After a mild cut in its inflation forecast, the CBR now expects consumer price inflation to be in the range of 4.5–6.5 % at the end of this year. Central bank officials still expect to reach their inflation target of 4 % by 2024. The CBR expects the average key rate to be in the range of 7.1–8.6 % at the end of this year implying that pressures to raise rates this year are greater than pressures to lower rates.

The average of 2023 GDP forecasts compiled by Consensus Economics in April was -0.9 %. Russian inflation was expected to be around 5.7 % in December 2023.

Consumer prices in Russia spiked in the first months of the Ukraine invasion

Sources: Macrobond, Rosstat, Eurostat and BOFIT.