BOFIT Weekly Review 18/2023

China-Russia trade continued to strengthen in first quarter of this year

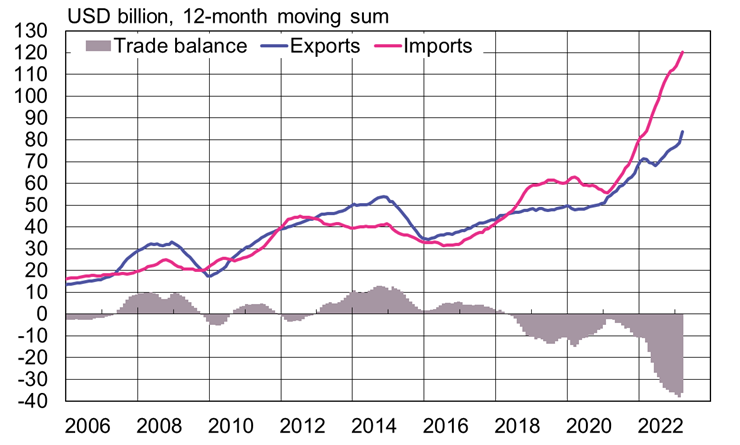

China’s imports from Russia have increased substantially faster than exports to Russia since February 2022. As a result, China’s trade deficit with Russia has hit an all-time high of more than 35 billion dollars. The value of China’s import from Russia in the first quarter of 2023 increased by more than a third from 1Q22. The bulk of China’s imports from Russia, about 80 %, were energy products.

In January-March 2023, Chinese energy imports from Russia were up by 40 % y-o-y in dollar terms. Volume-wise, China’s crude oil exports from Russia were up by a third from a year earlier, liquefied natural gas (LNG) by 66 % and coal by 145 %. Although the volume of natural gas imported via pipeline is no longer disclosed, its import from Russia in dollar terms was nearly five-fold in the first quarter of this year. Russia surpassed Saudi Arabia at the beginning of this year as China’s largest supplier of crude oil, accounting for about 18 % of China’s crude oil imports. Iraq was China’s third-largest supplier of crude oil. In recent months, China has been able to buy Russian oil at an approximately 10 % discount compared to crude oil imported from elsewhere.

Non-energy imports from Russia were up by about 30 % y-o-y in the first quarter. Especially strong growth was seen in animal fats and plant fats, vegetables, chemicals, mechanical and chemical wood pulps, as well as imports of precious metals. Each category represented roughly a 2 % share of total imports. In contrast, imports of basic metals and metal products fell by 25 % (4 % of total imports), and wood products by nearly 10 % (2.5 % of total imports). After averaging just under 3 % between 2019 and 2021, Russia’s share of China’s total goods imports has increased to about 4.5 % after February 2022.

The value of China’s exports to Russia was up by nearly 50 % y-o-y in January-March. Some of the high growth reflects the low reference basis of 1Q22. The largest export categories were machinery & equipment (24 % of exports), vehicles (20 %), electronics (15 %), as well as chemicals and plastics (14 %). Exports of motor vehicles were up sharply after last summer’s halt, with the dollar value of motor vehicle exports to Russia in January-March nearly doubling from a year earlier. In March, China exported nearly 60,000 motor vehicles to Russia, up from fewer than 5,000 in August last year. Russian purchases of Chinese mobile phones were also up by over 40 % y-o-y in the first quarter. China’s share of the mobile phone market in Russia grew from 50 % to 70 %. Exports of chemicals and plastics also increased by over 60 % y-o-y in dollar terms during 1Q23. Russia’s share of Chinese exports has increased in recent months to around 3 %, up from an average of about 2 % earlier.

Our just-released BOFIT Policy Brief 9/2023 shows that China’s role in Russian foreign trade has increased substantially since the invasion of Ukraine. In December 2022, China accounted for about 40 % of Russia’s imports, up from just 25 % a year earlier. At the same time, China’s share of Russian exports rose from about 15 % to 20 %.

China’s trade deficit with Russia reached an unprecedented level this year

Sources: China Customs, Macrobond and BOFIT.