BOFIT Weekly Review 16/2023

China’s growth picked up in the first quarter as the economy reopened; BOFIT expecting relatively strong growth for the year

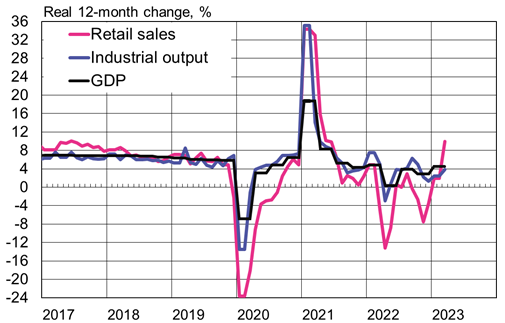

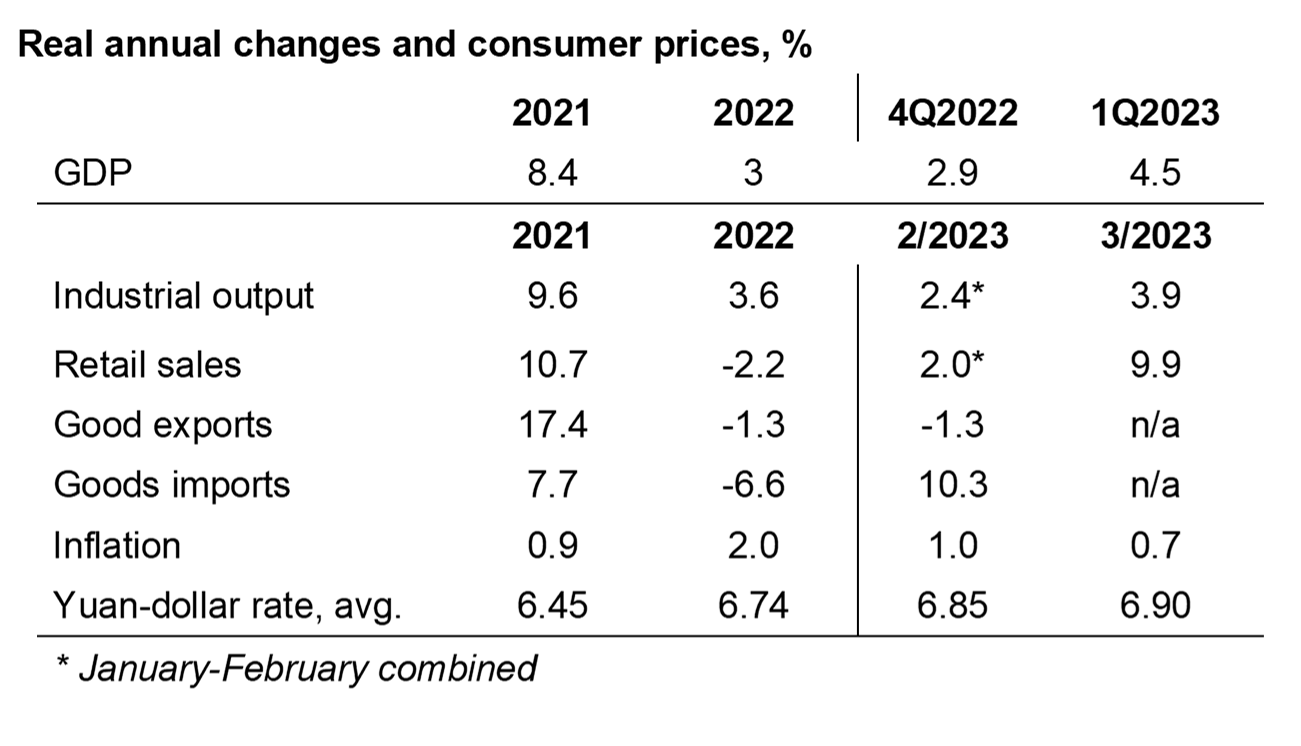

China’s National Bureau of Statistics reports that the economy returned to its growth track with the ending of lockdowns and other zero-covid measures. Official GDP growth accelerated in the first quarter of this year to 4.5 % y-o-y. Increased consumer demand accounted for two-thirds of the growth. Looking at supply-side GDP indicators, wholesale and retail trade was up by 6 % y-o-y in January-March, a significant rise from 2022. After contracting for well over a year, the troubled real estate sector grew by 1 %. Hotel and restaurant services experienced rapid growth (up 14 %), bouncing back after last year contraction. Industrial output, on the other hand, rose by less than 3 %. In addition to official figures, alternative GDP figures produced by other institutions that monitor China (including BOFIT's own estimates of real GDP growth) showed distinct signs of economic recovery in the first quarter.

The revival of consumer demand could also be seen in March retail sales, which grew nominally by nearly 11 % y-o-y and approximately 10 % in real terms. The return of economic normality was particularly clear in restaurant sales, which, following a year of contraction, were up by 26 % y-o-y in nominal terms. March sales were notably robust in the categories of clothing, recreational goods and luxury goods such as jewellery. The downturn in housing is reflected in depressed sales of construction and decoration materials, furniture and household appliances.

The government has pushed this year to provide financing and other supports for completion of partially built projects that shows up in drop in floorspace under construction and increase in the floorspace awaiting sale. However, far fewer new construction projects have been launched this year that at any time since the start of the real estate crisis. The on-year contraction in real estate investment continues. On-year apartment sales still fell in March when measured by volume (floorspace), but showed a slight increase in terms of value for the first time since June 2021. NBS figures show March housing prices in China’s big cities were up on-month, but still down from March 2022.

Growth in industrial output in March accelerated slightly from the first two months of this year to 3.9 %, but still failed to keep up with overall demand growth. Weakening demand in China’s main export markets is a factor dampening growth in industrial output. While the value of March exports measured in dollars increased by 14 % y-o-y, there was no overall growth in exports in the first quarter. Imports contracted by 7 % y-o-y in the first quarter, and were down by 1 % in March. China’s first-quarter exports to ASEAN countries were up in value terms by 18 % from 1Q22, while exports to Australia were up 10 %, South Korea 5 % and Russia 46 %. In the same period, exports to the US fell by 17 %, EU countries by 7 % and Taiwan by 22 %.

Retail sales showed a particularly strong rally in March as China recovered from zero-covid measures

Sources: China National Bureau of Statistics, CEIC and BOFIT.

Real growth in retail sales based on consumer prices inflation.

Inflation slows, but indebtedness accelerates

Consumer demand is currently supported by household spending of savings amassed during the Covid-19 pandemic. The increase in the bank savings of many wealthier households also reflect a flight to safety as they have moved investments away from riskier portfolio investments and real estate holdings. The real disposable incomes of urban residents rose by 2.7 % in the first quarter. Real incomes in the three years of the pandemic (2020–2022) rose overall slower than official GDP growth. Labour market is currently affected with the rise in youth unemployment. Unemployment among persons aged 16-24 was nearly 20 % in March. The national unemployment rate for urban areas was 5.3 %.

Bank lending, which has revived this year, saw growth in the bank lending stock accelerating to 12.2 % in March. China’s “aggregate financing,” the central bank’s broad term for the credit stock, rose by 10.3 %. Aggregate financing includes bank lending, bonds and equity financing by the government, households and non-financial firms, as well as credit extended through instruments of the shadow banking sector. China’s aggregate financing credit stock at the end of March corresponded to 293 % of GDP, a 20-percentage-point increase from the end of 2021. In recent years, the government has pressed the banking sector to increase lending through various targeted programmes that help problem areas such as the real estate sector without significantly easing overall monetary policy. In China’s case, inflation does not seem to be a factor preventing a more accommodative monetary stance in the near future. The rise in consumer prices in March was just 0.7 % y-o-y and the decline in producer prices continued. More relaxed financing conditions, however, would likely trigger even a faster plunge into debt and thereby increase financial risk, as well as assure depreciation pressure on the yuan by inducing capital flight.

Sources: China National Bureau of Statistics, China customs, WTO, CEIC and BOFIT.

BOFIT releases latest forecast for China

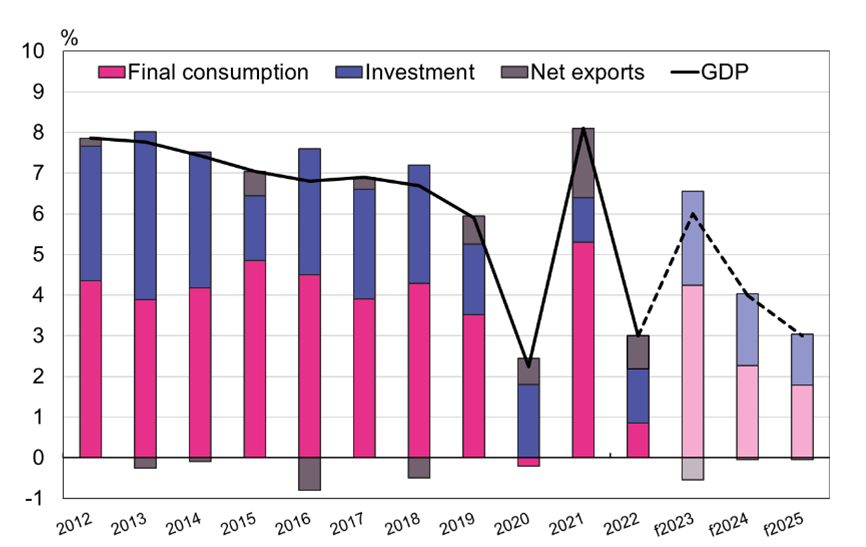

On Thursday (Apr. 20), BOFIT released its Forecast for China 2023–2025. The biggest adjustments from our October 2022 forecast reflect the government’s surprise reversal on zero-covid policies late last year, as well as interventions in the real estate market that appear to have averted the downturn. The reopening of the Chinese economy has boosted consumer confidence and revived consumer demand. We now expect that the decline in real estate investment ends, and they should support GDP growth in the second half of this year.

Factors hampering long-term growth persist. China’s labour force is shrinking, the population greying, political grip has tightened, and high indebtedness is hindering corporate profitability and investments. Real estate investments are unlikely to support economic growth as earlier. The lion’s share of people’s wealth is already tied up in apartments, which are now relatively more risky investments. This could restrain growth in consumer demand. The outlook for global demand is still clouded by rising living costs and higher interest rates in most countries. Thus, China’s export sector no longer serves as the engine for domestic growth as it did in 2021.

We expect Chinese annual GDP growth to reach about 6 % this year, due in part to the opening up at the start of the year and last year’s low reference basis which was revised even lower this April. The expected recovery in the real estate sector in the second half of this year should help lift GDP growth next year to 4 %. GDP growth then slows to around 3 % in 2025.

China’s GDP growth, main contributors to growth and BOFIT forecast for 2023–2025

Sources: China National Bureau of Statistics, CEIC and BOFIT.