BOFIT Weekly Review 15/2023

Russian exports down, imports up in first quarter

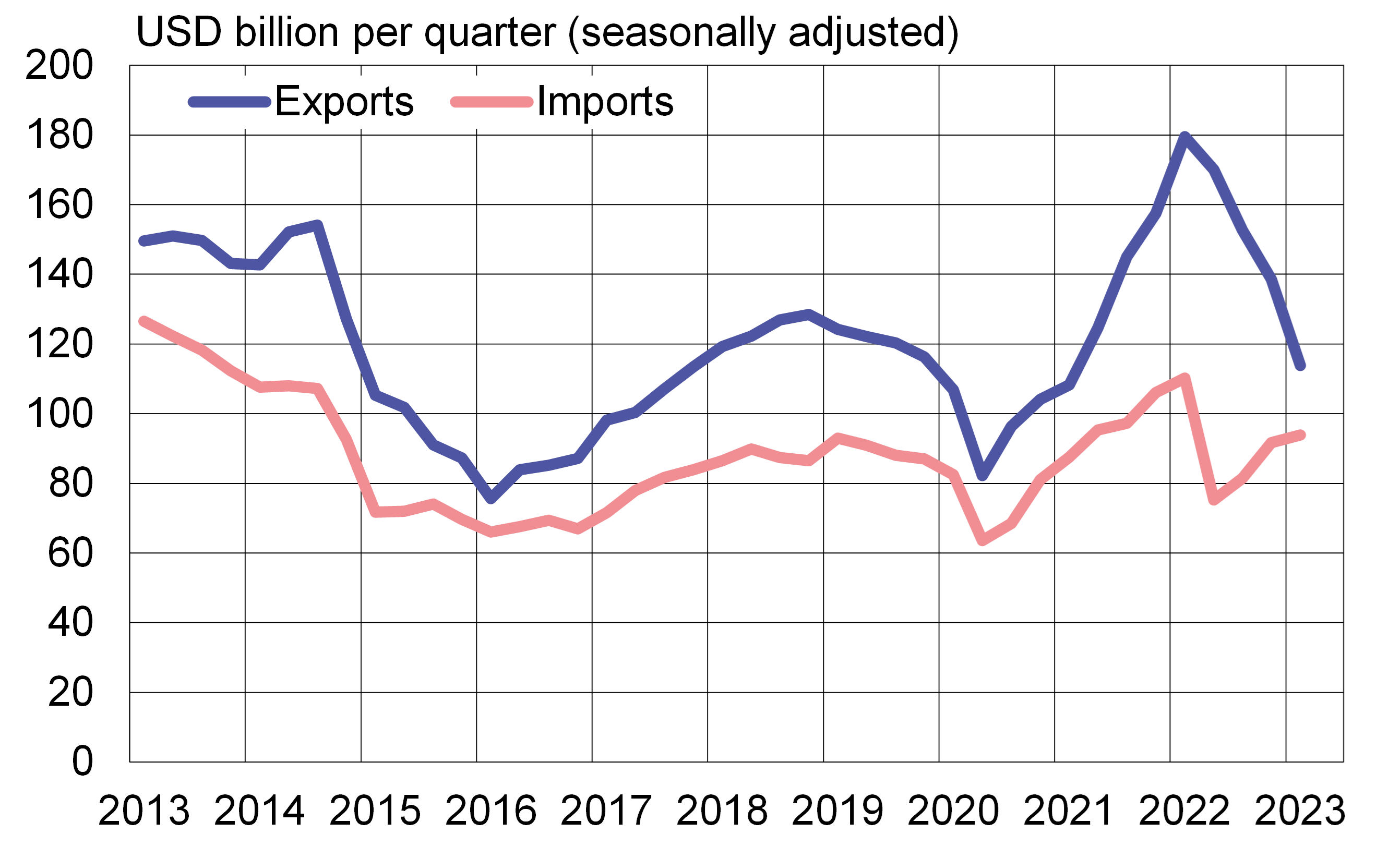

Preliminary balance-of-payments figures released by the Central Bank of Russia show that the value of Russia’s exports of goods and services in January-March fell by 35 % y-o-y. The value of exports peaked last spring during the post-invasion spike in prices of crude oil and other commodities. The subsequent decline in prices was accompanied by a decrease in exports as Western countries implemented import bans on several Russian products, as well as Russia’s own decision to reduce its natural gas exports to Europe. The value of exports in the first quarter was roughly the same as the 2019 quarterly average.

The CBR estimates that the value of Russia’s imports of goods and services in the first quarter was down 3 % y/y. Compared to previous quarter, imports continued to grow (in seasonally adjusted terms). Although imports collapsed in the immediate aftermath of Russia’s invasion of Ukraine last spring, they have gradually recovered. Some of the increase in imports probably reflects higher import prices as the acceleration in inflation has been a global phenomenon. Sanctions and decisions by many international firms to pull out of Russia altogether have also likely affected Russian import prices because Russia has been forced to find alternative sources for imports and alternative transport routes.

With the decline in export revenues and increased spending on imports, Russia’s massive trade and current account surpluses have declined sharply. The current account surplus in January-March 2023 was 20 billion dollars, down from 70 billion dollars in the same period last year. The dwindling current account surplus has also been reflected in the ruble exchange rate. The ruble’s official exchange rate this month is down by about 10 % from the end of last year. The ruble-dollar rate currently stands at about 82.

The value of Russian exports of goods and services contracted in 1Q23, while the value of imports of goods and services increased

Sources: CEIC, CBR, BOFIT.

Alternative estimates and official figures generally agree on current trends in Russian trade

After the attack on Ukraine last spring, Russia ceased almost entirely to release its foreign trade figures. In recent months, Russia has resumed the publication of some trade data. There has, however, been suspicions about the reliability of Russia’s official statistics since the beginning of the war.

Foreign trade trends can be constructed from the mirror statistics published by Russia’s main trading partners. Estimates based on mirror statistics show largely similar trends in Russian foreign trade as indicated by Russia’s official figures, even if there are differences in the exact growth figures.

Analysed by product category, there was a notable increase in Russia’s imports of chemical products last year. Some of this increase may just reflect higher raw material prices. On the other hand, the figures released by Russian customs and mirror trade statistics show the drop in imports of technology products has been larger than the general drop in imports.

Russian customs figures show that last year the rise in value of exports was rapid for such commodities as fossil fuels, fertilisers and most metals. Some of this reflects higher global commodity prices. Russian customs data on export volumes of various export products is not available.

Volume of oil exports largely unchanged over recent months, but Urals export price has declined sharply

The International Energy Agency (IEA) estimates that the overall volume of Russian oil exports in January-February was essentially unchanged from the monthly average for 2022. The slight decline in the volume of exported petroleum products was offset by a small increase in the volume of crude exports. Although exports to EU countries have nearly ceased, exports to Asia in particular have risen and African countries have boosted their imports of refined oil products.

On December 5, 2022, the EU’s import ban on Russian crude oil and the introduction of a price ceiling mechanism by the EU and G7 countries entered into force. This was followed by similar sanctions on Russian petroleum products, which entered into force on February 5, 2023. The sanctions are intended to end Russia oil exports to the EU with only certain exceptions. To avoid a major disruption of global energy markets, the EU and G7 did not seek to prevent Russian oil exports from being redirected to other countries. Instead, the price ceiling mechanism was designed to restrict Russia’s export earnings, while allowing Russian oil exports to continue to flow.

The price of Urals blend crude oil has fallen significantly over the past 12 months. Russia’s finance ministry reports that the average export price for Urals crude was about 48 dollars a barrel in the first quarter, a 45 % drop from 1Q22. Russia has announced plans to cut its oil production this year by about 5 % due to sanctions.