BOFIT Weekly Review 14/2023

2022 was a mediocre year for China’s banking sector

The China Banking and Insurance Regulatory Commission (CBIRC) reports that total banking sector assets grew by about 10 % y-o-y last year. The pace of growth was on par with asset growth in 2020 but accelerated slightly from 2021. As in the previous two covid pandemic year, 2022 growth of balance sheets of large banks continued to be higher than in other banks and their share exceeded 40 % of the sector’s entire total assets. The amount of deposits shown on bank balance sheets grew at its fastest rate (11 % y-o-y) since 2015, likely because the covid conditions last year caused households to save more and by some estimates reduce their investment assets. Growth in the lending stock slowed slightly to 11 % y-o-y, while sluggish economic growth, uncertainty and the downturn in the real estate sector slowed credit demand. The annual reports of large banks show that the average interest rate on corporate loans fell from 4.1 % in 2021 to 3.9 % last year, while the average interest rate on loans to households remained unchanged. In their earnings reports, banks claim that they were helping support the real economy by offering firms loans at discounted rates in line with government policies.

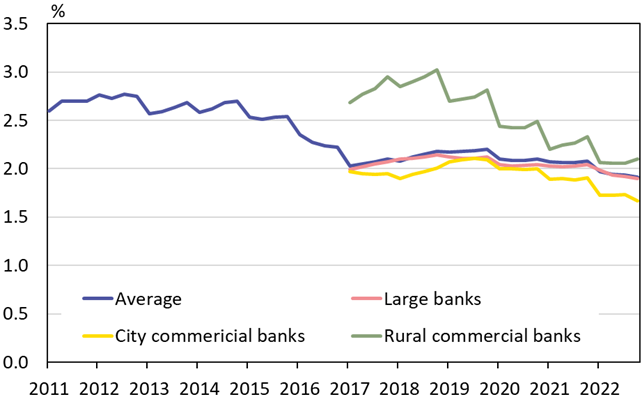

Banking sector profitability on average remained at a modest level last year. Total banking sector profits rose by 5 % y-o-y despite the fact that the main revenue stream for banks, the net interest margin (difference between lending and deposit rates) narrowed to 1.91 %, the tiniest margin in over a decade. Another measure of profitability, return on assets, fell to 0.76 %, its lowest level in at least 15 years.

In recent years, observers have expressed fears that problems in the construction sector might significantly increase the amount of non-performing loans (NPLs). There are no signs this came to pass, at least at the macro-level. Indeed, banks report that their NPL ratios have fallen to just 1.6 % of total lending. The true quality of the loan portfolios of Chinese banks is anybody’s guess, however. The actual amount of NPLs is generally considered to be considerably larger than banks report, despite the fact that banks, and large banks in particular, have been able to write down or sell off their NPLs to government-sponsored bad banks. During the pandemic, firms were also allowed to suspend and extend their loan schedules. According to the latest policy decision, this possibility will terminate at the end of June 2023.

China has over 4 000 banks and the shape of their balance sheets varies a lot. The largest bank are quite solid and in good shape, while some smaller and mid-sized banks may have problems. The government has resorted to the use of public funds to bail out a handful of small and mid-sized banks in recent years (BOFIT Weekly 34/2022). Large difference in the sector can be seen in the capital adequacy ratios of banks. For example, the average capital adequacy ratio of the banking sector has risen in recent years, reaching 15.2 % at the end of last year. The rise, however, has been almost entirely driven by the big banks, which have seen a sharp improvement in their capital adequacy ratios to 17.8 %. The ratios of city commercial banks, in contrast, fell last year to 12.6 %. The minimum requirement is 10.5 %.

The collapse of Silicon Valley Bank and Signature Bank in the US and Credit Suisse in Switzerland are unlikely to have large impacts on China’s banking sector. China’s capital controls significantly insulates the country’s banking sector from external shocks, as well as insulate the rest of the world from the turmoil in China’s domestic banking sector. The outlook of banks for this year has become brighter as lifting of covid measures will boost the economy and reduce uncertainty. The PBoC’s quarterly survey of banker sentiment improved significantly in the first quarter of this year.

Bank net interest margins have been shrinking in recent years.

Sources: CBIRC, CEIC and BOFIT.