BOFIT Weekly Review 14/2023

Chinese inflation remains remarkably low

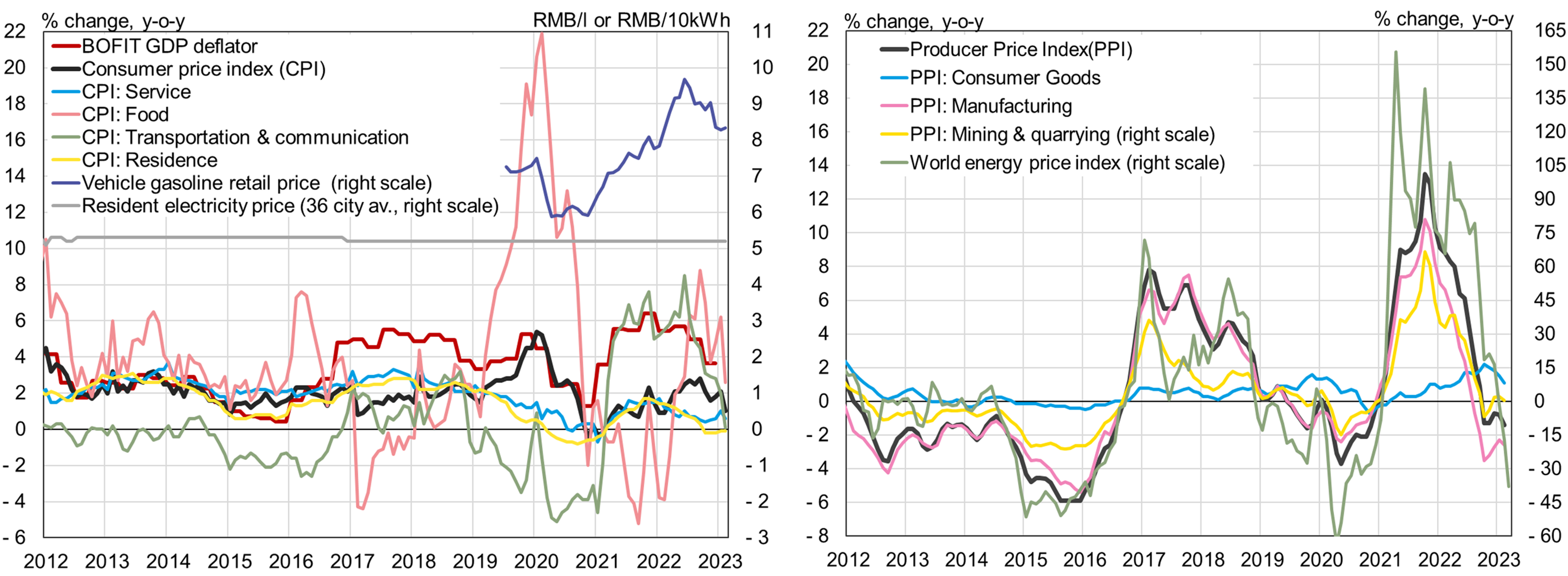

China’s National Bureau of Statistics (NBS) reports that the 12-month rise in consumer prices slowed to just 1 % in February. Consumer prices were up by 2 % last year. Russia’s invasion of Ukraine created an energy crunch in most countries with higher energy prices hitting just as post-pandemic demand was reviving and production bottlenecks were getting cleared. China appears to have largely avoided the inflation spike.

Some of China’s modest inflation reflects the current phase of the business cycle and economic policies, but some is methodological. During the height of the pandemic, many countries provided generous supports to households that resulted in strong consumer spending after their economies reopened. China, in contrast, chose not to provide wide support to households but instead directed support almost exclusively to the corporate sector. Throughout the entire pandemic, and even after the lifting of covid restrictions, consumer demand in China has been tepid. Growth in retail sales has lagged far behind industrial output growth.

The labour markets in China are less tight than in many countries. After several months of decline, youth unemployment flared in February again to above 18 %. The large body of migrant labour that constitutes China’s labour reserves does not show up in the unemployment statistics. Many migrant worker returned to their villages during the pandemic when work in the cities dried up. Many are now likely to return to jobs in cities as demand returns. Pressure to raise wages has remained quite modest, which is also reflected in prices of services. The NBS reports that real disposable incomes in urban areas rose by less than 2 % y-o-y last year.

Differences in the structure of the consumption basket used by Chinese officials to measure inflation as well as price regulation further explain China’s modest inflation levels. The current weightings in the consumer basket are as follows: food and tobacco 29 %, housing 25 %, transport and communications 15 %, household goods and services (including clothing) 12 %, healthcare 10 % and education & culture 8 %. Compared to the euro area Harmonised Index of Consumer Prices, the Chinese consumer basket places greater weight on food, housing and healthcare components. Changes in Chinese consumer prices are particularly sensitive to changes in food prices. This was seen quite dramatically in 2019–2020 when pork prices skyrocketed due to the African swine fever epidemic.

Changes in energy prices do not channel as directly to consumer prices as in many other countries. Energy prices are reflected in consumer prices in housing and transport categories, but other than vehicle fuels, the price increases have been quite modest in China. This reflects the fact that domestic energy prices are largely regulated or government guided, i.e. fixed for finite periods or adjusted based on global prices. For example, retail fuel prices are adjusted every two weeks if global crude oil prices are in the range of USD 40-130 per barrel. Above or below the this range, prices are essentially kept unchanged to cushion the economy from potential shocks. In contrast, producer prices in China are quite sensitive to swings in global prices of energy and raw materials. The connection between producer price and consumer prices, however, is quite weak at the moment. Producer prices overall rose by over 4 % last year, but started to fall already last autumn as energy prices started to decline.

In addition to tracking consumer and producer prices, economy-wide price changes can be assessed with a GDP deflator that is used to translate national accounts in current prices to constant prices. While China does not publish an official GDP deflator, implicit deflator can be calculated by subtracting real GDP growth from nominal GDP growth. For example, the 2022 implied GDP deflator in official statistics was roughly 2.5 %. Some researchers have chosen not to use China’s official figures in measuring real GDP and instead created their own GDP deflators. For example, BOFIT's alternative GDP calculation re-estimates the GDP deflator using official NBS-released price series. According to our alternative estimate, the price rise in China last year was higher, about 5 %. Real GDP growth also appears to have been well below the announced 3 %. BOFIT’s alternative GDP calculations for 2021 also showed the rise in prices was clearly higher than the official consumer price inflation.

China’s official inflation target (12-month inflation) sets a ceiling value for the rise in consumer prices. This year’s target was set at 3 % at last month’s session of the National People’s Congress. As such, inflation is not expected to constrain monetary policy this year. Indeed, inflation has not been much of a factor in Chinese monetary policy-setting in recent years. The main policy priorities have been supporting the economy (especially though various targeted lending programmes to select sectors), assuring financial market stability and reducing debt when conditions permit. The Communist Party of China currently seems to prefer taking on debt to support growth rather than limiting indebtedness. The monetary policy toolkit in China is part of a larger set of instruments used by authorities to implement economic policy. The People’s Bank of China has so far managed to only modestly ease monetary policy and in many cases using targeted policy instruments. For example, the reserve requirement ratio for commercial banks was lowered by 0nly 25 basis points on March 27 (BOFIT Weekly 12/2023). The PBoC has kept its key policy rates unchanged since last autumn. One factor limiting the use of more accommodative monetary policy is the widening gap between interest rates in China and the rest of the world as central banks in most countries have raised rates to quell inflation.

China consumer and producer prices and their sub-indices.

Sources: China National Bureau of Statistics, NDRC price monitoring center, World Bank, CEIC and BOFIT.