BOFIT Weekly Review 12/2023

China sees cautious signs of reviving growth in the first two months of this year

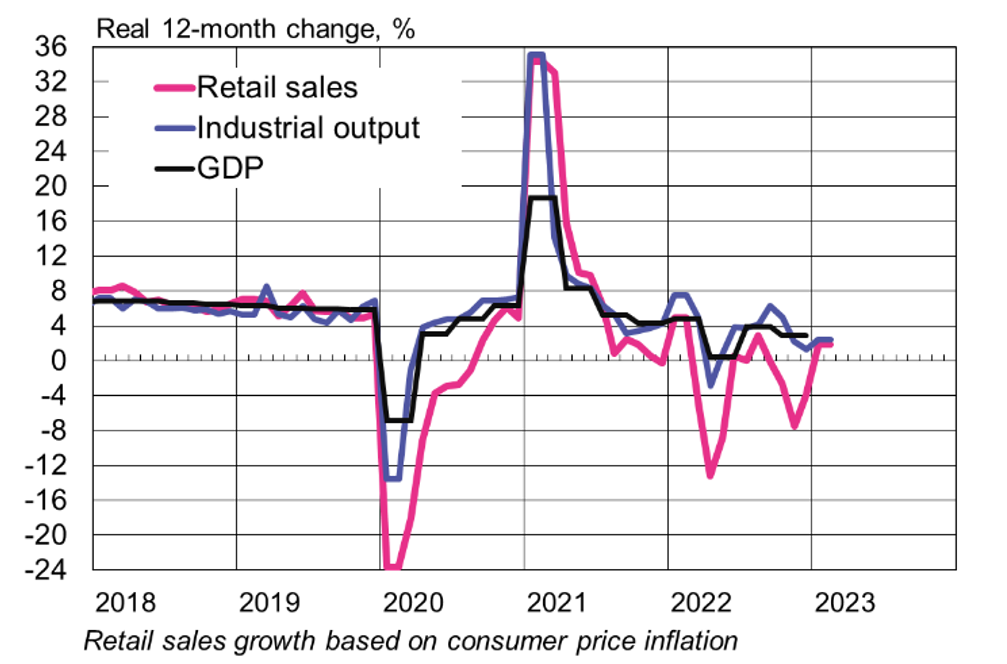

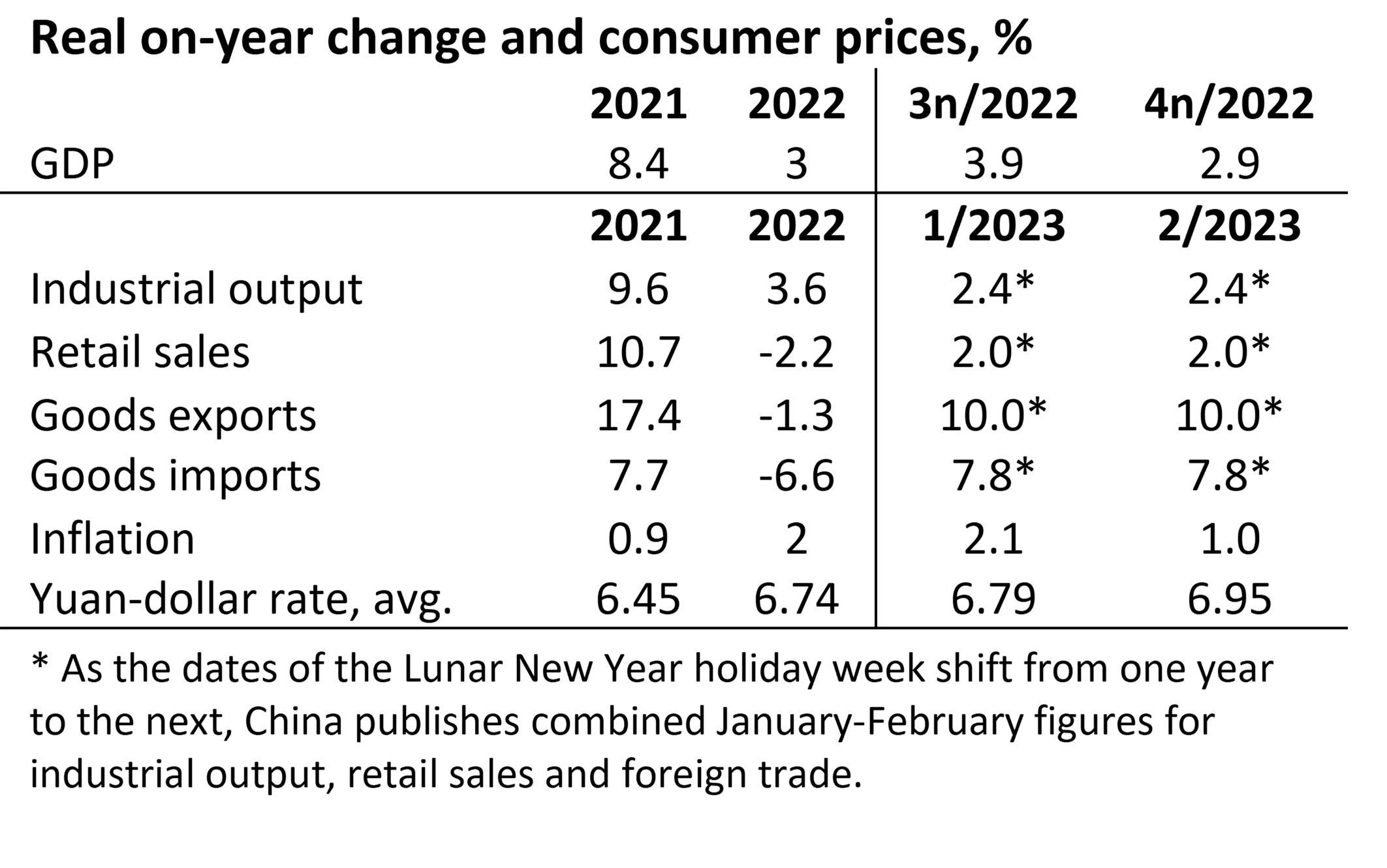

Consumer confidence in China returned quickly with the ending of covid restrictions, signalling a return to growth for private consumption. The combined figures for January and February released in March show that retail sales grew by 3.5 % y-o-y in nominal terms. Based on average consumer price inflation, we estimate that real growth in retail sales was around 2 %. In the service sector, value- added grew by 5.5 % y-o-y and that growth was broad-based. Highest growth was posted for hotel and restaurant services (up over 10 %), IT services (up 9 %) and financial services (8 %). Consumer confidence has remained high in March, suggesting that the first quarter overall should show a strong performance.

For now, the worst may already be over for China’s troubled real estate sector. Sales volumes fell by just 4 % y-o-y and building starts were down by just 9 %. In December, the declines in both categories were still in double digits. Officials have sought in recent months to make sure that construction projects underway are completed (BOFIT Weekly 6/2023). In the January-February period, the number of completed construction projects increased for the first time in twelve months, rising by 8 % y-o-y. The drop in apartment prices also appears to have ended, at least in some cities. The National Bureau of Statistics reports that 30 of 70 cities tracked still experienced price declines from previous month, down from over 60 cities at the end of last year.

Industrial output grew by 2.4 % y-o-y in January-February. Mining & quarrying rose by nearly 5 % y-o-y, largely a reflection of increased production of construction materials. Manufacturing increased by 2 % y-o-y. Turning to the February manufacturing purchasing manager indices (PMIs), the subindices for new orders and booked export orders rose to levels not seen since the 2020 growth spurt. Exports and imports were still contracting in January, falling sharply in both dollar and yuan terms. In February, however, exports for the most part returned to the growth track. Yuan-denominated exports grew in February by 5 % y-o-y and imports by 13 % (in dollar terms down by 1.3 % and up by 4 %, respectively). The volume of exports grew in January-February by a total of roughly 10 % y-o-y, while the volume of imports was up by nearly 8 %. Looking a raw material imports in January-February, China saw on-year increases in imports of iron ore and pulp, while imports of crude oil and copper declined.

Nominal growth in fixed investment was up by 5.5 % y-o-y in January-February. Although real estate sector investment fell by nearly 6 %, investment in infrastructure grew by 9 % and manufacturing by 8 %. China has ceased to publish some datasets, making more detailed assessments of investment trends very difficult. Moreover, those statistical datasets that continue to be released are somewhat contradictory.

With China’s about-face on covid policy, retail sales returned to positive growth in the first two months of this year

Sources: NBS, CEIC, Macrobond and BOFIT.

Consumer price inflation fell from 2.1 % in January to 1 % in February. Overall inflation moderated on the slowing rise in food and energy prices. The rise in food prices slowed from 6.2 % in January to 2.1 % in February. Services inflation fell from 1 % in January to 0.6 % in February. Energy inflation also slowed to just 0.6 % (down from 2.4 % in January). Core inflation, which excludes the fluctuation in food and energy prices, was 0.6 % in February.

The volume of new bank lending rose in January-February to 6.7 trillion yuan, which was nearly a third more than in the same period a year earlier. The lion’s share of new loans were long-term loans to corporations. New housing loans in January -February was still less than half of the borrowing in the same period a year earlier (86 billion yuan).

Last Friday (Mar. 17), the People’s Bank of China announced that it was lowering its reserves requirements for banks by 25 basis points. The reduction does not apply to those banks (including all small banks), for which the reserve requirement ratio has already been set at 5 %. The banking sector’s combined weighted reserve requirement thus fell by 20 basis points to 7.6 %. The reserve requirement ratio was last lowered in December. When banks no longer have such a large share of their assets tied up as deposits with the central bank, they can more productively invest those assets, which in turn lifts bank profitability and encourages banks to lend more.

CENTRAL BANK GOVERNOR GETS NEW TERM, POLITICAL GUIDANCE REMAINS STRONG

At the conclusion of the plenary session of the National People’s Congress on Sunday March 12, (BOFIT Weekly 10/2023), the Communist Party of China affirmed policy directions and numeric economic targets for the coming year, as well as appointments to the highest posts in leadership. Li Qiang, Shanghai’s CPC party chief, was tapped as the new premier. Somewhat surprisingly, central bank governor Yi Gang and finance minister Liu Kun were both given new terms even if both have reached retirement age and neither was recommended for even a deputy member post at the October 2022 plenary session of the CPC’s central committee. Observers note that actual decision-making power in China rests increasingly with political office-holders. Guo Shuqing has served as central bank party secretary and deputy governor since 2018. The preserving of the old guard in economic policy at this point could be seen as part of ongoing efforts to stabilise the economic situation.

On March 16, the government announced the creation of the Central Financial Commission (CFC), a new agency for supervision of the financial sector and strategic policymaking. The CFC is intended to strengthen and focus the party’s oversight of decision-making in the financial sector. The government also announced the convening of a new Central Financial Work Commission tasked with overseeing the party’s ideological and policy roles in the financial sector. A commission of the same name was established in the wake of 1998 Asian financial crisis, but was disbanded a few years later. A similar Central Science and Technology Commission has also now been created for the technology sector, but the persons to head either of the new commissions have yet to be named. Both moves are consistent with a general tightening of central government control over the economy.

Sources: China National Bureau of Statistics, China customs, WTO, CEIC and BOFIT.