BOFIT Weekly Review 10/2023

China’s National People’s Congress convenes to approve policy agenda, targets, administrative reforms and budget

China’s highest decision-making body, the National People’s Congress, is currently convening in Beijing for its annual plenary session, which runs from March 5 to March 12. Although most policy decisions were reached earlier, the NPC must still rubberstamp those decisions. China’s leaders have put much emphasis on familiar themes at this year’s meeting, including maintaining stability, national security, self-sufficiency and technological advancement. The main focus of policies, however, is reviving consumer demand. Other areas of focus are making progress in industrial modernisation, strengthening state-owned enterprises and supporting private firms, attracting foreign capital, decreasing economic risks, stabilising grain harvests, making the shift to a green economy, as well as improving certain aspects of social security and public services. Appointments to top posts this year are being closely watched. Today (Mar. 10), Xi Jinping was chosen for his third term as president. This weekend will see the selection of premier, finance minister and central bank governor among many other key positions.

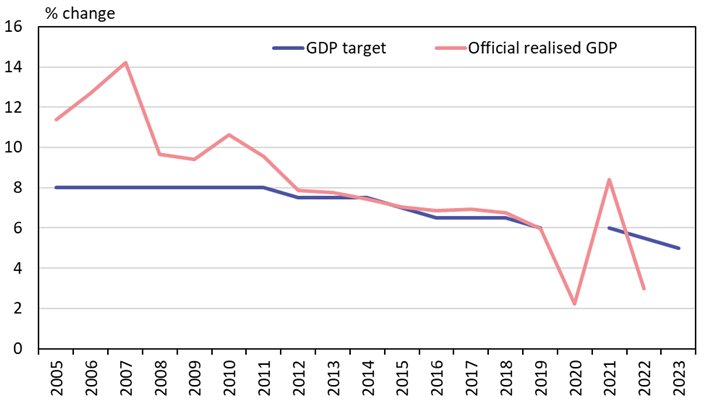

Outgoing premier Li Keqiang announced the set numerical growth targets for 2023. The GDP growth target for this year is “around 5 %.” Some observers expected a higher growth target as many forecasts predict higher growth for this year. However, the target should be seen as a floor or minimum requirement rather than a growth forecast. China’s GDP growth target has been lowered incrementally since 2011 and for example in 2021 it was already clear that the goal would be reached when it was set. The reasonable GDP growth target might leave some room for officials to pursue other important goals and it also provides some breathing room for local governments digging out from under the large debts incurred from administering zero-covid measures. Other targets remain consistent with the current five-year plan (2021–2025). The household income growth should increase same pace with GDP growth. The inflation target (really more of ceiling than target) has been set at “around 3 %.” Employment should remain at the current 5.5 % level and another 12 million new jobs in urban areas should be added, i.e. the average pace of job creation in recent years. The grain harvest target is 650 million metric tons a year. The government will seek to reduce the economy’s “energy intensity” (reduced energy consumption per unit of GDP).

China’s annual GDP targets vs. official realised GDP growth

*) How the GDP growth target is expressed has varied over the years. The chart shows the average target when a range was given. No growth target was set for 2020.

Sources: China National Bureau of Statistics, CEIC and BOFIT.

Significant structural changes in China’s administrative bodies were announced at the NPC. China will create new national financial regulator, the National Financial Regulatory Administration (NFRA). It will take over the China Banking and Insurance Regulatory Commission (CBRIC) in its entirety, as well as the central bank’s current functions of overseeing financial holding companies and consumer finance protection and the functions of the China Securities Regulatory Commission (CSRC) involving investor protection. The securities regulator CSRC will take over approval authority of corporate securities from the National Development and Reform Commission (NDRC) and the CSRC will be elevated to the status of an agency operating directly under the State Council. China’s National Intellectual Property Administration will also be elevated to the status of an agency that reports directly to the State Council. The county-level branches of the People’s Bank of China (PBoC) will be closed. The Ministry of Science and Technology (MOST) will be given a larger role, even if some of its departments and operations will be spun off to other ministries. A new party organ, the Science and Technology Commission, has been established to oversee MOST. China also will establish a new National Data Administration that operates under the NDRC. Certain other administrative changes will also be implemented. At the same time, 5 % of the central government’s current posts will be shifted to new “important and key” tasks. The transfers will apparently be based on the “cheese slicer” principle, i.e. personnel cuts of 5 % will be required at all current ministries, agencies and other units that report to the central government.

This year’s budget was also presented to the NPC delegates. Nominal budget revenues and expenditures are expected to increase at a rate of just over 3 % a year, which seems quite modest pace in light of current inflation expectations and projected GDP growth. Little specific information on spending trends for individual administrative branches is yet available, but defence spending is set to increase at the same pace as nominal economic growth (7 % a year) as in numerous years before. The budget deficit will remain at around 3 % of GDP. The budget covers only a part of overall public-sector revenues and spending. At the local government level, off-budget spending is very significant. According to the IMF’s January estimate (BOFIT Weekly 8/2023), China’s actual general government deficit amounted to nearly 17 % of GDP last year. Moreover, that deficit is expected to remain nearly as large this year and public-sector indebtedness will continue to rise rapidly causing financial difficulties in many regions. Also the finance ministry notes in its budget assessment that some local governments have amassed large deficits and that certain cities and counties are struggling with their debt liabilities.