BOFIT Weekly Review 7/2023

Government support keeps banking sector stable in first year of war

In Russia’s bank centric financial markets, bank lending pays a significant role in corporate finance. Given that the state, either through direct ownership or via intermediaries, dominates commercial banking, the government assures that the system continues under all circumstances. The smoothest possible operation of the payments system and the banking sector have been a top government priority throughout the Russo-Ukraine war.

Most domestic payment traffic had already been shifted prior to the w

ar away from the international SWIFT payment system to the SPFS system owned by the Central Bank of Russia. SPFS operation was expanded in 2022 and now operates around the clock. Russia’s alternative to Western payment cards was rolled out on a broad scale in 2018. Since then social benefits and wages paid by the state have only been deposited in bank accounts associated with a Mir card. The market exit of Western mobile payment options has forced banks to offer solutions based on the CBR-owned Faster Payment System (SBP). While domestic payment traffic flows fairly smoothly, Western sanctions and the reluctance of Western banks to get involved with payments to or from Russian counterparties have made foreign payments increasingly challenging. Moreover, despite Russia’s efforts to attract banks in “friendly” countries to join the Mir system, the response has been fairly muted.

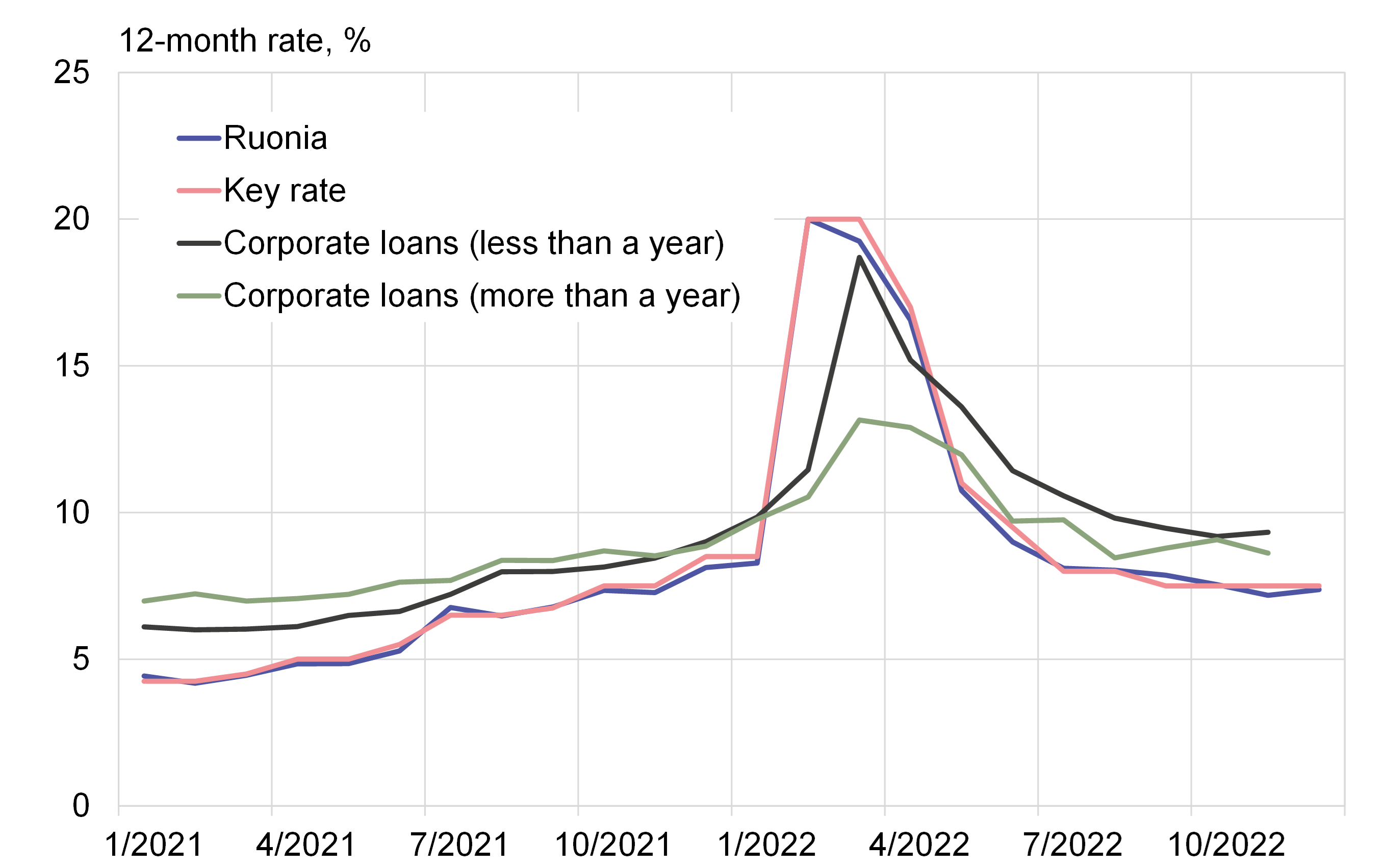

Lending growth accelerated at the end of 2022

Following a sudden stop in March, domestic bank activity in Russia gradually returned to near-normal function. Total corporate lending contracted slightly in March-June, but the pace of new lending was quite brisk in the second half of the year. Growth in total lending was boosted by many state-backed programmes or interest support programmes for such groups as systemically critical firms and small-and medium-sized businesses, as well as funding for housing construction projects. Interest rates sank back to pre-invasion levels towards the end of last year. Besides support programmes, extensive loan restructurings increased the amount of total lending, which was up by about 14 % y-o-y at the end of 2022.

The growth in total household lending last year was driven by housing loans. The growth in housing loans, in turn, reflects the government’s extremely generous interest-support programme. Housing loans for new apartment purchases were available at a fixed 7 % rate, i.e. significantly below the central bank’s key rate for a large part of the year. Special breaks were offered to groups such as families with small children, soldiers sent to the front and IT professionals. The stock of consumer credits contracted in the spring and barely grew in the second half of the year. At the end of 2022, total household lending was about 10 % higher than a year earlier.

The market panic in the spring, the collapse of the ruble’s exchange rate and high interest rates caused severe problems for many banks. A more granular assessment is not possible at this point due to the unavailability of bank-specific information for 2022. On the other hand, temporary easing of bank solvency rules and liquidity support from the central bank helped banks get through the worst of it. Bank balance sheets were generally healthy going into the war and the CBR has evaluated that the banking sector is capable of withstanding moderate credit losses. Although banks targeted by sanctions must effectively surrender their assets in the West, international operations were not a major aspect of activities for any of these banks. Losses can be absorbed over several years as domestic operations carry on at near-normal levels.

Russian interest rates fell back to pre-invasion levels by the end of last year

Source: Central Bank of Russia, BOFIT.

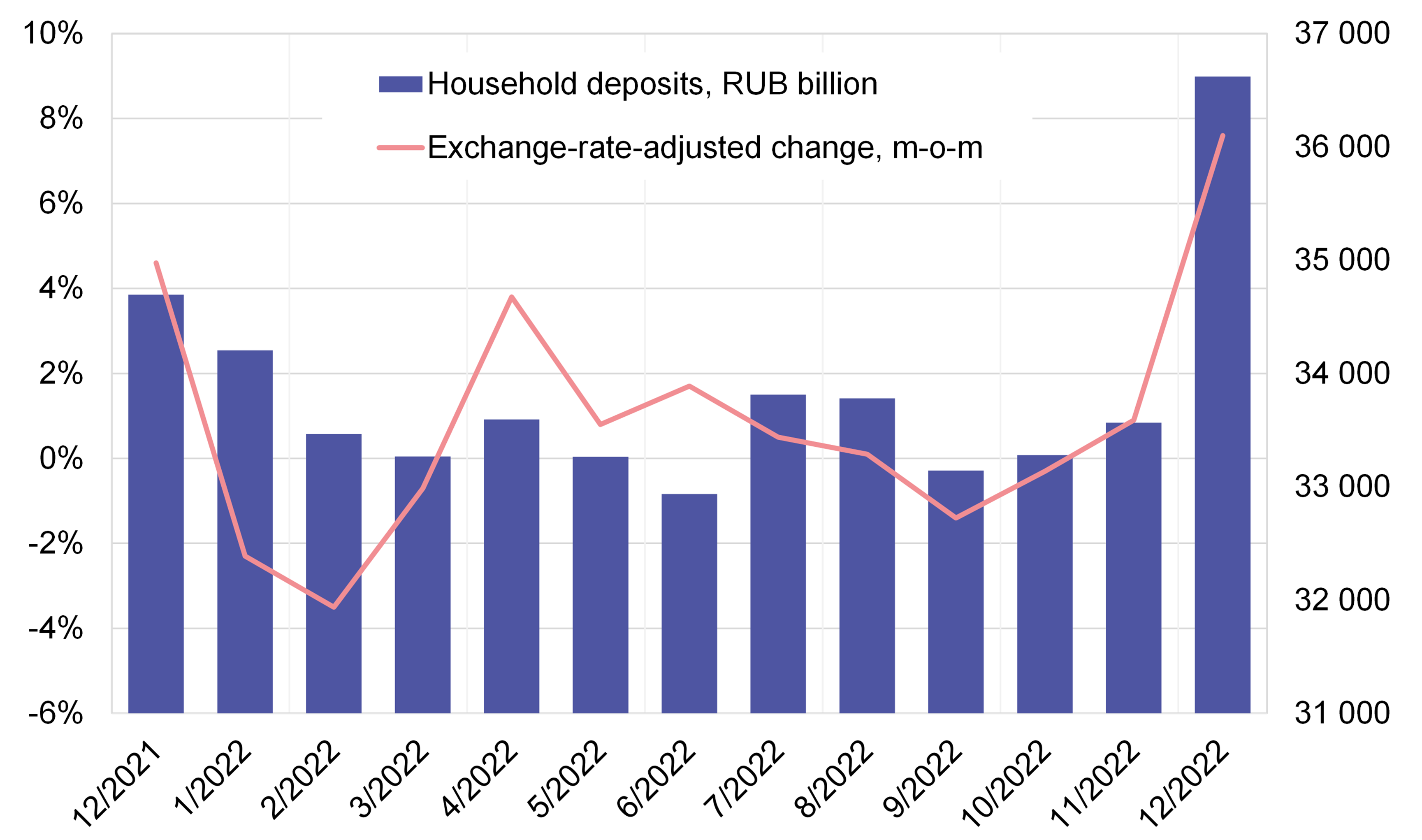

Brief dip in total deposits

Deposits of the general public are an essential source of bank funding, accounting for about two-thirds of banking sector total assets. At the end of 2022, finance ministry deposits and loans from the central bank accounted for about 10 % of banking sector total assets. During 2022, total deposits rose by 13 %, driven mainly by growth in corporate assets. In contrast, household assets grew by just 7 %. The on-year growth in household assets was due mainly to the payout of an exceptionally large amount of benefits in December. In January-November, the amount of household assets held by the banking sector contracted slightly from the same period in 2021.

During February and March, and again after the announcement of the partial mobilisation in late September, private customers shifted their assets out of banks. The sharpest drop was seen in foreign currency deposits, where the money was either converted into cash or transferred to foreign bank accounts. As different banks likely experienced deposit flight differently, an average for the entire banking sector can mask substantial variation across banks. Last year’s growth in banking sector total assets (12 %) was nearly the same as growth in total deposits in 2022.

Total Russian household deposits declined last spring and autumn, then rose at year’s end

Sources: Central Bank of Russia, BOFIT.