BOFIT Weekly Review 6/2023

China relaxes regulation of the real estate sector and provides additional stimulus

Among the top goals for 2023 spelled out at last December’s economic work conference were stabilisation of the property market, prevention of financial risks and completing the construction of already purchased apartments. With the ongoing financial troubles of developers and China’s lethargic housing market, officials have decided to increase economic stimulus to the sector this year. In practical terms, it means the abandonment of earlier policies designed to bring the sector’s indebtedness under control.

A variety of targeted programmes have been introduced since last autumn with the goal of easing the financial distress of developers and depressed housing sales (BOFIT Weekly 42/2022). In November, the People’s Bank of China and the China Banking and Insurance Regulatory Commission (CBIRC) released a 16-point programme that included extending developer repayment periods on bank loans and bonds, as well as lifting quotas on how much banks can lend to developers or housing buyers (BOFIT Weekly 6/2021). The programme also incentivises developers to use shadow banking sector financing instruments, particularly trust loans. Commercial banks were encouraged to increase their lending to developers to help them complete stalled projects. Soon after, the big state-owned banks announced that they have allocated roughly 1 trillion yuan (143 billion dollars) in credit lines to developers. Credit lines do not necessarily mean that the loans have actually been granted. The PBoC offers interest-free financing to banks through its relending facility for financing developers unfinished projects. In addition, limits on commercial bank lending to foreign subsidiaries of developers have been relaxed to help developers pay off their foreign debts. Developers can also use the money from presales of apartments more freely. The money was earlier locked in escrow accounts that could only be accessed for completing sold apartments.

After a hiatus of over ten years, exchange-listed developers can again raise money from China’s equity markets. The money developers raise from share sales must go to paying down debt, completion of construction projects or corporate acquisitions. State-owned China Bond Insurance has promised to guarantee more developer bond issues.

So far the broad support measures have failed to invigorate construction activity or apartment sales. In January, officials released a new 21-point plan aimed at providing liquidity to “quality” developers and to strengthen their balance sheets. The plan does not mention which firms qualify or even clear conditions they must meet to receive financing. The lending programme will rely largely on tried and true measures. For example, the country’s policy and commercial banks are encouraged to provide financing to stalled projects. In addition, state asset management companies will offer financing for acquisitions in the real estate branch. In a significant policy shift, a central bank representative said in January that China has ended the use of its “three red line” debt metrics (debt-to-cash, debt-to-assets and debt-to-equity) for 30 unnamed, but “well-performing” and systemically important developers. The extent of the stimulus measures for the property sector suggest that they are not necessarily binding for other firms either.

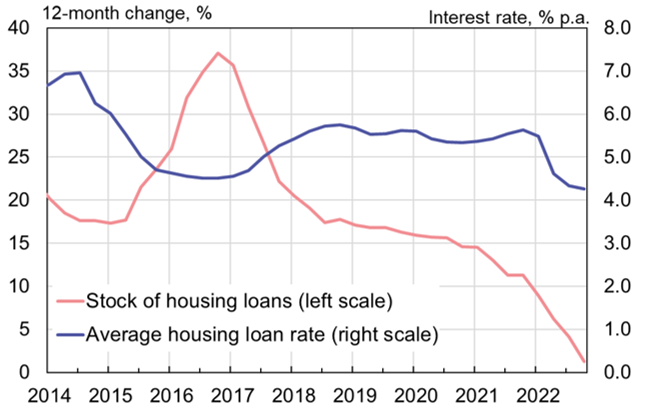

In addition to support measures directed at developers, restrictions have been eased to increase housing demand. Several areas last fall lowered the floor at which banks can grant housing loans. In January, the PBoC and CBIRC allowed for adjustment in the minimum interest rate charged on housing loans to first-time buyers in provinces where housing prices have fallen for over three months in a row. Many provinces have lifted their restrictions on housing purchases, e.g. allowing buyers to own multiple apartments in areas where purchase limits were earlier imposed to quell speculative buying. Together with low housing demand, the interest rate on housing loans has fallen. According to PBoC figures, the average interest rate on a housing loan as of end-December was 4.26 % (5.63 % in end-2021). There are no signs yet of revival in demand for housing loans. The stock of housing loans grew by just 1 % last year, down from 11 % in 2021.

Developers face a daunting range of financial problems. Some developers have sought debt restructurings of both their domestic and foreign bond issues in recent years, and sold off some of their businesses and land use rights. Bloomberg estimates that Chinese developers last year defaulted on over 140 domestic and offshore bond payments, collectively valued at 50 billion dollars. The investment research firm Refinitive puts the value of developers’ domestic and offshore bond issues coming due this year at around 140 billion dollars, a 17 % increase from 2022.

The access of Chinese builders to foreign financing has been limited for years, but it could gradually revive with the abandonment of the sector’s strict regulation. In January, real estate giant Dalian Wanda staged a dollar bond issue of 400 million dollars. The share prices of Chinese developer listed on the Hong Kong exchange have risen in recent months, even if they are still at low levels. The value of developer bonds have also recovered in recent months. Many traded last year at very low prices.

China has effectively lifted all restrictions imposed of the past two years that were designed to cope with soaring developer indebtedness and runaway housing prices. It remains unclear, however, whether the government has succeeded in reducing risk in the sector. The currently proposed support measures entail considerable funding. Some construction-related branches have already downsized. There is also the ongoing risk that problems in the real estate sector will spread to the banking sector or financial markets. The wide variety of targeted support measures is required as it is extremely difficult for officials to provide funds to stabilise the sector and rein in contagion risk while simultaneously tamping down speculation and moral hazard. A repeated theme at last December’s economic work conference was still that “houses are for living in, not for speculation.”

Interest rates on Chinese apartment loans have hit an all-time low,and growth in the housing loan stock continues to slow

Sources: People’s Bank of China, CEIC and BOFIT.