BOFIT Weekly Review 06/2023

Sharp drop in building construction continued, while infrastructure construction saw high growth

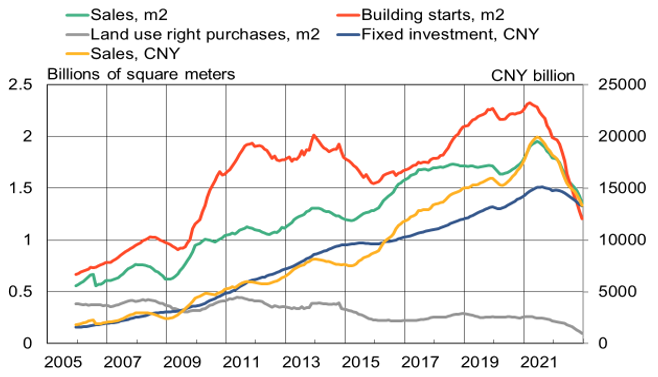

Building construction in China went into decline in summer 2021 after officials imposed strict limits on developer indebtedness. Last year’s sizeable drops in building activity were apparent from several metrics. In terms of volume (floorspace), new building starts were down by 40 % y-o-y. Purchases of land use rights for building construction were down by half and property sales were off by 25 %. The volume of unsold apartments (measured in floorspace) was 10 % higher in December than a year earlier. The downturn has been broad-based, hitting construction of apartments, office buildings and commercial buildings equally hard. The National Bureau of Statistics (NBS) also reports housing prices have been falling throughout China, as last autumn housing prices began also to fall in the big cities, including Beijing and Shanghai.

On the other hand, the outlook for building construction has brightened recently, following the government’s December declaration that it will halt the contraction of the real estate sector this year. Indeed, it has already significantly eased the access of developers to financing (see BOFIT Weekly 6/2023). The end of zero-covid policies is expected to also revive apartment sales as people can again move about freely. Increased building construction activity should bring fiscal relief to local governments, which get a significant share of their revenues from the sale of land use rights.

In response to the slowdown in building construction, the government cranked up investment in infrastructure projects (up by 9 % y-o-y according to the NBS). While the pace of growth in infrastructure investment last year reached its highest level since 2017, information on how the money has been spent is fragmented. Investment is canals, ports and waterways grew by 17 %. Figures from November suggest that highway investment rose by about 10 % last year, with the strongest growth in the northeastern provinces of Liaoning and Heilongjiang. There was a lot of talk last year about increasing investment in China’s telecommunications infrastructure, but no comprehensive statistics are available. The number of 5G base stations increased by 60 % last year, bringing the total number of base stations in use to 2.3 million at the end of 2022.

The emphasis in railway construction shifted during 2022. At the start of the year, the government expected to commission 3,300 km of new track. Last month, state rail company China Railway reported that 4,100 km of new track was commissioned last year. Even with the increase in track-laying, however, the amount was still 2 % below 2021 and just half of the amount of track laid in the peak years of 2014, 2015 and 2019. Less bullet-train track was commissioned last year than at any year in the past decade. NBS figures show that investment in China’s railways has declined steadily since 2019. It appears that rail investment this year will also slide as the current plan is to commission just 3,000 km of new track in 2023.

China treats energy-sector investment as distinct from infrastructure investment. Energy-sector investment last year grew quite rapidly. Investment in energy production and electrical grids in the first eleven months of 2022 was up by 16 % y-o-y. High growth was posted in construction of nuclear and coal-fired power plants. Although no specific numbers are available, the huge increase in solar power capacity points to major increase in solar power investment. On the other hand, the investment in wind power declined slightly last year, but the value continued to be massive. Spending on development of the electrical power grid increased by 1 %.

Building activity in China has plunged since last spring

Sources: China National Bureau of Statistics, CEIC and BOFIT.