BOFIT Weekly Review 51/2022

Rising investment in Russia slows economic slide, but sees increased role of state-owned enterprises and the government

Real growth in fixed investment exceeded 3 % y-o-y in the third quarter, down from over 4 % in the second quarter. Large weapons systems are not included in Russia’s investment figures (but are included in fixed capital formation in the GDP data which do not show larger increases than in investments in the first half of this year or all of last year).

Growth slowed in investment by large and mid-sized firms, as well as government budget sector investment, from over 6 % y-o-y in the second quarter to around 5 % in the third quarter. For January-September, these investments, recorded statistically in the course of each year, accounted for nearly 80 % of total investment (and in the below-specified sectors and industrial branches, for which within-year data are available only on this basis, 80−97 % in 2021). Rosstat’s estimate of other investment, which includes investments of small firms, households and the shadow economy, fell slightly on-year in the third quarter after having declined by several percent in the second quarter. For these investments to show a weaker picture than total investment is quite exceptional.

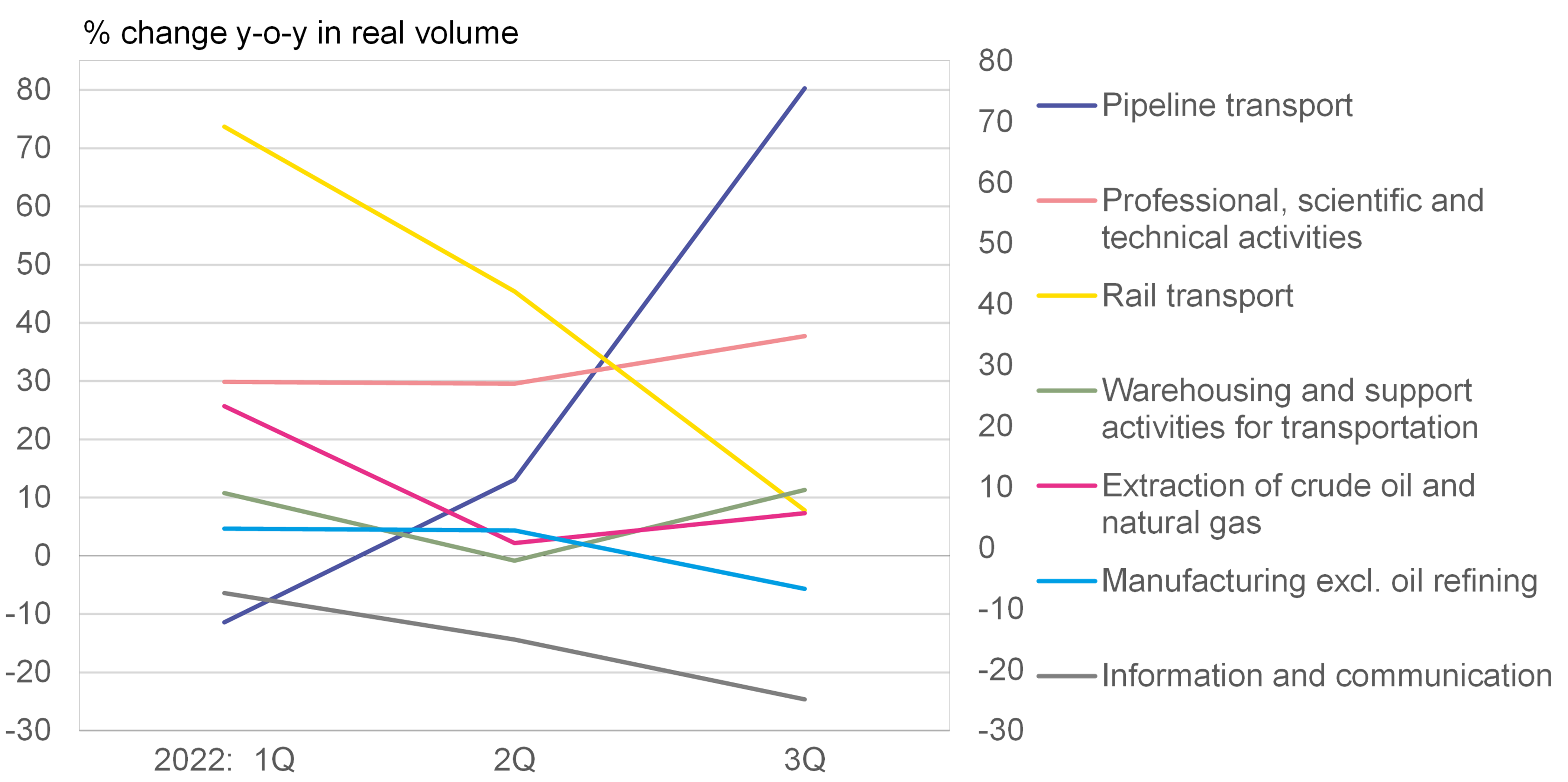

Continuing projects already underway may have helped sustain investment. Financing of investment from federal and regional budgets increased in April-September by 50 % y-o-y in nominal terms. Investment has risen especially in those sectors of the economy dominated by state-owned firms. Investment in pipeline transmission for oil & gas has risen fast, largely for increases in domestic consumption of gas. Investment in production of crude oil and natural gas has recovered from 2021. Investment in rail transport has increased rapidly, even if the pace slowed in the third quarter from a very strong surge in the first half of the year. Increases in investment in these three sectors contributed nearly 45 % of total investment growth in the second quarter and all growth in the third quarter.

The investments of large and mid-sized manufacturing firms (excluding oil refining), which grew briskly last year, turned to decline in the third quarter (down by about 6 % y-o-y). Investment in an overwhelming number of industrial branches, which already declined on-year in the second quarter, mostly saw even steeper declines in the third quarter. On the other hand, certain key industrial branches continued to invest heavily throughout the second and third quarters. These include the chemicals industry, metal refining and construction materials. In addition, investment in fabrication of metal products returned to growth in the third quarter and investment in production in transport vehicles other than automobiles soared. The increases in investment in these fields probably come at least partly from Russian government orders for additional military hardware.

Despite being in recession, among large investment sectors of large and mid-sized firms investment rose from last year in firms providing warehousing & support activities for transport, and especially professional & technical services. Information and communication branches, particularly telecommunications, have seen investment plummet this year after a few years of growth.

Investment of large and mid-sized Russian firms has risen in some branches, but manufacturing (excl. oil refining) turned down

Sources: Rosstat and BOFIT.