BOFIT Weekly Review 46/2022

Use of the yuan in international foreign currency trading rises

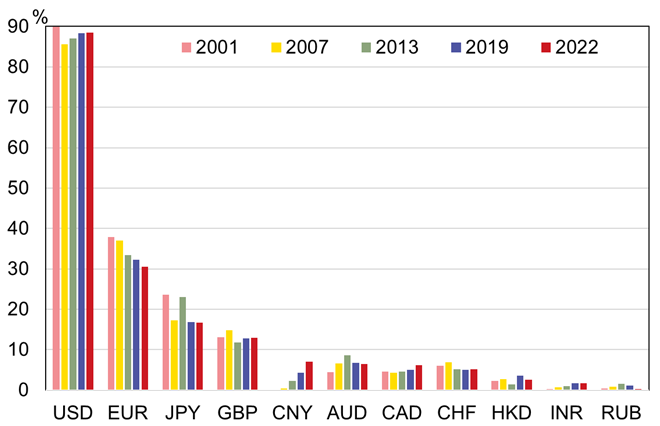

Last month the Bank for International Settlements (BIS) released its Triennial Central Bank Survey of foreign exchange and over-the-counter (OTC) derivative markets. This year’s survey found the yuan’s share of international foreign exchange trading was 7 % in April, with the yuan rising to become the world’s fifth-most-traded currency. As two currencies are involved in any currency trade, the sum of currency trades adds up to 200 %. Thus, the respective currency shares in April were 88 % for the US dollar, 31 % for the euro, 17 % for the Japanese yen and 13 % for the British pound. The yuan’s share in the April 2019 survey was 4.3 % (8th most exchanged currency) and 4 % in the 2016 survey.

Most yuan trading and overall international forex trading is based on foreign exchange (FX) swaps and spot agreements. A tenth of yuan trade involves option contracts, which is more than the average in international FX trading. Most yuan trades are done against the dollar (94 % of all yuan trades). In addition to yuan-dollar currency pair, the BIS also reports yuan-euro trading. In this year’s survey, euro was the counterparty currency involved in 2 % of yuan trading. From a geographic standpoint, the most forex trading is conducted in the UK, which is also the second largest yuan trading hub. The most yuan trading is done in Hong Kong, and the next largest yuan trading hubs are in mainland China and Singapore.

Use of the ruble in forex trade has collapsed, falling from nearly 2 % in 2013 and 1.2 % in 2019 to just 0.2 % in April 2022. The Indian rupee’s share remained around 2 % and the Hong Kong dollar’s share fell from 4 % in the 2019 survey to just under 3 % this year. 94 % of ruble trades are done against the dollar, and the dollar is even more dominant counterparty currency in rupee trading (97 % of turnover). The bulk of the ruble forex trading is concentrated in the UK.

The survey also addresses trade in OTC interest rate derivative markets. The yuan plays a significantly smaller role in derivatives trading, and in April its share was only 0.6 %, smaller than e.g. the New Zealand dollar or the Czech koruna (shares summed to 100 %). Practically all yuan OTC derivatives trade consists of interest rate swaps. The UK is also the global hub for interest rate derivatives trading. Only 0.2 % of trade is conducted in mainland China and 5.6 % in Hong Kong.

The Chinese yuan (CNY) plays a small, but growing, role in global currency trading.

As two currencies are involved in each transaction, the sum of shares in individual currencies in foreign currency trades totals 200%.

Sources: BIS and BOFIT.