BOFIT Weekly Review 37/2022

Russia’s federal budget revenues down in August

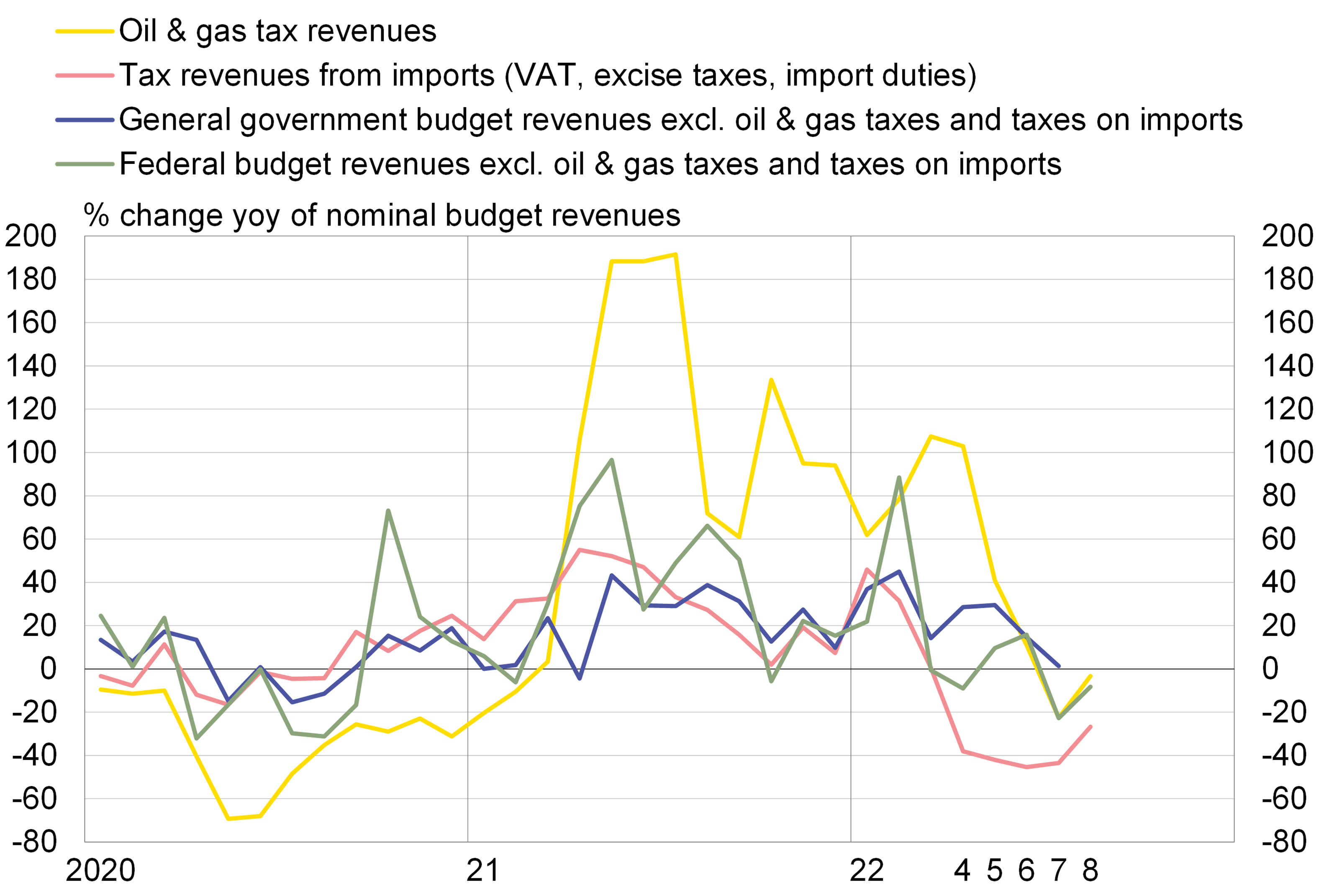

Nominal federal budget revenues were down by about 10 % y-o-y in August. Part of the revenue drop was cushioned from the July fall by a relatively small 3 % decline in oil & gas tax revenues. The price of Urals blend crude oil was about 9 % higher in July and August compared to a year earlier. The ruble-value of oil & gas tax revenues (almost entirely defined in dollars), however, saw a downward impact from the fact that the ruble was about 25 % higher on-year against the dollar. Oil sector production and exports have avoided a downward slide in recent months.

The decline in federal budget revenues other than from oil & gas taxes moderated in August to about 14 % y-o-y. The moderation, however, came completely from sharply higher value-added tax collections from domestic production. VAT gives a large revenue stream, but the monthly collections have varied very strongly this year. Even with a lower decline of revenues from taxes levied on imports, the rate of decline remained substantial. All other federal budget revenues were also deep down.

Revenues to the government sector budget overall (excluding tax revenues from oil & gas taxes and taxes on imports) have performed better than the federal budget this year. Regional and local budget revenues experienced robust growth in spring. Government sector revenue streams, however, weakened significantly in summer as revenues to state social funds turned clearly lower than a year earlier. The rise in revenues to regional and local government budgets also slowed considerably.

On-year growth in nominal federal budget expenditures was exceptionally slow in August. Growth for the January-August period was 20 % y-o-y. Calculating from available partial data, observers indicate that undisclosed federal budget spending rose sharply this year, suggesting an unavoidable increase in defence spending by as much as 50–70 %. In any case, the federal budget surplus for January-August was already quite small, and the last 12-month period saw a slight deficit.

Overall government sector budget expenditures rose in January-July by well over 20 % y-o-y. The rise accelerated notably in the second quarter as large amounts of supplemental spending from regional and local budgets went especially to supporting various economic sectors. Even if non-pension social spending rose sharply in the second quarter, the rise in total spending of state social funds cooled and considerably lagged inflation.

Russia’s government sector revenues have performed weakly in recent months

Sources: Russian Ministry of Finance and BOFIT.