BOFIT Weekly Review 35/2022

Russian economic trends seem to have stabilised in July

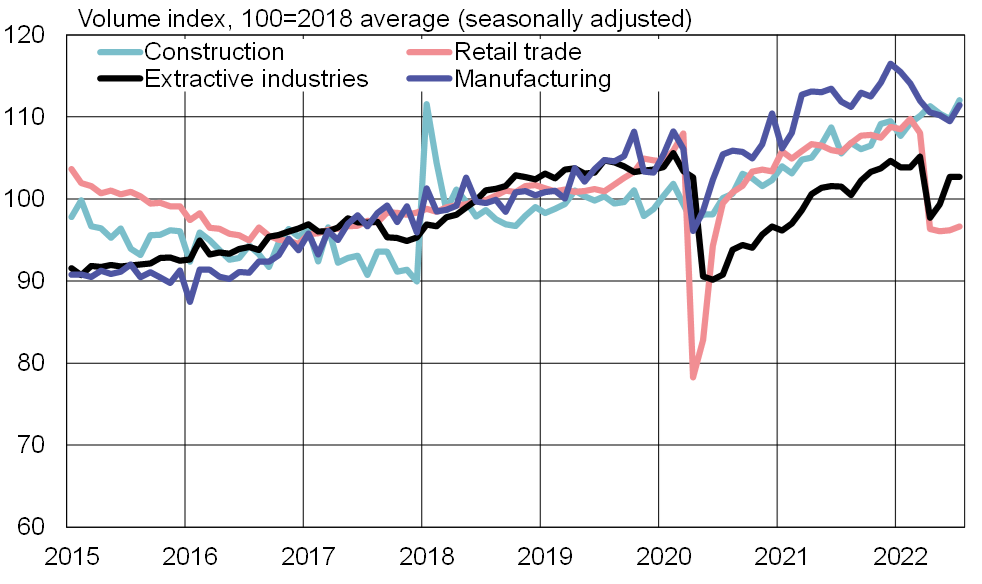

Although retail sales and many branches of manufacturing experienced weaker growth in July, the Russian economy garnered support from oil production and construction activity. The preliminary assessment from Russia’s economic development ministry shows GDP contracted by 4.3 % y-o-y in July and 1.1 % y-o-y for the first seven months of this year.

While retail sales, a rough indicator of consumer trends, have plateaued in recent months, the volume of retail sales in July was still down by 9 % y-o-y. Even with inflation cooling slightly in recent months, July consumer prices were still up by 15 % y-o-y. Rosstat’s preliminary estimate for June shows that the average real wage contracted by 5 % y-o-y, while real disposable household income fell by 1 % in 2Q22. Labour market conditions have remained stable. Unemployment in July remained near a historical low of 4 %.

Industrial output contracted in July by just 0.5 % y-o-y. Extractive industries helped cushion the blow, however, posting positive growth in 1 % y-o-y in July. Crude oil production grew by 3 %, while production of liquefied natural gas (LNG) was up by 25 % y-o-y. Other natural gas production contracted by 24 %. Russian crude oil exports have performed strongly in recent months, while pipeline gas exports have collapsed. Manufacturing output overall contracted in July by 1 % y-o-y, but output trends fluctuated widely from industry to industry.

Construction and agricultural production supported growth in July. Construction activity increased by 7 % y-o-y in July, while agricultural output rose by 1 %. The transportation sector faltered with freight volumes falling by 5 % y-o-y.

Construction and extractive industries have supported Russian economic output, while retail sales and manufacturing trends were weaker

Sources: CEIC, Rosstat and BOFIT.