BOFIT Weekly Review 34/2022

China’s central bank lowers interest rates; inflation rate still below official target ceiling

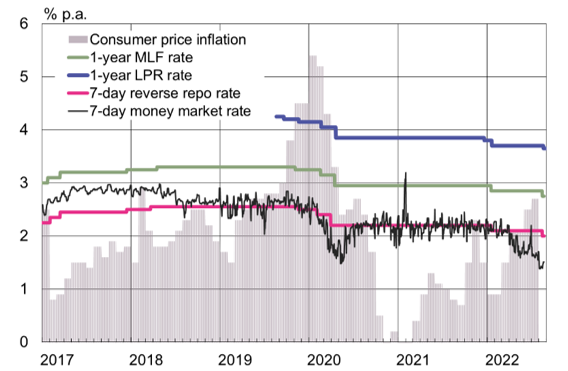

On August 15, the People’s Bank of China (PBoC) lowered its key policy rates for the second time this year (the first cuts were in January) in response to July’s weak economic indicators. The medium-term lending facility rate (1-year MLF) was dropped by ten basis points to 2.75 %, and the 7-day reverse repo rate used in PBoC operations fell to 2 %. The central bank’s MLF programme provides commercial banks with secured medium-term credit. On Monday (Aug. 22), the PBoC also cut its lending prime rate (LPR) in an effort to stabilise the economy. The 1-year LPR was reduced by five basis points to 3.65 %. The 5-year LPR, which is used as the reference rate for housing loans, was lowered 15 basis points to 4.3 %. The cut in the 1-year LPR was the first since January, while the 5-year LPR was last reduced in May. The purpose of the rate cuts is to ease the interest burden on debtors and bring relief to the struggling housing market.

Consumer price inflation rose to 2.7 % p.a. in July (2.5 % in June), but was still low enough to permit monetary easing measures. The government has set a 3 % ceiling for its inflation target this year. Most of the inflationary pressure in July came from rising food and energy prices. Slowing economic growth kept price increases at bay in other sectors. Core inflation, which does not include prices of energy or food, decreased to 0.8 % in July (from 1 % in June). July producer price inflation was down by nearly two percentage points from June to just 4.2 %.

China’s main policy interest rates and market rates have all dipped recently

Sources: CEIC, PBoC, National Interbank Funding Center and BOFIT.