BOFIT Weekly Review 34/2022

China’s economy continued to sputter in July

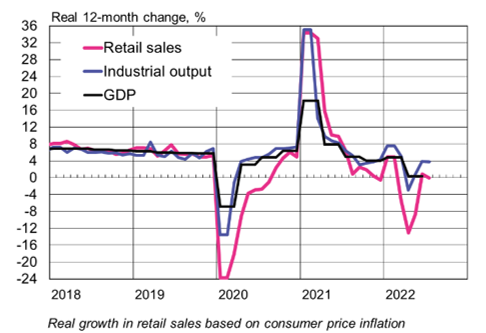

With consumers uncertain about the future and a troubled real estate sector, July economic growth underperformed June across the board. Retail sales, a rough indicator of private consumption trends, rose by just 2.7 % y-o-y in nominal terms. China does not release real trade growth figures, but it can be inferred from July’s consumer price inflation number of 2.7 % that real growth was close to zero. Total service sector output in July contracted from June, and was up by only 0.5 % from a year earlier.

Nominal fixed investment in the first seven months of this year rose by 5.7 % y-o-y. In January-June growth was still over 6 %. Investment in infrastructure increased by over 7 % y-o-y in January-July, while real estate investment contracted by more than 6 %. July real estate sales (measured in terms of both floorspace and yuan) were down by about 30 % y-o-y, and new building starts were down by 45 % y-o-y. The decline in China’s real estate sector has lasted about a year. Most larger cities saw slumping apartment prices last month.

July industrial output growth was about the same as in June (up 4 % y-o-y), and driven mainly by energy production and mining & quarrying activity. Manufacturing growth, in contrast, slowed by over half a percentage point from June to less than 3 % y-o-y. Certain green energy products such as electric vehicles and solar panels, however, experienced strong growth in July.

Robust export growth boosted China’s foreign trade figures. The value of exported goods in July climbed to 330 billion dollars, an increase of 18 % y-o-y. Low domestic demand kept import growth fairly restrained. The value of goods imports totalled 230 billion dollars, up 2 % from a year earlier. China is unlikely to sustain its blistering export growth in the coming months as China’s main export markets see faltering consumer demand and lower economic growth due to eroded purchasing power and the challenges of dealing with high energy prices.

China’s economic growth remained modest in July

Sources: NBS, Macrobond and BOFIT.